This series by Brandon Quittem was published in his blog.

Foreward #

I need to give credit to Dan Held for publishing his 4-part series comparing bitcoin’s origin to planting a tree. While I loved his series, I believe a more robust analogy is comparing bitcoin to fungi. If you’re new to this topic, strap in — it is my honor to initiate you into the fascinating world of fungi.

Polymathic responsibility: Just as Satoshi combined separate disciplines to stitch together a franken-technology we call bitcoin… It is my belief that each of us has the responsibility to explore our unique cross sections of knowledge. Here’s my exploration of fungi and bitcoin — the parallels are astounding.

Chapter 1: Bitcoin is a Decentralized Organism (Mycelium) #

Bitcoin appears superficially simple upon first glance, however truly understanding the system is a daunting task.

“Intellectual traps” exist along the way, tricking observers into making hasty assumptions. I liken the pursuit of understanding bitcoin to a mountain climber continually reaching “false peaks” that momentarily fool the climber into thinking they’ve reached the actual summit.

As soon as you think you have bitcoin figured out, you discover how little you actually know (false peak).

Competing narratives make it even more challenging… Magic internet money, speculative mania, fintech revolution, bitcoin boils the oceans, rat poison squared, libertarian idealism, digital gold, apex predator of monetary media, gordian knot of interlocking incentives, etc.

To make matters more complicated, bitcoin is a living system constantly changing based on environmental stimuli. True understanding is a moving target unlikely to ever be hit.

Attempting to answer the question “what is bitcoin,” I found exploring parallels to the natural world to be particularly illuminating.

In particular, some of bitcoin’s best characteristics are simply reflections of successful evolutionary strategies found in nature, specifically in the fungi kingdom.

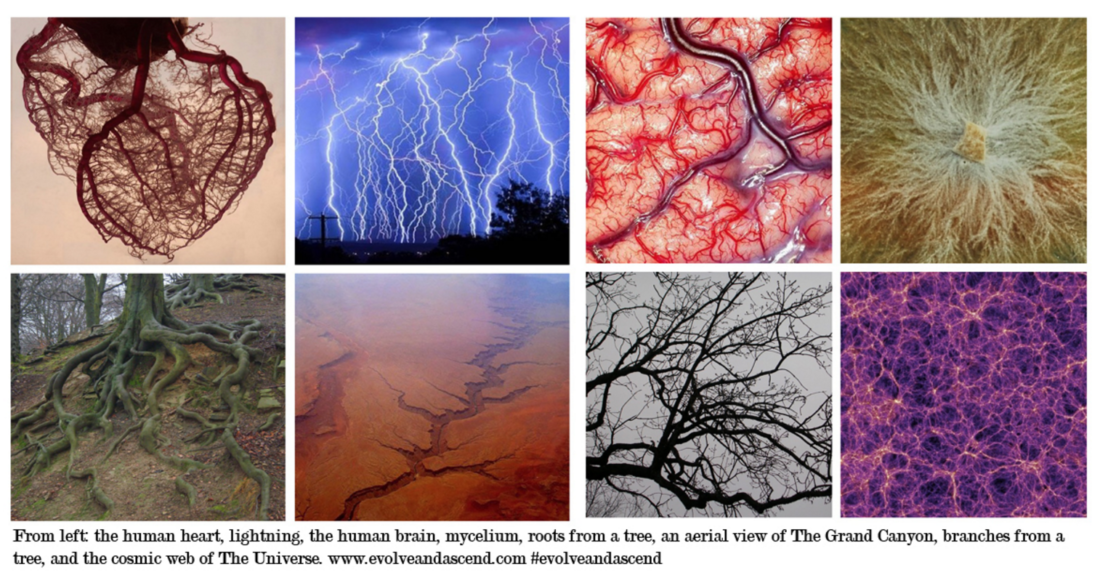

Fungi are predominantly made up of “mycelium” — an underground decentralized intelligence network described by Paul Stamets as “earth’s natural internet.”

Image credit: John Upton

“I believe that mycelium is the neurological network of nature. Interlacing mosaics of mycelium infuse habitats with information-sharing membranes. These membranes are aware, react to change, and collectively have the long-term health of the host environment in mind. The mycelium stays in constant molecular communication with its environment, devising diverse enzymatic and chemical responses to complex challenges.”

— Paul Stamets, Mycelium Running: How Mushrooms Can Help Save the World

In this article, I’m going to explore the similarities between fungi and bitcoin. Originally this was published as separate articles. If you’ve already read some parts of this series, feel free to fast forward 🙂

- Chapter 1: Bitcoin is a Decentralized Organism (Mycelium)

- Chapter 2: Bitcoin is a Social Creature (Mushroom)

- Chapter 3: Bitcoin is the Antivirus to Macro Uncertainty (Medicine)

- Chapter 4: Bitcoin is a Catalyst for Human Evolution

Introduction to Fungi #

Fungi are in their own separate kingdom just like plants and animals. There are more fungi species than plants and animals combined.

Animals are more closely related to fungi than we are to plants. Both fungi and animals inhale oxygen and exhale carbon dioxide. Plants produce their own food through photosynthesis (autotrophic) while animals and fungi must find their own food (heterotrophic). Animals evolved to have internal stomachs/brains whereas fungi pursued external stomachs/brains.

Fungi Fact #1: humans share over 50% of their DNA with fungi. Scientists proposed a new super kingdom called Opisthokon combining Fungi and Animals.

Fungi can take many forms. Most organize in an underground “root structure” called mycelium that’s found nearly everywhere on this planet.

When conditions are right, fungi produce mushrooms which then release spores (seeds) that attempt to colonize life in a nearby location. Mushrooms are simply the reproductive organ. Mushrooms are to the mycelium what apples are to a tree.

Fungi are paramount to life on earth:

- The largest organism on our planet is a fungal network

- Fungi are the best chemists on our planet, much of our medicine comes from fungi

- Trees cannot survive without underground fungal allies

- Fungi have been around for 1.3b years surviving all 5 great extinction events

- Fungi are capable of saving the bees

Fungi are Decentralized Intelligence Networks #

Fungal networks don’t have a centralized “brain.” Instead, they are a one-cell walled “root system” called Mycelium. This underground stomach and distributed intelligence network is capable of sending information bi-directionally over long distances and even across species lines. These fungal networks constantly evolve based on feedback from their environment.

At any one point, a fungal network contains millions of endpoints each searching for food, defending their territory, or inventing new molecules to subvert their competition (other fungi, bacteria, etc). These networks form a decentralized consensus on how to use resources, when to reproduce, and what strategy best defends the organism.

This mirrors the decentralized consensus (social contract) formed in bitcoin. Nodes determine what software they wish to run and enforce the consensus rules they support accordingly. Miners determine which transactions to include in blocks. Exchanges, wallets, and merchants each steward large groups of users. Each participant in bitcoin voluntarily chooses how they wish to participate and the aggregate consensus represents the network.

Decentralized Networks are Older Than Humanity #

Decentralized networks have existed long before humans were around. In fact, fungi have been successfully implementing such systems for 1.3 billion years making them the most successful kingdom on our planet.

Besides fungi, there are several examples of distributed network archetypes found throughout nature (mycelium, dark matter, neurons, the internet, etc). Clearly this strategy works otherwise nature wouldn’t insist on replicating it.

When seen in the context of this long history of the decentralized network archetype, the advent of decentralized digital money seems less novel and more inevitable.

The decentralized network archetype is Lindy.

During a Billion Years of Evolution, Fungi Have Become Masters of Survival #

Fungi are uniquely adaptive and continue surviving mass extinction events.

65 million years ago a giant asteroid hit our planet-killing most life (including the dinosaurs) on our planet. The impact created a cloud of smoke so thick that it blocked sunlight from reaching the earth’s surface for many years. Without sunlight, plants died off and with them most animals. Fungi however do not rely on sunlight to survive, they can adapt quickly, and can find their own food.

After each extinction event, fungi “inherit the earth” and slowly rebuild until conditions stabilize and life can continue again.

Bitcoin will become the most successful monetary specie because its decentralized, adapts (relatively) quickly, finds its own food (unmet demand), and doesn’t need government support. In the event of a mass monetary extinction event, bitcoin will “inherit the earth.”

Japanese Government vs the Humble Slime Mold #

Whether it’s central banks trying to steer the economy or hierarchical corporations trying to maximize value in the information age… Central planning has many flaws.

When making decisions in the “information economy,” decentralized or flat organizations are more effective. They resist corruption, minimize bureaucracy, and push decision-making to the extremities where individuals (nodes) have the most up-to-date information about the problem at hand.

Let’s take a look at the Tokyo subway system to illustrate the power of decentralized networks.

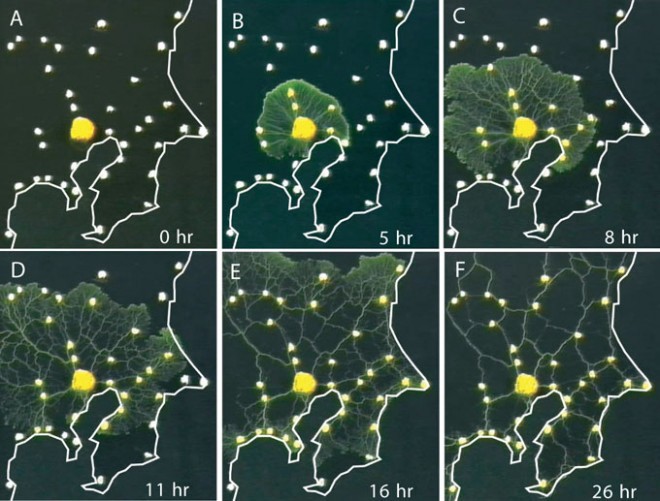

Scientists conducted an experiment where an ancient fungus (slime mold) was incentivized to recreate the Tokyo subway system. Each subway stop (node) was marked with the slime mold’s favorite food (oat flakes).

After a short while, the slime mold grew to connect all the nodes/stops in a more efficient design than the centrally planned committee of engineers hired by the Japanese government.

Slime Mold designing Tokyo Subway System

From the Abstract:

Transport networks are ubiquitous in both social and biological systems. Robust network performance involves a complex trade-off involving cost, transport efficiency, and fault tolerance. Biological networks have been honed by many cycles of evolutionary selection pressure and are likely to yield reasonable solutions to such combinatorial optimization problems. Furthermore, they develop without centralized control and may represent a readily scalable solution for growing networks in general. We show that the slime mold Physarum polycephalum forms networks with comparable efficiency, fault tolerance, and cost to those of real-world infrastructure networks — in this case, the Tokyo rail system. The core mechanisms needed for adaptive network formation can be captured in a biologically inspired mathematical model that may be useful to guide network construction in other domains.

When you think of the costs and complexities involved in such an infrastructure project, it’s quite sobering to realize a slime mold can design a better network in a single day.

Satoshi understood the power of the slime mold.

Bitcoin is a non-sovereign monetary good that pushes complexity and decision-making to the edge just like fungi. Over time, this free market decentralization allows bitcoin to out-compete various legacy financial systems who have little skin in the game, suffer from the innovator’s dilemma, become more fragile over time, and often drown in bureaucracy (or worse).

Life Without a Centralized Point of Failure #

Mycelium has no “central point of control.” Any individual part can be removed but the system as a whole survives.

“If you come at the king, you best not miss.”

— Omar Little (The Wire)

Nation states and central banks face a paradoxical challenge. If they attempt to destroy their competition, they’ll highlight the very need for bitcoin in the first place. And yet, the longer they wait, the stronger bitcoin becomes.

Hardened from hostility #

Both mycelium and bitcoin endure in the most competitive ecosystems on our planet and must constantly adapt in order to survive. They have skin in the game and become hardened from hostility.

Fungi are in a 24/7 competitive environment, constantly fighting little underground battles against various bacteria, microbes, and competing fungi.

If one mycelial “node” senses a predator/prey, it sends information to the “mushroom scientists” who then create a new enzyme to target the predator/prey. The fungal network distributes this new enzyme where needed.

Fungi fact #2: As humans, we benefit from medicinal compounds created by fungi. Most famously: Penicillin, which came from an accidental discovery by Alexander Fleming. Penicillin has been used to combat bacterial epidemics that historically have decimated human populations. Since the discovery of Penicillin our population has tripled.

Bitcoin responds to its environment in a similar manner. As bugs/threats/opportunities are found in the system, information travels to the “bitcoin scientists” (developers) who create an “enzyme” (software patch) and this update propagates through the system. This enables greater ecology success for bitcoin too. Bitcoin is antifragile.

Both fungi and bitcoin harden their defenses over time and learn to consume new food sources. This has a compounding effect increasing antifragility as well as life expectancy over time.

In one extreme case, let’s take a look at the largest organism on our planet, the Honey Mushroom (Armillaria sp). Found in the Blue Mountains in Eastern Oregon, this single organism is over 2.4 miles (3.8 km) across. It’s estimated to be between 1,900 and 8,650 years old and is currently consuming an entire forest.

Dealing with Competition #

Fungal networks steal competitive advantages from their neighbors in the form of genetic information just like bitcoin absorbs competitive advantages displayed by altcoins.

There is a (misguided) belief in which people assume that altcoins will implement cool new features that will eventually outcompete bitcoin.

The opposing camp believes that bitcoin will eventually absorb all the best features after they’ve been tested in the market which makes alternative currencies unable to compete over the long term. I stand in this camp.

Let’s take a look at how fungi approach their competition…

First, we need to understand some basic genetics. Genes are typically passed down from parent to offspring in what’s known as “Vertical Gene Transfer.”

Interestingly, fungi perform “Horizontal Gene transfer” — effectively slurping up genetic information from different species competing in the same ecosystem.

This process of horizontal gene transfer demonstrated by fungi foreshadows the future state where bitcoin integrates any proven ideas produced by altcoins at large.

For example: Combining the Lightning Joule Browser extension with a node (launch your own, use Casa, or otherwise) enables micro-transactions through your browser. This effectively eliminates the need for tokens like BAT.

You could even make the argument that bitcoin has been performing horizontal gene transfer since Satoshi first combined technologies used in previous attempts at electronic cash systems such as Hash Cash, E-gold, etc.

Arbitrage, Incentives, and Finding Their Place in Ecology #

Fungi perform two ecological roles on this planet: they recycle all matter into base elements & act as our planet’s immune system.

“Mycelia are the grand disassemblers of nature.”

— Paul Stamets

Fungi spend their days quietly decomposing organic matter. They transform rocks, branches, leaf litter, dead animals, and oil spills into their base elements (carbon, nitrogen, oxygen, etc). Then fungi trade these valuable elements with nearby organisms.

Fungi fact #3: Our forests would be buried in hundreds of feet of leaves and branches if fungi didn’t decompose them and redistribute the nutrients.

In other words, fungi unlock stranded resources. A tree cannot re-use its own leaves or branches as the carbon/nitrogen/phosphorus is locked in an unusable form. Fungi exploit arbitrage opportunities in their ecosystem.

Bitcoin, Through its PoW Mechanism, Unlocks Stranded Resources in the Form of Energy #

Before we tackle bitcoin, let’s explore a fascinating historical example: How aluminum was used to “export stranded renewable energy” from a country like Iceland.

Iceland produces renewable geothermal energy, often in remote places. This leads to an excess supply that cannot reach the demand (energy doesn’t travel well over long distances).

Iceland took advantage of its excess energy by producing aluminum, which is a very energy-intensive process. Iceland effectively turns excess energy into a durable store of value (Aluminum) which can be exported.

Bitcoin does the same thing. Instead of stranded energy “dying on the vine,” producers can mine bitcoin (or just sell excess energy to miners). This, too, enables excess energy production to be turned into a durable store of value. The second-order effect is that bitcoin is effectively subsidizing renewable energy projects.

To explore this concept in-depth, check out Dan Held’s Article: PoW is Efficient.

Fungi Fact #4: Fungi eating rocks is the main reason we have topsoil. Topsoil enables us to grow food. It took fungi over 1b years to produce just the ~18 inches of topsoil that we have today.

Fungi (and Bitcoin) Are Ecological Immune Systems #

Fungi are the immune systems for both the ecosystems in which they live and the planet at large.

Fungi produce medicinal compounds and protect their ecosystems through complex symbiotic relationships. Fungi broker resources underground (via mycelium) between species to ensure the health of the entire ecosystem.

How trees secretly talk to each other in the forest #

What do trees talk about? In the Douglas fir forests of Canada, see how trees “talk” to each other by forming…

In crude terms, the fungi mine minerals underground for trees in exchange for sugars (food) that the tree produces through photosynthesis. Trees get increased protection from invaders and crucial minerals which they cannot find on their own. Ever wonder why the baby oak tree can survive on a forest floor where it receives no sunlight?

Each organism participating in this shared incentive system improves the evolutionary fitness of the forest. I believe forests are living super-organisms consisting of a variety of different species.

Bitcoin performs a similar ecological role #

The market sends signals for bitcoin to create features that satisfy unmet demands or improve security as new threats emerge.

- Block space demand increases above capacity, Lightning Network is born.

- China cracks down on exchanges, LocalBitcoins.com flourishes.

- As Venezuela, Turkey, and Argentina hyper-inflate their currency, bitcoin steps in as a non-sovereign SoV.

- Blockstream launches Satellites able to broadcast bitcoin transactions to mitigate catastrophic events.

Positive feedback loop #

Bitcoin also benefits from the aligned incentives between users, full nodes, miners, exchanges, and merchants. As bitcoin better adapts to its environment, it better meets the demands of its growing constituents, which in turn recruits more network participants. This positive feedback loop promotes sustained growth of the network.

Like the honey mushroom consuming entire forests in Oregon, bitcoin is getting bigger and stronger over time.

Fungi fact #5: I wrote most of this essay while consuming medicinal mushrooms used for cognitive enhancement (Lions Mane, Chaga, and Cordyceps).

Chapter 2: Bitcoin as a Social Phenomenon (Mushroom) #

Exploring Hype Cycles, Ethnomycology, and the Cult of Satoshi

Original Artwork by Richard Giblett

In the first section, we explored bitcoin’s decentralized architecture through the lens of mycelium. We covered the decentralized network archetype, antifragility, PoW, arbitrage, bitcoin’s role in it’s ecology, and the merits of decentralization.

However, our fungi story is not yet complete. The next stage in the fungal life cycle is to reproduce and this all happens inside the mushroom. After reaching maturity, mushrooms release little mushroom seeds called spores capable of colonizing new territory.

Although the fungi kingdom is quite alien compared to life in the animal kingdom, humans have had a relationship with mushrooms for a long time. Historically, mushrooms have represented mystery, fear, opportunity, impermanence, and to some a cult-like reverence.

In Chapter 2, we’re going to explore bitcoin as a social phenomenon through the lens of the mysterious mushroom.

Let’s dive in!

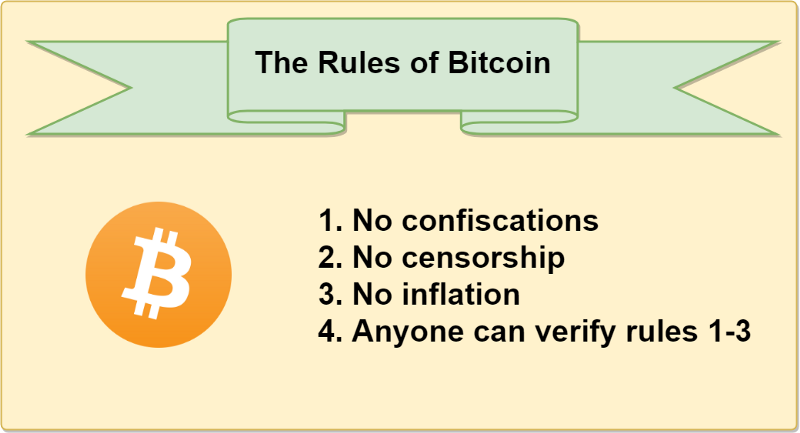

Bitcoin is a Social System Ratified by Code #

Bitcoin is made up of individual constituents each with their own perspectives, motivations, and abilities. Collectively they form consensus on the rules of the bitcoin game. The code simply ratifies this social consensus.

From Hasu’s seminal piece Unpacking Bitcoin’s Social Contract:

“The Bitcoin protocol automates the contract that is agreed upon on the social layer, while the social layer determines the rules of Bitcoin, based on the consensus of its users. They are symbiotic: Neither would be sufficient without the other.”

Humans are messy, emotional, predictably irrational beings. Bitcoin, being comprised of a network of humans, is no different.

Human Psychology, Hype Cycles, and the Mushroom Method #

Fungi exist primarily in their “mycelium form” which you can think of as an underground root system connecting trees and plants. Humans wouldn’t even know mycelium exists as it stays quiet underground for the majority of its life.

However, when fungi sense that conditions are favorable (temperature, humidity, etc), it sends up a mushroom above ground. These mushrooms are the sexual organs of fungi — essentially phallic spore (seed) delivery systems.

Before mushrooms break the ground, fungi concentrate energy into a tiny mass of cells underground called “pinheads” which persist until the perfect moment. Then, seemingly out of nowhere, mushrooms explode out of the ground doubling in size each day until reaching maturity.

Fungi Fact #6: Some fungi can produce mushrooms with enough force to break through asphalt.

After the mushroom is fully mature it crescendos with a release of millions of spores (mushroom “seeds”) before quickly decomposing back into the ground.

The mushroom only lives for a few triumphant days and most spores perish before infancy, however a small percentage of the spores will travel nearby and form new fungal colonies. These new colonies might stay underground for several years before the reproductive cycle continues again.

Fungi Fact #7: Spores are lighter than air which makes travel easy. Theoretically spores could catch an updraft and leave earth’s orbit. Luckily, they’re on a short list of biological matter capable of surviving the cold vacuum and radiation of space. Panspermia anyone?

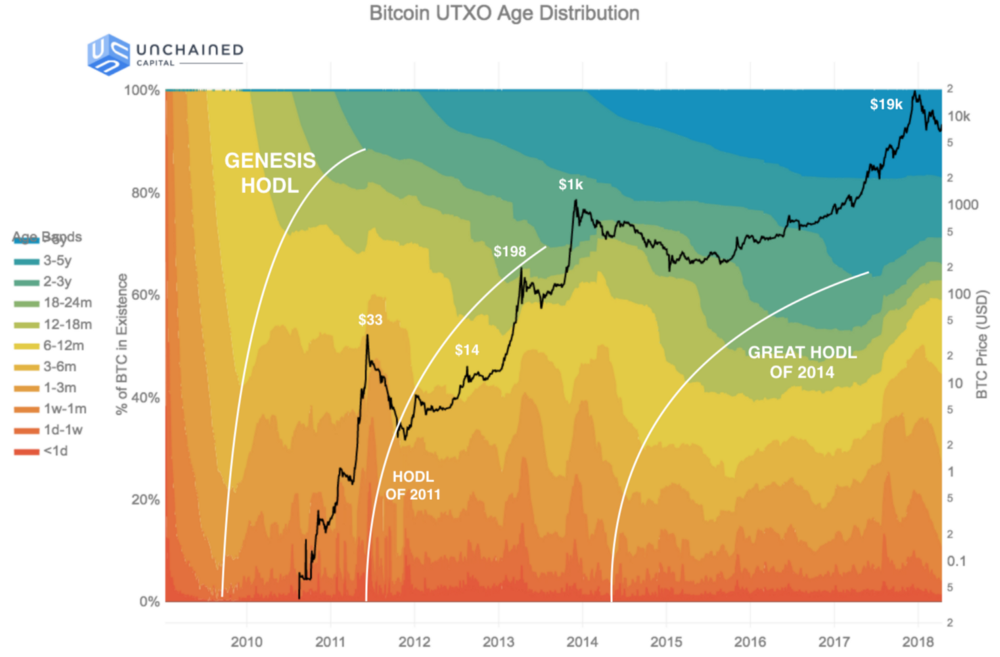

Bitcoin’s Hype Cycles Parallel Fungal Reproduction #

To the casual observer, most of bitcoin’s life is boring — months go by with relatively little action. Then when conditions are just right, bitcoin explodes into life, growing massively in size, and hijacking the consciousness of observers. Price goes to the “moon,” media is flooded with hyperbole, and “DMs from normies” flood in.

Then almost as soon as it crescendos, bitcoin fades away, dying back into obscurity as casual participants write it off as a fad, hype, or a failed experiment. Like the mushroom spores, most new users exit the ecosystem. However a small percentage form new colonies in bitcoin land. These bear market survivors become new “hodlers of last resort.”

Unsurprisingly, the bear market narrative is driven by surface-level activity (price).

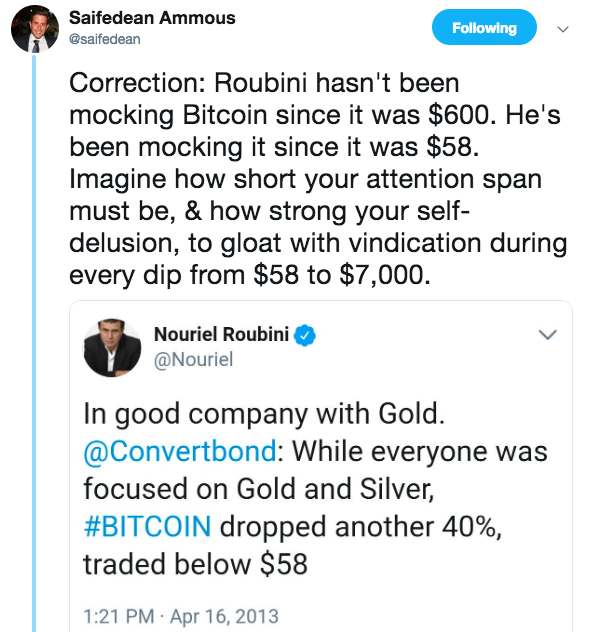

Bitcoin Detractors Mistake the Hype Cycle (Mushroom) for the Big Picture (Mycelial Network) #

Amnesiac pundits proudly pile on proclaiming bitcoin has perished (for the 335th time). Fiat maximalists take victory laps on twitter by posting 12 month charts.

“You’re missing the mycelium for the mushroom!”

— h/t Nic Carter

Roubini celebrates by hosting his 3rd bear market barbecue. Detractors gather to roast the proverbial (bitcoin) mushroom while patting each other on the back.

However to be fair, bitcoin is complicated. Many “crypto people” still think bitcoin is myspace and Ripplecoin is the “standard.” Unsurprisingly most journalists don’t grasp what’s going on. Imagine being assigned the “bitcoin beat” as a well-intentioned, run-of-the-mill journalist.

While the mushroom has died (recent hype cycle), the mycelium (bitcoin) is thriving underground. #

Like a mushroom past its prime, bitcoin exuberance decays and the price plummets. This bear market will shake out weak hands, hedge funds will fail, ICOs will give back investor money or worse, projects will fail, and some charlatans will be exposed.

However hodlers, new and old, collectively go underground and quietly make bitcoin better: building, learning, and forming alliances.

Bitcoin Improved Dramatically during the 2018-2019 Bear Market #

- Lightning Network is picking up momentum

- New services such as SwanBitcoin make acquiring bitcoin easier then ever (auto DCA)

- SegWit adoption grows to around 50% improving transaction throughout

- New developers being groomed by Jimmy Song & Justin Moon

- Casa, Pierre, Nodl, and others make running full nodes easier

- Nomics producing cleaner data than CMC

- Bitcoin Financial Services being built out (Unchained, River, Blockfi)

- Foundations laid for inevitable financialization (Fidelity, Bakkt, etc)

- Schnorr signatures are being built out (tech specs / whitepaper / TL;DR)

- “Proof of Keys” to minimize risk of rehypothecation + stress test ecosystem + remind new users about self-sovereignty

- Blockstream enables bitcoin transactions via satellite. Things get interesting when combined with mesh networks.

- Metrics for measuring health of cryptocurrencies emerge such as Realized Cap, Economic Throughput, Economic Density ($/bytes), and MVRV.

- Passed the peak of miner centralization (bye bye Bitmain)

- Coinshares report says 77% of bitcoin’s energy consumption is from renewable sources

- New scribblers stand on the shoulders of giants attempting to describe bitcoin in novel ways.

As time goes on, narratives evolve as bitcoin continues to reveal herself (himself? itself?) to curious onlookers.

Hodl Waves by Dhruv Bansal at Unchained Capital

Eventually the market bottoms. Hodlers cling together like a Band of Brothers creating a strong foundation capable of sustaining future growth.

“Hodlers are the revolutionaries”

— Dan Held

As hodlers hoard more bitcoin, the “float” (supply actively being traded) is increasingly constrained. With a decreasing available supply, each new user puts more upward pressure on the price. As price rises, media shines a spotlight, new users are pulled in, and before long we’re back in another hype cycle.

Mycophobia, Maria Sabina, and the Cult of Satoshi #

Sometimes people say crypto can be a bit “culty.” This is both true and a net positive. Before we get into bitcoin’s religious tendencies, let’s learn from our history with mushrooms.

The modern western world has been inflicted with “mycophobia” — the irrational fear of fungi. People fear what they do not understand, and let’s face it: most people think mushrooms are “vegetables.”

Mushrooms are strange. They represent the life-and-death cycle of impermanence that humans subconsciously fear. Facing our own mortality is no fun, better to just avoid it.

However, it hasn’t always been this way. In fact, humans have had a relationship with mushrooms for a long time. From food, to medicine, to superstitions and religious artifacts. Mushrooms can save your life, kill you, feed you, and even alter your consciousness.

Anthropological evidence suggests that humans who partnered with fungi had an evolutionary advantage. As more people understand fungi (and bitcoin), they’ll soon realize how important they just might be.

Humans Who Partner with Fungi have an Evolutionary Advantage #

Ancient man relied on mushrooms to survive in the Alps of northern Italy. Ötzi, the Ice Man, who died nearly 5,300 years ago, was discovered carrying two mushrooms (Amadou and Birch Polypore) tethered on a leather strap. One of the mushrooms was used to start fires and the other was discovered to be medicinally active against the parasite discovered in his gut.

(source)

As far back as 19,000 years ago, a particularly high status woman dubbed the “red lady” consumed mushrooms as evidenced by the spores recovered from her teeth. Whether this mushrooms was for food, religious purposes, or otherwise is unknown.

One of our oldest examples of cave paintings was discovered in northern Algeria, estimated to be over 6,000 years old. This painting depicted “bee man” who has mushrooms in his hands and growing out of his body.

Cave painting: “Bee man” covered in mushrooms. Circa 4,000 BC

In Siberia, the Koryak people revered the “Fly Agaric” mushroom (Amanita Muscaria) which is the iconic “red and white” mushroom famously portrayed in Super Mario Brothers and Alice in Wonderland. The Koryak loved this mushroom so much they would drink the urine of humans and reindeer who recently consumed the mushroom. Apparently you can recycle urine in this way up to 5x while achieving desired effects. How they discovered this phenomenon is another question all together…

Get your tinfoil hat, the Fly Agaric may have inspired our Christmas traditions.

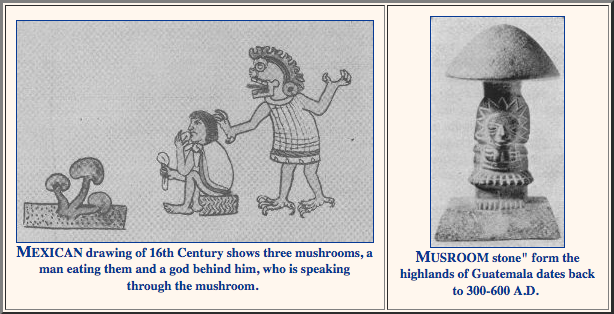

The Mazatec Culture from present day Mexico revered the mushroom as sacred. Discovered relatively recently by Gordon Wasson which he detailed in a famous article in a 1955 edition of Life Magazine. Many tourists have since visited this region in Mexico seeking to learn from the famous Mushroom Shaman, Maria Sabina, and her kin.

Mushroom artifacts from Central America

Clearly the mushroom has captured the attention of our ancestors.

Bitcoin Conjures up a Similar Quasi-Religious Fervor #

Described brilliantly by Yuval Noah Harari, Homo Sapiens are uniquely capable of cooperating flexibly in large numbers. This enables us to collectively agree on abstract concepts such as nations, gods, and money.

Just as humans formed religious cults around the mushroom, one way to describe bitcoin is a neo-money religious movement.

The Mystery of Satoshi created a strong foundation enabling emergent religious tendencies.

Bitcoin was created through immaculate conception by a mythical character (Satoshi) who later sacrificed himself for the greater good.

The Cult of Satoshi inspires some fanatics to dedicate their lives to promoting the “good word.” Not all bitcoiners fall into the same religious sect. Some scholars cling to the ancient religious text (whitepaper) while others interpret Satoshi’s vision through his early forum posts.

Disagreements about priorities evidenced by the scaling debates have lead to hard forks and fractured “congregations.” Not unlike Martin Luther fracturing the catholic church by pinning the “Ninety-five Theses” on the church door in 1517.

Roger Ver was known as “Bitcoin Jesus” from his early days spreading the good word by gifting satoshis to fiat afflicted restaurateurs.

Messianic figures like Faketoshi (Craig Wright) spring up claiming to be the real Satoshi Nakamoto. Faketoshi, the fundamentalist, brands his sacrament as “Satoshi’s Vision,” the one true bitcoin as laid out in the “bible” (whitepaper).

“The functional details are not covered in the paper, but the sourcecode is coming soon.” — Satoshi Nakamoto

Nevermind how incomplete or how many errors are found in the whitepaper, Faketoshi claims his fork of a fork is the real “Satoshi’s Vision.” Even if Faketoshi’s fork WAS closest to Satoshi’s original vision (it wasn’t), does it even matter?

The answer is no. The essence of bitcoin is intimately tied to the ever-evolving social consensus surrounding the protocol.

Each Rival Sect is a Competing Social Contract #

Bitcoin’s social contract coalesces around a few simple rules. These agreed upon rules (a Schelling point) are then ratified in the bitcoin protocol automating social consensus.

(Source: Hasu’s Bitcoin as a Social Contract)

Let’s use the “great scaling debate” as an example. One group (BCH) believed we should focus on “cheap payments” at the expense of “decentralization,” while the other (BTC) believed we need to prioritize “decentralization” on the base layer and scale payments off-chain.

As a competing religious sect in a free market, the BCash gang was free to fork the bitcoin code and test their hypothesis. One year later, it’s clear that the social consensus surrounding bitcoin doesn’t agree with the BCH approach as the market doesn’t value BCH or any other fork spawn.

Detractors of bitcoin might then say “forking bitcoin code inflates supply.”

However, that’s like saying when Zimbabwe prints more money it devalues the US Dollar. [h/t Murad]

In the case of the failed BCash fork(s), they copied the code (bitcoin protocol) but failed to mobilize the people (social layer) resulting in an asset with relatively minimal value. A prime example of bitcoin resisting corruption from bad actors by requiring social consensus in order to change the network.

In other words, bitcoin replaces social assumptions with mathematical assumptions. We will dive deeper into the consequences this has on our social scalability in chapter 4.

Religious Fanatic Behavior is an Indicator of Future Success? #

We’re witnessing a new scarce commodity being monetized in real-time. No living person has witnessed such a phenomenon.

In order to actually pull this off, the collective consciousness of the planet will need to change. Convincing people that money isn’t green paper and it doesn’t need to come from our government will take time.

In order to overcome the inevitable adversity required to create a new global reserve currency, it just might require some “religious zeal.” As each new disciple converts to the cult of Satoshi, the chances of hyperbitcoinization increase.

That being said, there are risks of over-politicizing bitcoin. [h/t Hasu]

Some factions of the community portray bitcoin as a club for Austrian Economists who only eat meat that they personally shot with one of their many guns. While those things are well and fine, they are not prerequisites for being a bitcoiner. Let’s not entangle the two at the cost of repelling prospective bitcoiners.

Now, be sure to convince all your friends and family to read the New Testament (The Bitcoin Standard) at least twice before heading out on your next FUD Crushing Crusade.

Good Cults Have Incentives to Evangelize #

Money is the ultimate network effect — its value is determined by the number of people you can interact with.

In bitcoin, not only does it capture its user’s imagination in a religious sense, but there are also financial incentives to recruit new members into the congregation. With each new user that buys bitcoin, the value of bitcoin directionally increases, benefiting previous hodlers. Then that new user is incentivized to convert their friends. Who then convert their friends. And the cycle continues.

As price increases, so do the incentives to improve security as evidenced by the difficulty adjustment — one of Satoshi’s most brilliant contributions.

Price increases → mining becomes more profitable → more miners contribute hash power → better security makes bitcoin more valuable.

The Fungus Is Spreading #

If the bear market blues make you frown, just look underground. There are countless developments (some listed above) to be optimistic about.

The bitcoin fungus is quietly spreading underground.

With each passing day bitcoin is eating more fiat, becoming more robust, more decentralized, and more Lindy.

Even the darkest night will end and the sun will rise.

Chapter 3: Bitcoin is the Antivirus (Mushroom Medicine) #

We’ve all heard the incredible potential of a Bitcoin future. I’m certainly on board for sound money and social scalability.

However, this drama will take decades. What if Bitcoin doesn’t survive long enough to realize its full potential?

Thankfully Satoshi learned from failed attempts at private money. Bitcoin’s genetic code was engineered for maximum survivability.

In this section, we’re going to explore the fertile macro environment and Bitcoin’s survivability through the lens of fungi.

Let’s dive in!

Honey Bees, Varroa Mites, and Mushroom Medicines #

In 1997 a curious Mycologist by the name of Paul Stamets observed a unique behavior demonstrated by honey bees. The bees went out of their way to consume water containing mushroom spores. “Hmm that’s interesting” thought Paul.

15 years later, Paul started to connect the dots. Honey bees were dying at an unprecedented rate due to colony collapse disorder (CCD). The bees were dying in part, by infestations of Varroa Mites which transmit deadly viruses such as Deformed Wing Virus and Lake Sinai Virus.

Chemicals used in modern agriculture poisoned the bees so their immune systems are too weak to fend off the Varroa Mites. As bees travel around they spread the Mites to all nearby bees leading to a 70% decline in Bee populations since 2005.

Who cares about the bees?

Bees are a bedrock species responsible for pollinating a large percentage of our food sources (avocados, almonds, etc). If we lose the bees, there are countless downstream effects such as lost jobs, destroyed ecosystems, and reduced food security.

(Image source)

Back to our mycologist Paul, who in 2012 made a monumental realization: fungi are known to support immune systems — the bees must have instinctively known to drink the fungal water. Paul tested his hypothesis and soon after demonstrated that using a simple antivirus “mushroom medicine,” we can reduce the effects of Deformed Wing Virus / Colony Collapse by 80%.

Our current monetary regime is the Varroa Mite

Our current central banking-based monetary regime is just like the pesky Varroa Mites attacking our financial markets.

- Varroa Mites are hard to kill — fiat currency regimes benefit from a monopoly on violence

- They spread viruses on everything they touch — market distortions, cronyism, regulatory capture

- Negative downstream effects — capital misallocation, increased time preference, limits human productivity, increases risk of catastrophe.

Bitcoin is the antivirus (mushroom medicine) that “saves the bees.”

Bitcoin (mushroom medicine) prevents the spread of our destructive financial hegemony (Varroa Mites) which will usher in a new era of human achievement (saving the bees has secondary effects such as ensuring food security).

Heading into the Great Unknown #

We’re heading into a period of uncertainty never before witnessed by our civilization. The fiat money experiment is on shaky ground and our social systems are beginning to break down.

Globally, we’re facing unprecedented debt-to-GDP levels. The Fed, European Central Bank, Bank of Japan, and the Bank of England now appear to “own a fifth of their governments’ total debt.” Central banks are running out of moves.

In a last ditch effort, European Central Banks are pushing negative interest rates. Are we really going to allow the hegemonic banking system to CHARGE depositors for storing our digital fiat in their insecure panopticon banks?

How about China?

China’s real estate market is shaky and long overdue for a correction. Capital controls and seeking yields in a cooling economy have led to inflated real estate prices in China. What happens when the market corrects and everyone rushes for the door? Better have a plan ₿.

And the US?

The US is currently over $22 Trillion in debt, however don’t expect the US to default on their obligations. Former Fed chairman Alan Greenspan said “the United States can pay any debt because we can always print money to do that.”

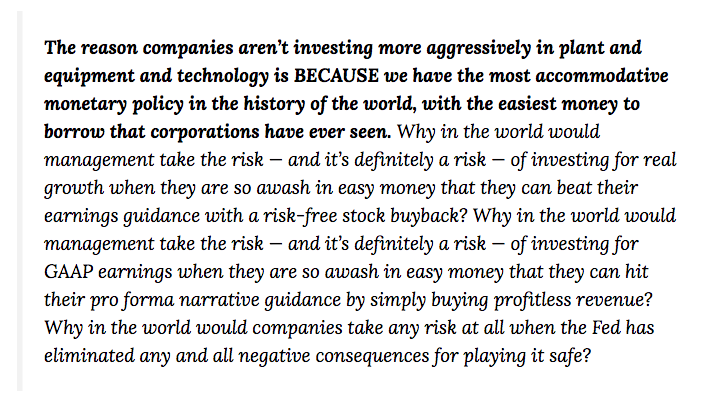

In an enlightening article titled This is Water, Ben Hunt explains how artificially suppressed interest rates (easy money) lead to decreased productivity and a zombification of our financial markets. This same pattern foreshadowed the 08/09 financial collapse.

Social structures are showing weakness

Countries around the world are seeking to eliminate physical cash. Cash is a fundamental tool for privacy and is a requirement to maintain an open society. Without physical cash (or Bitcoin), citizens are at the mercy of the financial surveillance machine. A slippery slope indeed.

Can’t forget China’s Social Credit System. Soon China’s surveillance technology will be exported all around the world.

Young people don’t trust their governments or financial institutions. 40% of Americans cannot afford an unexpected $400 expense. No wonder potential Democratic nominee Andrew Yang is gaining steam in the polls while campaigning for Universal Basic Income.

An uncertain future is a perfect substrate to breed extremism. Democratic Socialism, Modern Monetary Theory (MMT), Negative Interest Rates Policy (NIRP), the war on cash, widespread consumerism, and mounting student debt are merely symptoms of a derelict regime.

Our Legacy Institutions are Simply Not Equipped to Deal With the Complexity of the Information Age #

Current attempts to fix the political-economical machine from the inside are unironically powered by the “waste heat of war machine” (h/t Vinay Gupta). We need a systemic change. Something cut from a different cloth.

What if a sound money regime (Bitcoin) is an antidote to the madness?

It is my hope that in the future, we’ll look back on our current “fiat banking experiment” with disgust. How could we live under such an archaic regime for so long?

Just like fungi transforms dead and dying organic matter into new life, Bitcoin will transform our decrepit banking system into a robust financial foundation upon which new growth can occur.

The Great Filter of Cryptocurrencies #

Can bitcoin survive long enough to reach its full potential?

Cypherpunks, Anarchists, and Voluntarists have been trying to create private, non-government money for a very long time. In fact, modern attempts date back more than 30 years, since the early days of Chaumian Ecash, to E-gold, and B-Money.

Despite moderate success of private money before Bitcoin, eventually they were all shut down by overreaching governments and/or business interests.

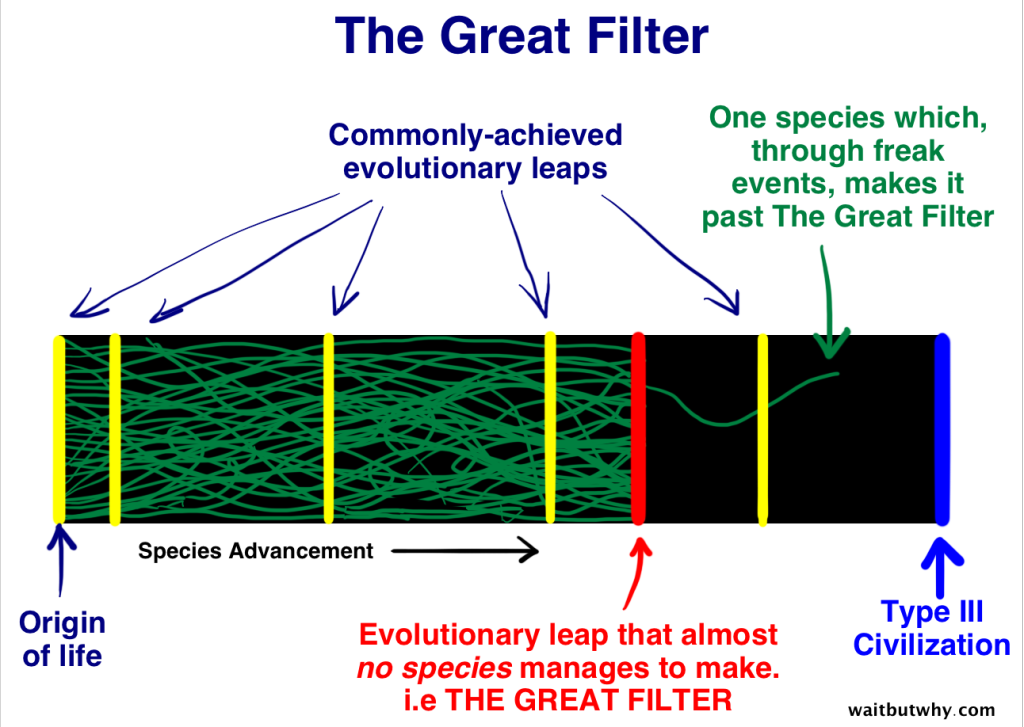

The Great Filter Theory

The Great Filter theory was developed after noticing our lack of success finding intelligent life in the universe. Where is everybody?

The theory predicts: during life’s evolutionary process, there are some obstacles that are extremely unlikely or impossible to overcome. That obstacle is “The Great Filter.”

For example, what if every time an advanced civilization created nuclear bombs it ended up destroying itself? In this scenario, it might be statistically improbable to survive long after inventing nuclear weapons.

(Source: The Fermi Paradox by Tim Urban which is my favorite blog)

For Cryptocurrencies, The Great Filter is surviving nation-state-level attacks.

Bitcoin is the only monetary species that has a chance of surviving the great filter. More on this below.

Why would a nation-state or entrenched business want to attack a competitive form of money?

In short: he who has the gold, makes the rules.

The two main benefits of controlling the money supply are the ability to inflate the money supply (shadow tax) and the Cantillon effect.

The Cantillon effect describes the uneven expansion of the money supply. When the central bank prints new money, those closest to the money (banks and big corporations) profit from new “cheap money.” By the time the rest of the population receive the new money, price inflation has already begun.

The Cantillon effect results in a wealth redistribution from the poor to the rich.

The government goes to great lengths to protect its monopoly

Like E-gold in the 1990s, any competing cryptocurrency can thrive in times of peace. However, when sufficiently agitated, those in power will lash out to protect their interests. History is littered with examples.

Between 2006–2008, the US government expanded the definition of the ‘money transmitter license’ (under the Patriot Act) to target E-gold. In its peak, E-gold was processing over $2B worth of purchases per year. Unfortunately, the US government took advantage of the centralized nature of E-gold, busted down the door, and shut it down.

Moral of the story? Governments do not like competition.

In fact, Congressman Sherman from California recently called for a complete ban of Bitcoin. Sherman is surprisingly enlightened. He understands Bitcoin’s true mission: Creating a new global base money that cannot be weaponized by the global superpower du jour.

Time For a New Strategy: Be Unstoppable

In 1984, famous Austrian Economist, Friedrich August von Hayek, unknowingly laid the foundation of Bitcoin’s evolutionary strategy: be unstoppable.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.”

With chilling foresight, Hayek predicted Bitcoin some 25 years prior.

Satoshi obviously read Hayek and he understood “The Great Filter of Cryptocurrencies”

In 2009 Satoshi Nakamoto released an implementation of Hayek’s “unstoppable money.” From day one, Bitcoin was engineered to survive “The Great Filter.”

“A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990’s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system.”

— Satoshi Nakamoto

In order for the full potential of Bitcoin to be realized, it needs to be so resilient that even nation-state-level actors cannot successfully kill Bitcoin. This meant preventing any party from having full control over the system.

Parallels with Fungi: the most resilient species on our planet

Ancient mushrooms called Prototaxites

Over 1.3b years of evolution, fungi have perfected the art of staying alive. Unlike plants, fungi do not rely on sunlight, instead they find/create their own food. Fungi do not have a centralized point of failure making them resilient to attacks. When sufficiently perturbed, fungi steal genetic code from their ecological neighbors (Horizontal Gene Transfer).

Since complex life evolved on our planet, we’ve experienced 5 great extinction events where 75–96% of all life on earth perished.

During each cataclysmic event, fungi inherited the earth due to their anti-fragile nature. In an effort to survive “the great filter,” Bitcoin mimics effective evolutionary strategies observed in the fungi kingdom.

Can Bitcoin Survive “The Great Filter?” #

How could you kill bitcoin? Turn off the internet? Make it illegal to use? Tax it to hell?

Any cryptocurrency that cannot (feasibly) survive a nation-state-level attack is pointless. Simply delaying their inevitable demise.

Satoshi designed the Bitcoin super-organism to survive “The Great Filter” and to resist corruption. This lofty goal kick-started an evolutionary path separating bitcoin from all the other cryptocurrencies and “blockchain projects.”

Does this mean Bitcoin is guaranteed to survive the great filter?

Not necessarily. It’s impossible to know until the day it suffers a coordinated attack by a state-level actor. However, Bitcoin is the only existing cryptocurrency that stands a chance. Let’s explore some positive trends in Bitcoin’s survivability toolbox.

- Bitcoin is unregulatable. No one person or entity in charge. Code is free speech. Each country has its own competing jurisdiction.

- Game theory protects Bitcoin from a global coordinated attack. Nation-states compete with each other. Unlikely to see top nations cooperate. If the US bans BTC, China has an incentive to adopt. Nations not benefiting from the current USD regime have an incentive to adopt BTC.

- Bitcoin’s PoW protects the ledger with an “energy shield.” By anchoring Bitcoin to real economic value (energy), the only way to change the ledger is to “re-do all the work” aka spend the same amount of money in the form of electricity. h/t @danheld

- Bitcoin inspires a religious fervor from its supporters. Ideologically motivated “hardliners” act as an immune system. Surviving the scaling wars (NYA/S2X) demonstrates this. Bitcoiners “provide cover fire” until Bitcoin gets through the door. (h/t Bitcoin Sign Guy)

- Bitcoin can route around ISP censorship. Bitcoin has a growing network of alternatives to the mainstream internet (mesh networks, HAM radios, and satellites). Maybe even routing transactions through a mycelial network(theoretically possible).

- Bitcoin is an idea, ideas are eternal. Bitcoin spreads like a mind virus. Even if somehow the current form was “killed,” the idea will live forever. “This Snow Crash thing — is it a virus, a drug, or a religion?” Juanita shrugs. ‘What’s the difference?’” h/t @nealstephenson

- Bitcoin’s privacy improvements reduce taxability. CoinJoins and other privacy technologies will minimize the ability for governments to attack Bitcoin through predatory tax legislation. Thank you @wasabiwallet @SamouraiWallet

- Bitcoin minimizes the ability to cheat. Bitcoin doesn’t rely on trust. Think “can’t be changed” instead of trusting that a system “won’t be changed.” Bitcoin recognizes leaders, formalized governance, and concentration of power as attack vectors waiting to be exploited.

- Nation-states underestimate Bitcoin. This buys time for Bitcoin to get stronger + harder to kill. The hegemonic banking system is digging their own grave with shovel made of 100% pure hubris. If only we had a ₿ackup plan

So far, we haven’t seen any serious state-level attack on Bitcoin. However, if Bitcoin continues to absorb value there is an incentive to attack it. In the future, we’ll call this period in Bitcoin’s life the “great peace.”

Alternative Game Theory: Honey Badger Lives Here

Bitcoin only needs to convince a few superpowers that the reward of adopting it outweighs the risk of attacking it.

This game theory is similar to having a sign in front of your house that says “Security system installed” or “big angry dog lives here.” Doesn’t matter if you actually have a dog or security system, the threat alone acts like a deterrent to would-be attackers.

Bitcoin has a sign in the front yard that says “Beware of Honey Badger.” This sign reminds nation-states that they cannot easily kill Bitcoin.

If nation-states attempt to destroy their monetary competition, they’ll highlight the very need for bitcoin in the first place. And yet, the longer they wait, the stronger Bitcoin becomes.

The “Blockchain Industry” is a Red Herring #

First, it’s important to understand that blockchainers, stable coiners, security tokenizers, and corporate chainers do NOT compete with Bitcoin. They taxonomically branched off and are attempting to satisfy a separate niche.

By and large, the “blockchain industry” is a Red Herring, leading businesses and governments to false conclusions. It serves as a distraction and unwillingly provides cover fire for Bitcoin.

Does that mean we should shun the blockchainers? No. They simply mistake Blockchain Hype (Mushroom) for Bitcoin (Mycelial Network).

We should first attempt to educate them as most people were not born Bitcoiners. That being said, deliberate scammers deserve to be flamed.

How the “blockchain industry” helps Bitcoin…

Blockchainers tie up government resources, train future developers, confuse incumbent businesses, and lull banksters to sleep.

Banks like JP Morgan will train hundreds of blockchain developers. Eventually, they’ll discover Bitcoin and say goodbye to boring bank coin & and instead join the peaceful revolution. JP Morgan is funding their own demise? How poetic.

Zuckerberg will soon put a “crypto wallet” in everyone’s pocket. Instead of competing with Bitcoin, ZuckBucks may actually attempt to compete with USD. Either way, it gets people comfortable with non-state money on their phone similar to WeChat and Alipay. The first widespread censorship of ZuckBucks will nicely demonstrate the need for BTC in the first place.

Blockchainers and scammers claim Bitcoin is old and can’t scale. It’s Beanie Babies and myspace. They paint Bitcoin as a friendly, but limited-use fungus, that “brought us the blockchain.”

While the blockchain zeitgeist chases their tail, Bitcoin is quietly growing underground, fusing with the “roots” of the legacy finance system, building resilience, recruiting volunteers, infecting curious minds like a cordyceps mushroom, and preparing for “The Great Filter.”

If we’re lucky, Blockchainers will distract global superpowers just long enough for Bitcoin to become “too big to fail.”

Chapter 4: Bitcoin is a Catalyst for Human Evolution (Symbiosis) #

Exploring Bitcoin through the lens of natural selection, evolution, and symbiosis

Original Art by FritsAhlefeldt.com

This is a story of how symbiotic relationships can change the course of history forever.

Just as fungi and plants formed a symbiotic relationship to successfully colonize dry land, humans can form symbiosis with Bitcoin to improve individually and to advance our species.

In this article we’re going to explore Bitcoin as a catalyst for human evolution, through the lens of geological timescales, evolution, and symbiosis.

Definition of Symbiosis: when two dissimilar organisms live together in intimate association (as in parasitism or mutualism). Example: Clownfish and Sea Anemones

Bootstrapping Life on Terra Incognita #

Five hundred million years ago, all biological life lived in the oceans. Dryland as we know it was a sterile volcanic wasteland devoid of life. That is, until plants and fungi formed a fateful partnership that changed the course of history forever.

This symbiotic partnership created a cascade of evolutionary forces leading to the creation of all terrestrial life, including homo sapiens.

Fast forward to modernity, humans now organize around network-based technologies, such as the internet and Bitcoin, which are reincarnations of the ancient mycelial archetype out of which we emerged.

Take a deep breath. Life is amazing.

Ok, so how did we get here?

First, a quick biology lesson. Organisms are classified as either Autotrophic or Heterotrophic.

Autotrophs are organisms that make their food. For example: plants convert sunlight and carbon dioxide into food via photosynthesis.

Heterotrophs are organisms that find their food. For example: lions eat gazelles and fungi produce enzymes to externally digest their environment.

Like human settlers, organisms colonizing new territory are most vulnerable in the early days. In order for fungi to colonize dry land (terra), they needed to secure a reliable food source.

Fungi effectively domesticated photosynthesis machines (algae) to harness a self-sustaining food source. We can think of these algae as little solar panels bolted onto fungal networks which made colonizing virgin dry land possible.

Soon after getting established, the fungi began digesting the volcanic rock upon which they sat. This ultimately liberated valuable nutrients which were then traded with other nearby fungi, algae, bacteria, etc. Together, these early settlers bootstrapped life on dry land. Let’s see how this compares to Bitcoin.

How Satoshi Bootstrapped Embryonic Bitcoin #

In order to colonize the internet (terra incognita) with a new form of money, Satoshi needed to form a symbiotic partnership.

Fortunately, he found the perfect partnership and made a series of wise decisions that maximized Bitcoin’s chance of survival during the bootstrapping phase.

How satoshi “partnered with the algae” to bootstrap Bitcoin’s life on the internet

- High early issuance rate disproportionately rewarded early adopters (the early issuance rate might have been too aggressive)

- Launched on the Cryptography mailing list (if anyone could incubate Bitcoin it was the Cypherpunks on that email list)

- Timing the launch during the 08/09 financial crisis (was this blind luck?)

- Satoshi’s message in the genesis block “Chancellor on the second brink of bailout” (rallying cry to gain ideologically motivated supporters)

Mutualism or Parasitism: Examining the Cypherpunk-Satoshi-Symbiosis #

Were the algae complicit in the fungal partnership (mutualism)? Or were the fungi taking advantage of the algae’s ability to make food at the expense of the algae (parasitism)?

It appears to be mutualism. The algae may have been initially kidnapped, however in exchange for photosynthesizing, they gained a mycelial security system, and the opportunity to colonize a new niche.

Were the cypherpunks complicit and did they benefit in the partnership (mutualism)? Or did satoshi take advantage of the cyberpunks because he needed an initial distribution strategy (parasitism)?

“It’s very attractive to the libertarian viewpoint if we can explain it properly. I’m better with code than with words though.”

— Satoshi Nakamoto

Most cypherpunks dismissed Bitcoin initially, however a select few (most notably: Hal Finney) jumped onboard. Considering they were first to learn about Bitcoin, they had a chance to acquire Bitcoin’s native monetary units in exchange for the marginal electricity cost to mine (essentially nothing). With the advantage of hindsight, acquiring Bitcoin during the first few years would lead to wealth beyond measure.

“The possibility of generating coins today with a few cents of compute time may be a good bet, a payoff of something like 100 million to 1!”

— Hal Finney

(Economic) Evolution by Natural Selection #

With the initial conditions of life on land set into motion, the fungal-plant alliance can start welcoming new market participants (organisms) to enter the ecosystem.

Fungi interact with the world through chemistry. They secrete enzymes to externally digest their environment. Volcanic rock was the only restaurant in town. These early fungi liberated molecular resources by metabolizing the volcanic rock upon which they stood.

This enabled a proto-economy made up of primitive fungi, plants, and bacteria. They traded essential molecules required for carbon-based lifeforms (carbon, nitrogen, oxygen, etc).

Fungi were essentially turning rocks into fungible biology tokens. These biology tokens were then traded on top of mycelial rails connecting all nearby life. Fungi both created the market and facilitated trade leading to an explosion of biodiversity on dry land.

Terra Takes Her First Breath #

Before plants colonized dry land, our earth’s atmosphere wasn’t very hospitable. As you know, plants inhale CO2 and exhale O2. This ultimately led to the formation of our oxygen-rich atmosphere — planet earth was taking her first breath.

In a sense, fungi unleashed free market dynamics in a new market which led to an incredible proliferation of life. Now let’s explore the parallels with Bitcoin.

Bitcoin Enables a New Economic Paradigm #

Just as novel organisms emerge (via speciation) to occupy newly created niches on dry land, Bitcoin evolves it’s DNA (code) to produce new phenotypes (novel features) to take advantage of new niches.

In other words, Bitcoin enables novel financial use cases that were not possible before. This increases the size of the economic pie, thus generating wealth for society.

Novelty provided by Bitcoin:

- The first and only implementation of absolute scarcity (hard to overstate)

- A global, near instant, apolitical, settlement system

- Neutral money not easily captured by special interests.

- Uncensorable medium of exchange for black/grey markets

- Democratization of basic financial services

- Non-sovereign store of value with negligible barrier to entry

Bitcoin and Mycelium Improve Trade #

Mycelial networks act as a resource transport layer and communications network connecting organisms in the biosphere. This enables organisms to voluntarily trade resources and knowledge across species lines. Increasing trade leads to increased specialization (division of labor), further increasing biodiversity (wealth and resilience) in the ecosystem.

Currently, our governments form economic monopolies which prevent many citizens from accessing the global markets.

Think about all the unproductive human capital siloed in countries like Iran, Venezuela, and Argentina. Without access to a common economic language (Bitcoin) many people are unable to participate in global trade.

As Bitcoin becomes ubiquitous, it unleashes human productivity leading to increased innovation, specialization, and trade. We’re already seeing some basic examples such as freelancers in Venezuela using Bitcoin as a bridge currency to access USD which effectively evades financial controls.

We can extrapolate “Bitcoin being used as a bridge currency” into a grander vision of the future where everyone speaks the same economic language. A global market for talent leads to more goods and services produced for a cheaper price. Not to mention, increased trade with developing countries will help lift people out of poverty.

Bitcoin Enables Economic Evolution by Natural Selection #

Darwinian evolution by natural selection is a biological engine designed to reward successful actors and eliminate unsuccessful actors. When the antelope gets eaten by the lion, it dies, no one bails out the antelope. Nature has skin in the game. This feedback loop is crucial. Individuals are fragile in order to ensure the system is antifragile.

Market-based economics is an engine designed to seek more efficient uses of capital by rewarding successful ventures and punishing the unsuccessful. However, our current form of “capitalism” is more like cronyism or as Travis Kling said: “socialism for the rich.”

Instead of letting companies fail, we bail them out. This results in broken incentives which create a moral hazard making the entire system more fragile. Not to mention, disproportionately hurting the working class. Heads I win, tails you lose.

A sound money system (like Bitcoin) improves this economic engine by tightening the feedback mechanism that rewards value creation and punishes failure. In a Bitcoin world, bailouts aren’t really possible because monetary expansion is restrained by a fixed monetary base. Bitcoin ensures individual people/companies are fragile in order to ensure the economic system remains antifragile.

In other words, Bitcoin increases economic “skin in the game” which improves the feedback loop leading to economic evolution by natural selection. Economic Darwinism for the win.

Taming of the Tenrec #

Tenrec: the ancestor to all living placental mammals

Due to a symbiotic relationship with fungi and plants, and evolution by natural selection, our pale blue dot was transformed from a barren rock to the garden of Eden. Truly marvelous.

Let’s zoom in to the tail-end of the Cretaceous period (~65 million years ago). The planet was dominated by dinosaurs both on land and in our oceans. Mammals were hardly relevant. Narrator: but things were about to change.

A giant meteor crashed into present-day Mexico ending the dinosaurs and most life on planet earth. The impact caused a short-term spike in surface temperatures followed by an extended cooling due to debris blocking out sunlight.

Although most organisms were culled during the cataclysm, some species thrived during the chaos. Most notable for our story are Fungi (of course) and a small shrew-like mammal known as the Tenrec (surprising).

Without sunlight, most plants quickly perished. However, the Fungi thrived because they don’t rely on sunlight (remember they find their own food). Fungi were happily decomposing all the newly deceased organisms.

What About the Tenrec? #

As temperatures declined and food became scarce, most animals who survived the initial shock were killed by fungal pathogens or eventually starved to death as the global food chain seized up. However, not the Tenrec.

Tenrecs are humble shrew-like mammals that lived underground which protected them from hostile conditions on the surface. Their favorite foods (insects and aquatic plants) were relatively unaffected.

Tenrecs are capable of hibernating for up to 9 months at a time. This protects them from short-term volatility and enables them to outlast their competition. The best offense is a good defense.

Bitcoin reminds me of the tenrec, both live underground and thrive on volatility. Like the tenrec, Bitcoin simply needs to outlast its competition.

“If you wait by the river long enough, the bodies of your enemies will float by.”

— Sun Tzu

Give thanks to the tenrec

Turns out, the tenrec is the common ancestor to all living placental mammals. In other words, the only reason both you and I are alive today is because the tiny tenrec survived the dinosaur-ending apocalypse 65 million years ago.

Standing on the Shoulders of Mycelium #

Although mammals got off to a slow start, we’ve really come into our own over the last million years. One particular great ape, the homo sapien, achieved global dominance in a relatively short time span.

Current evidence suggests Humans have only been around for about ~500k years, making us a relatively young species. For comparison, modern elephants have been around for ~5m years.

Like our fungal forefathers, humans have formed symbiotic relationships with our environment throughout history. In fact, we owe our lives to the network-based organisms we call fungi.

Humans Begin to Settle Down #

One especially relevant fungal organism is Saccharomyces cerevisiae, otherwise known as brewers yeast.

Human agriculture appears to have begun around 11,500 years ago (although it might be much older). Interestingly, the first crops we cultivated were also the best grains for brewing beer. This begs the question: did we settle down for food/stability or to brew more beer?

Turns out fermented drinks (beer, wine, etc) provided a safe way to stay hydrated as water often contained pathogens that killed ancient man.

Although we didn’t know it at the time, humans formed symbiotic relationships with fungi in order to produce healthy drinking options that saved many lives.

Unbeknownst to most moderns, we still heavily rely on our fungal allies today. Without fungi, say goodbye to all beer, wine, chocolate, bread, and many medicines such as penicillin.

Like ancient man partnered with fungi to survive, us moderns have a similar opportunity to partner with Bitcoin…

Achieving Symbiosis with Bitcoin #

We’ve established how both fungi and Bitcoin symbiotically partner with other organisms to bootstrap life and build antifragile ecosystems. Now let’s finish up by exploring how humans can partner with Bitcoin to improve individually and to advance our species.

“The real problem of humanity is the following: we have Paleolithic emotions; medieval institutions; and god-like technology.”

— E.O. Wilson

Money is the most important coordination mechanism for society and our existing fiat system is driving our species off a cliff. Instead of arguing red vs blue, it’s time we address the root cause of our societal malaise. It’s time to unfuck the money.

Fiat money has appeared periodically throughout history, however, it’s the exception not the rule. Throughout most of history, humans coordinated around a free market for money. Gold and silver, mainly. Time to wake up from our fiat money coma.

Bitcoin is an Extended Phenotype for Humanity #

Extended Phenotypes are behaviors that extend an organism’s natural capabilities. Beaver dams are a good example. Bitcoin is an Extended Phenotype for humanity — it lowers the trust required for a global society to communicate value, which enables more sophisticated cooperation.

This offers a unique opportunity to re-architect society based on the separation of money and state aka “natural money.” A huge win for humanity. As such, it’s our duty to form symbiosis with such a force.

Take another deep breath as we’re fortunate to be alive during such an inflection point.

It all Starts with Individuals Forming Symbiosis with Bitcoin #

Bitcoin was the best-performing asset of the last decade. This created unimaginable wealth for early adopters. Besides financial gain, individuals also can benefit from bitcoin in other ways. Interestingly, the values imbued into bitcoin seem to rub off on its adherents.

As a deflationary asset, Bitcoin teaches us to delay consumption today in order to reap greater benefits tomorrow (low time preference).

In a world fulfilled with uncertainty, Bitcoin provides something to be optimistic about. Rather than change the system from the inside, we can put our energy towards a parallel system.

Bitcoin forces us to take personal responsibility for our wealth, both a blessing and a curse. In a world that doesn’t value personal responsibility, Bitcoin serves as a wakeup call.

Partnering with Bitcoin is good for the individual but is it good for mankind?

Cryptography is Fundamentally About Defense #

Bitcoin is the largest implementation of public key cryptography the world has ever seen. A world with strong cryptography shifts the balance of power towards defense. Defense from tyranny, censorship, overarching governments, and surveillance capitalism.

Cryptography allows us to assert our natural rights. Bitcoin protects free speech, ensuring we can “vote with our money.” Free speech is the foundation of open societies. Forming symbiosis with Bitcoin preserves freedoms for our future generations. A cause worth fighting for.

Bitcoin Metabolizes Fiat Infrastructure #

We can use fungi to clean up oil spills, halt erosion, create natural pesticides, and even decompose nuclear waste at Chernobyl. In a similar manner, Bitcoin can be used to clean up our dilapidated fiat infrastructure.

Fungi Fact: Fungi have already solved many of our problems, yet we barely understand them. Mycoremediation is a promising new field that leverages our understanding of mycology to improve our environment, essentially “applied mycology.”

We’re experiencing a period of unprecedented monetary expansion. Bitcoin as a fixed supply monetary good serves as a counterforce to unfettered money printing. Short term, individuals using Bitcoin to avoid capital controls and hedge against local currency risk. Long term, Bitcoin may force conservatism onto central banks, starting with developing nations.

In the richest country in the world (America), average people work for 40 years and never get ahead. The legacy system was designed to siphon wealth from the bottom to the top, most notably during each financial crisis. Since time is money, this forced wealth transfer system should be considered systemic time theft. Make no mistake about it, we should be radicalized by this.

Every time you buy Bitcoin you’re selling dollars. It’s time to join the peaceful revolution. Occupy UTXOs.

Opportunity Cost of Delaying Bitcoin #

Think of all the waste created from a fiat system. Bank bailouts, never-ending wars, and capital misallocation are greatly reduced (if not eliminated) under a hard money system.

Each year we delay, we incur increasing opportunity costs. Instead of destroying wealth unnecessarily, how can we invest precious capital into worthy causes?

“We were promised flying cars and all we got was 140 characters.”

— Peter Thiel

What about colonizing mars? Or reducing the risk of civilization “enders” such as pandemics or nuclear war? How about dyson spheres? Asteroid mining? Or eliminating infectious disease and infant mortality for good?

Let’s embrace the Bitcoin renaissance.

Bitcoin Wears Risk on its Sleeve #

Rather than persist in an opaque financial system designed to enrich the few at the expense of the many, let’s embrace a more transparent financial system. A system where risks are laid bare for all to see, rather than buried under bureaucracy and deception.

Fiat money is an inorganic system similar to a monocrop industrial farm. Centrally planned, susceptible to disease, unsustainable, and fragile. Fiat offers short-term price stability, at the expense of long-term systemic risk. In other words, we don’t account for the “fat tail risks” such as banks blowing up or global pandemics. Both examples lead to wealth transfer furthering wealth gaps.

Bitcoin, on the other hand, is an organic system similar to an old growth rainforest. Fierce competition, incremental growth, sustainable, and antifragile. Bitcoin accepts short-term price volatility in exchange for long-term systemic stability.

Bitcoin enables an antifragile monetary system, a huge win for humanity.

Bitcoin Promotes Energy Independence #

Bitcoin has an insatiable demand for low-cost energy. Miners scour the earth for cheap energy assets, acting as the energy buyer of last resort. This incentives innovation in low-cost energy production such as excess natural gas and stranded hydroelectric.

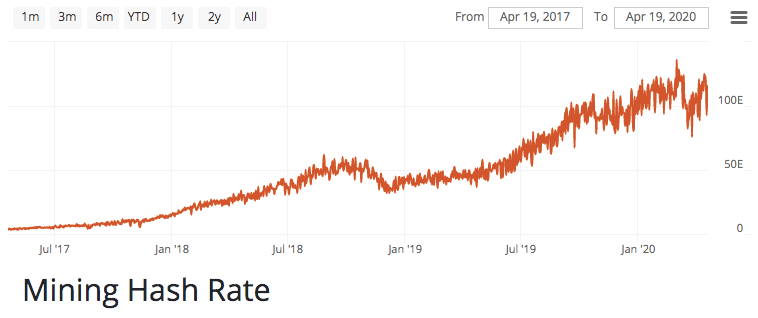

Hash rate has been steadily rising, even when price is not. Bitcoin miners are inherently long BTC. What do the miners know that you don’t? Rather than putting our heads in the sand, it’s time to form a partnership with reality.

Bitcoin’s hash rate continues to rise (source)

Let’s assume Bitcoin continues its monetization path. Eventually, Bitcoin mining becomes a matter of national security. Those countries who produce their own energy (and mine Bitcoin) will have further geopolitical advantage over countries reliant on importing energy.

Fungi Fact: fossil fuels (hydrocarbons) carry the energy of ancient sunlight originally captured by plants through photosynthesis. Interestingly, earth’s entire supply of coal was formed during the “carboniferous” period which ended ~300m years ago when fungi learned how to digest lignin. Lignin is the polymer that gives plants their rigid structure AND it’s a prerequisite to forming coal. Coal is simply plant material that was “half-digested” by primitive fungi. Modern fungi digest lignin which prevents new coal from being produced.

This creates another incentive for nations to secure local energy sources — whether from fossil fuels, nuclear plants, renewables, or otherwise. Long term, a world with more localized energy production is a more robust world. Like fungi, Bitcoin is an invisible membrane improving the health of the ecosystem it occupies.

Humanity Will Coalesce on Neutral Money #

The current geopolitical game rewards those who exert influence over money production. This means large powerful states, politicized money, and special interest groups competing for influence.

“Give me control of a nation’s money and I care not who makes the laws.”

— Mayer Amschel Rothschild

Instead, Bitcoin is a neutral money. A system designed to prevent special interests from exerting undue influence over the money. This creates a more fair game.

Why would any government give up control of their printing press?

In a post-dollar regime, nation-states won’t agree on a new reserve currency. Logically, each state prefers to settle debts in their own currency. We’re already seeing cracks in the dollar hegemony coming out of places like China, Russia, and Iran. Bitcoin is well suited for this problem.

Bitcoin is fully auditable, hard-capped, and offers final settlement quickly. The perfect neutral money for untrusting nation-states to settle debts. Under this light, Bitcoin is money for enemies.

It’s time to upgrade humanity by forming symbiosis with Bitcoin.

Let’s Wrap Up #

The story of life on earth can be summed up as: success comes to those who form symbiotic relationships with network-based organisms (particularly fungi).

As humble apes, it’s our duty to form a symbiotic relationship with Bitcoin. We must strive to understand this phenomenon so that we may shepherd her through adolescence.

Just like fungi colonizing dry land was the catalyst for biological evolution on terra, Bitcoin is a catalyst for human evolution.

Let’s embrace Bitcoin or suffer the fate of the dinosaurs.

Thank you,

Brandon

P.S. Who’s driving the ship? #

Fungi enabled complex life on earth, which eventually gave way to humans. Now humans are creating the internet (and Bitcoin) which both embody the same mycelial archetype of which we came.

We didn’t consciously choose to mimic mycelial networks in these designs. However, animals did taxonomically branch off from fungi millions of years ago. Humans came full circle, the student became the teacher.

Was this inevitable?

The mycelial archetype appears to be embedded into our species. Over time, network-based structures continually appear whether due to embedded wisdom or blind luck. These Mycelial inspired network technologies, once discovered, seem to persist due to their antifragile nature.

Many people claim we “discovered Bitcoin.” I’m sympathetic to this idea, however it’s more accurate to say we _re_discovered Bitcoin. The mycelial archetype is an emergent property of biology which means Bitcoin was inevitable.

Acknowledgments #

Thanks to Dan Held, Gigi, Robert Breedlove, Rob Fox, Danielle Diamond, Dan Liebeskind, Justin Evidon, and Nic Carter for providing thoughtful notes during the editing process

Thanks to the mycological community for inspiring my fascination with fungi (the bitcoin community welcomes you)

Inspiration and mentions: Paul Stamets, Merlin Sheldrake, E.O. Wilson, Richard Dawkins, Charles Darwin, Nassim Taleb (ideas, not the man), Peter Thiel, Tuur Demeester, Pierre Rochard, Brady Swenson, Andreas Antonopolous, Pomp, Hasu, Saifedean Ammous, Travis Kling, Yuval Harari, Neal Stephenson, and anyone else I forgot 🙂

Creative Direction: Part 1 cover photo art by Emmaline Bailey, part 2 cover photo art by Richard Giblett, part 4 cover photo art by FritsAhlefeldt.com

Finally, thanks to everyone who sharpened my thinking through conversations on this topic over the last few years.

Audio Versions read by Guy Swann at Bitcoin Audible

Video Versions

- Bitcoin is a Decentralized Organism (part 1) by Drew Spartz

- Why Fungi Makes Bitcoin Inevitable (part 2) by Drew Spartz

- Why Governments Can’t Stop Bitcoin (part 3) by Drew Spartz

- Why Bitcoin Accelerates Human Evolution (part 4) by Drew Spartz