Why it’s the most effective investment strategy for most people.

This article by Aleksandar Svetski was published in his Medium blog.

“Buy Low, Sell High”

It’s the mantra of traders, investors and financial advisers around the world. It’s the holy grail. It makes sense.

It sounds soooo simple..

But is it?

Oh the agony…

Everyone talks about it, and unless of course you’re an Alien that plans to lose money, it’s clearly what you need to do — although it’s been shown that less than 10% of market participants make money on a regular basis.

They sing the mantra of buy low, sell high — but when push comes to shove, they end up buying high & selling low!!

Why?

Because we humans are bound by our psychology and as a result; our emotions.

Some of you may be familiar with this (the Meme and the concept).

Markets are “technically” an objective representation of value, of which is mostly subjective.

And because of this subjectivity, objective valuation can become distorted — especially during times of heightened emotion.

When things are going up, people get exuberant and they keep bidding prices higher & higher.

When things are going down, people get scared and often run for the exits causing prices (and thus the perception of value) to go out the window.

Markets by their very nature, are a representation of mass human emotion, ie; Fear & Greed and when you can understand that better, you can develop models to overcome the emotional swings that inevitably come with trading or investing.

One such model is: “Dollar Cost Averaging”.

What is Dollar-Cost Averaging? #

Dollar-Cost Averaging is simply investing a fixed amount of money at regular intervals for a certain time period, regardless of the asset price at the time.

It’s a set & forget strategy, which makes it easy.

Over the last 100yrs studies have shown that it’s has been one of the most effective strategies for long term investment returns and in most cases, this is irrespective of the asset class!

The idea behind this strategy is to spread your investments out to achieve a lower average cost base, which means you purchase a greater number of units for the same investment amount.

Markets will always fluctuate and instead of attempting to “time the market” (which probably less than 0.0001% of the population can realistically do), you just buy at set intervals, un-emotionally and irrespective of the current sentiment.

Dollar Cost Averaging helps to avoid situations like THIS.

And this:

Most people’s experience.

Trading is hard. It’s one of the most un-emotional / robotic professions in the world, and most people are just not wired for it.

Dollar cost averaging is a great way to, remove the emotion, smooth out the volatility, alleviate the stress and;

- If your long term views are accurate, earn a great return.

- If your long term views are wrong, minimise the loss.

To understand exactly how it works, here’s a case study:

Case Study in Action #

Let’s say you receive $10,000 from your grandma and you want to invest it into something with some high return potential, that’s also a little volatile.

Let’s use Tesla. Elon’s company. Great potential, lots of volatilty at the moment. TSLA: NYSE?

You can choose to either:

- Invest the entire $10,000 now, or by attempting to pick the “best” price

- Invest it equi-proportionately ($1000 every month) over a period of 10 months until it is fully utilised.

The first method demonstrates lump-sum investing whereas the latter method demonstrates dollar-cost averaging.

Most people would have invested at the first sight ot the price “running up”. So let’s assume that the investment journey started at the beginning of June.

Tesla (TSL) Shares over the last 14mths

Scenario #1: Lump Sum #

In this scenario, you would have:

- Invested $9,940 at $355 per share.

- That equates to 28 TSLA shares

- Today, the value of your position would be about: $9016

- That’s about 10% lower than when you started.

That’s not a great result although not the worst thing we’ve seen, especially considering recent volatility in the markets.

10% difference, from then until now.

The hardest part for most people would’ve been sitting through the lows.

At some points, that $10,000 would’ve been worth around $8000, and more recently as low as $6500.

Scenario #2: Dollar Cost Averaging #

In this scenario, you would have invested your $10,000 over 10 months, at roughly $1000/mth.

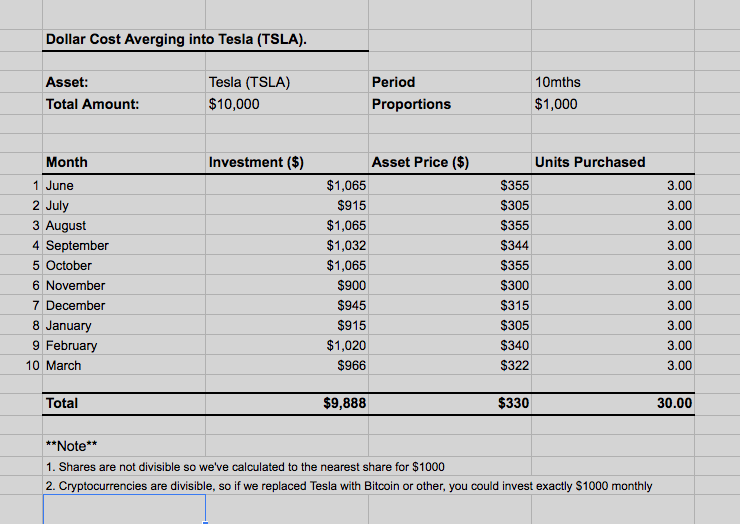

If you take a look at the graph below:

- Month 1: the share price is $355;

- Month 2: $305,

- Month 3: $355,

- etc…

- Month 9: $340,

- Month 10: $322

Dollar Cost Averaging

Let’s look at the numbers #

30 shares exactly.

The result is a meaningful difference. For the same amount of dollars invested;

- With rounding (buying whole shares) you would’ve invested $9,888,

- $9888 equates to a total purchase of 30 TSLA shares

- Today, the value of your position would be about: $9660

- That’s about 2% lower than when you started.

This is not only a better result than the lump sum, but the best part about it, is you don’t care about “when” you should be buying.

You just set aside a goal to buy $1000 monthly (or 3 shares monthly) and the volatility smooths itself out.

Benefits of Dollar-Cost Averaging #

The practice of regularly investing small equi-proportional amounts overtime has proven to be beneficial for many reasons:

You end up buying fewer units when prices soar and more when prices plummet (great for risk management).

In general, you lower the average cost per share compared to what you may have paid if you bought all shares at once. This also reduces the risk of “FOMO”, and investing a large amount in a single investment when the price “gets away” from you.

Emotion is removed from the decision-making process since money is invested at the same time every single period. There is no purchasing decision required in between. In fact, the main decision is made at the beginning of the process.

You remove the temptation to “time the market”. This eliminates alot of unnecessary stress and the “glued to the screen” syndrome that comes with constantly monitoring the market (See image below. Something a lot of newbie crypto traders are very well aware of).

You do not need to have a ridiculous amount of money to start. You can start small and over time your portfolio will both grow & compound.

Helps you avoid “buy high” / “sell low” syndrome. This alone is worth adopting this strategy.

Overall, the enemy of trading and investing is emotion.

Dollar Cost Averaging is an effective strategy that helps you remove emotion from the equation, and bring some sleep back into your life…

Micro Investing & Dollar Cost Averging can save your relationship…?

Does Dollar- Cost Averaging Suit You?

There’s a number of reasons why this strategy might suit you:

- If you can relate to the image above..

- If you are an investor, not a trader

- If you don’t have a large, initial lump-sum to invest

- During volatile markets. By “averaging into the market”, you have a better chance of riding through the volatility. (Crypto is a great example)

- If investing makes you nervous but you still want to participate

- If reading charts, trends, fibonacci, stochastics and a million other technical indicators is NOT something you want to spend your time doing

- Ditto if you’re not interested in being glued to a screen

- If you believe in something for the long term, but don’t want to be subject to the short term whims of the market.

- If you do not have the time or know-how to constantly follow market trends.

- Or if you don’t want to be this guy:

Conclusion #

Dollar-Cost Averaging is all about making investing easier, by setting up a plan you can follow routinely.

Lump-sum investing is preferred in markets when investors tend to have high convictions about what is to happen next, or they’re professionals that have some form of edge; be it technical, fundamental or other.

Most investors just don’t have the insight nor skill to be able to execute in such a way, thus rendering the lump-sum method ineffective, or too stressful.

Dollar-Cost Averaging is a far less stressful way of investing for the long term,irrespective of the kind of asset you’re buying whether it’s shares, real estate, ETFs, mutual funds, bonds and especially more volatile assets such as crypto assets & digital currencies.