Contents

- Gradually, Then Suddenly: Intro

- Bitcoin Can’t Be Copied

- Bitcoin Is Not Too Volatile

- Bitcoin Does Not Waste Energy

- Bitcoin is Not Too Slow

- Bitcoin Fixes This

- Bitcoin, Not Blockchain

- Bitcoin is Not Backed by Nothing

- Bitcoin is Not a Pyramid Scheme

- Bitcoin Cannot be Banned

- Bitcoin is Not for Criminals

- Bitcoin Obsoletes All Other Money

- Bitcoin is a Rally Cry

- Bitcoin is Common Sense

- Bitcoin is Antifragile

- Bitcoin is One for All

- Bitcoin is the Great Definancialization

This article by Parker Lewis was first published in Unchained blog.

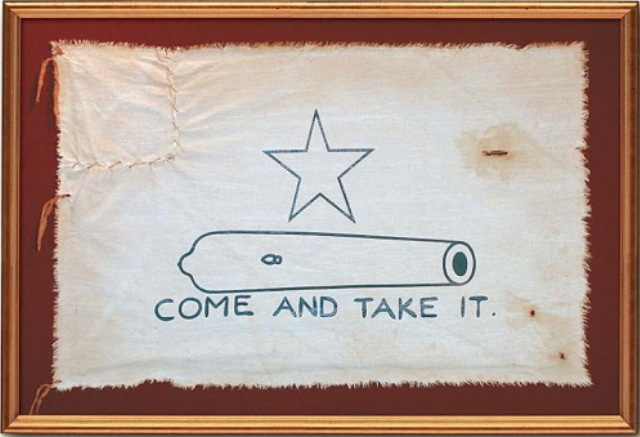

“To the People of Texas and all Americans in the world.” In his open call to arms from the Alamo, Lt. Colonel William B. Travis began with an expression of America as an idea extending beyond borders, to all Americans in the world. It was a plea to all those that valued the fight for liberty and freedom. Outnumbered ten-to-one, Travis responded to a demand for surrender with a cannon shot. He was no more than 27 years old at the time. Texas declared its independence a week later, but within days, the Alamo fell. The Travis letter became the rallying cry of a revolution. Remember the Alamo. Ultimately, Texas won its independence. Always outnumbered, it is a reminder that the endless pursuit of freedom is a most powerful equalizer. And it is something inherent to the character of Americans in all the world.

Opening of the Travis Letter from the Alamo, February 24, 1836

Minus the lionized heroes and a literal declaration of independence, bitcoin is still very much a fight for freedom, and it is similarly becoming a rally cry to all those that refuse to sit back and accept the fate of our tenuous financial system. The very idea of freedom may be the single most important tenet underpinning the monetary revolution to which bitcoin is giving rise. When the war is won, it will likely find its way directly into a constitutional amendment (even though it’s already covered by the first amendment). The right of the people to keep and bear bitcoin. Prior to bitcoin, everyone had no practical choice but to opt into a flawed currency system. That changed when bitcoin was released into the wild in 2009. Bitcoin is completely voluntary, it is controlled by no one, and it affords everyone the ability to store and transfer value in a form of currency that cannot be manipulated. Bitcoin may not be synonymous with the right to life, liberty and the pursuit of happiness but for those that choose to rely upon it as a better path forward, it is a fundamental and inalienable right.

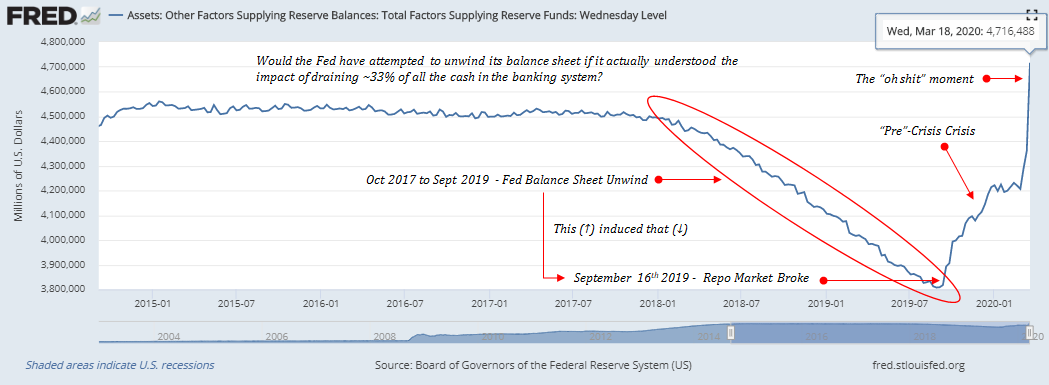

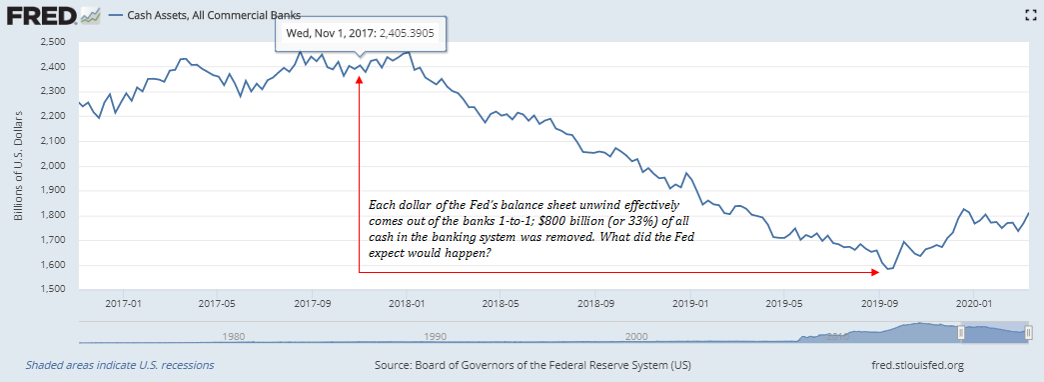

While bitcoin is valued for different reasons by different people, it consistently appeals to those that have identified the inherent level of freedom afforded by such a powerful tool, particularly in a world full of never-ending economic calamities. As the fragility and instability of the global financial system becomes more apparent by the day, central bankers and politicians scramble in a race to see who can provide more stimulus to an economy that is flatlining. Lest we not forget, the instability in the financial system is not just appearing; it is reappearing. The structural issues resurfacing are the same that existed during the 2008 financial crisis. Before the oil war and the global pandemic, the repo funding markets broke in September 2019. The writing was not just on the wall, it was in the repo markets. If it were not these recent events acting as the accelerant, it would have been some other random “act of god” which would have made evident what remained under the surface all along: a highly-levered financial system primed to break at the first signs of any material stress.

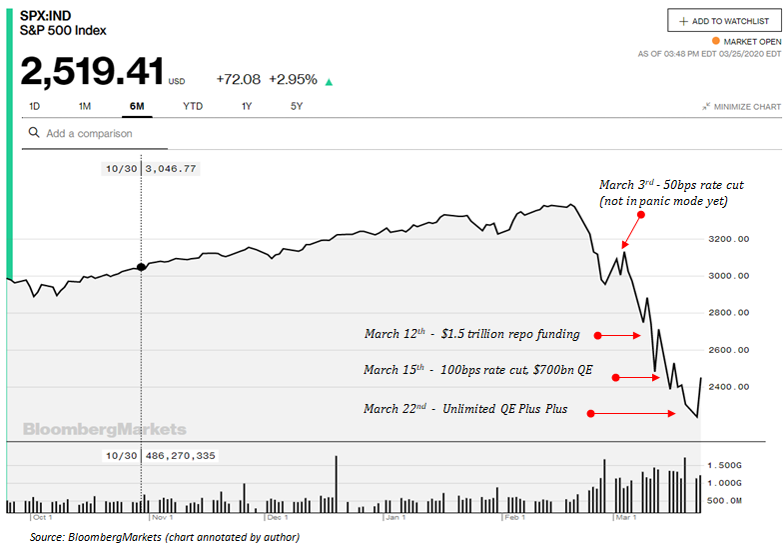

Even before the global shutdown (i.e. government-accelerated panic), the Fed had already supplied ~$500 billion in emergency funding to the repo markets. Now the fuel is really being dumped on the fire. But it is not just the scale that is alarming; it is the clear demonstration of control being lost through a meandering path of incrementalism. After the stock market crashed initially, the Fed issued an emergency 50bps interest rate cut; the market crashed some more and the Fed then announced an incremental $1.5 trillion in short-term funding (1-3 months) to be supplied in the repo markets. The market crashed again and three days later, a formal $700 billion “quantitative easing” program was announced to outright purchase $500 billion in U.S. government treasuries and $200 billion in mortgage-backed securities. Coinciding with this move, short-term rates were cut 100bps (all the way to zero).

Yep, the market crashed again, credit markets dislocated and the Fed followed with its “whatever it takes” response, announcing an unlimited QE program. Its three most aggressive moves to date all transpired within a 10-day window. And in its latest unprecedented act, the Fed will begin buying corporate bonds on the secondary market as well as participate in primary issuances of corporate credit. It also expanded its purchases of mortgage backed securities to include commercial mortgage backed securities (commercial real estate). In addition, the Fed established a facility to issue asset backed securities to purchase student loans, auto loans, credit card loans, etc. All of this without a price tag, and just a promise to do whatever it takes. It would be funny if it weren’t so serious, but the real question is, if the Fed were in control, why was it so reactionary? Why did its plans change so drastically in a ten-day period if it ever understood the extent of the issue? Never mind the unintended consequences, it is merely a demonstration that the Fed is not in control. Why would it have announced a $700 billion program if it didn’t expect it to work? It’s a classic game of guess and check, except the consequences can never be checked (only the immediate market reactions). The problem is our economy is at stake.

“There’s an infinite amount of cash at the Federal Reserve.”

— Neel Kashkari, Minneapolis Fed President – March 22, 2020 (60 Minutes)

To lend to a bank, we simply use the computer to mark up the size of the account they have with the Fed […] it’s much more akin to printing money than it is borrowing.”

— Ben Bernanke, Former Fed Chair – March 15, 2009 (60 Minutes)

Make no mistake, the $1.5 trillion supplied to the repo markets will be converted to increment the Fed’s formal quantitative easing program, and the entire unquantified program should conservatively be expected to exceed $4 trillion when all is said and done. The Fed cannot put out the fire that is a liquidity crisis through short-term funding, and it will have no other choice but to monetize a larger share of the credit system than it did in 2008 because the problem is now larger. In addition, while not yet passed, Congress is working on an initial $2.0 trillion stimulus package in response to the global pandemic. With a market already suffering a liquidity crisis, the banking system does not magically have this cash on hand to finance a massive expansion of the Federal government’s deficit. There is a liquidity crisis unfolding after all. As a result, the Fed will be forced to finance any fiscal response through an ever-expanding quantitative easing program. It is the only way for the banks to get the cash needed to finance such a fiscal stimulus. All roads lead back to the Fed and endless QE.

This is the new normal and there is nothing sustainable about it. It is also not a reality we have to accept. There is a better way. As the world looks on, amidst the fear and panic, it often seems that there is no alternative. It is unclear when so many began to view the government’s role as one of fighting global pandemics (rather than the free market) but that is the world for which so many seem to aggressively demand. It is a symptom of failing to understand the root problem. It is misdiagnosing the fallout of a global pandemic and falsely believing the only hope is to allocate money created out of thin air by central banks and governments. It is predictably irrational. There is no reason even a few-month, complete economic shutdown should put the world on the brink of a global depression. Instead, it is the output of an inherently fragile financial system, one dependent on perpetual credit expansion necessary to sustain itself and without which it would begin to collapse. It is the fragility of the global financial system itself that is the problem, not a global pandemic. Do not be fooled. This isn’t a pandemic induced failure of the financial system. This was a 100% eventuality, pandemic or not. If not for its heavy dependence on credit and an unsustainable degree of leverage, the world would not be waking up to the S&P 500 futures locked limit down with seeming regularity.

And the economic dependence on credit as well as the high degree of system leverage are not a natural function of either capitalism or a free market. This market setup is a function of central banks everywhere. The instability is not by design but the market structure is. In response to every economic slow down (or crisis) which has appeared over the last four decades, central banks (including the Fed) have responded by increasing the money supply and reducing interest rates, such that existing debt levels could be sustained and such that more credit could be created. Every time the system as a whole attempted to deleverage, central banks worked to prevent it through monetary stimulus, ultimately kicking the can down the road and allowing decades of economic imbalance to accumulate in the credit system. This is the root cause of the inherent fragility in the financial system (see here). And it is why each time an economic disruption surfaces, the monetary response from central banks need be larger and more extreme. With greater imbalance comes the need for a bigger boat.

In doing so, the entire system is pushed further and further out onto the same ledge. The terminal risk to the system (the stability of the underlying currency) becomes greater and greater. Everyone is unwittingly forced to be along for this most unnerving of rides, but for those paying attention to the real game that is being played, bitcoin is increasingly becoming the clearest path to opt out of the insanity. Simplified down to the least common denominator, quantitative easing is a forced debasement (or devaluation) of monetary savings. It distorts every pricing mechanism within an economy and its intended goal is the expansion of credit. When history books are written of this pre-bitcoin era, the failure to understand the consequence of distorting global pricing mechanisms will be identified as the source of all other critically flawed assumptions in modern central banking doctrine. There is no escaping it. You can only hope to manage the fallout. But where don’t-tread-on-me meets the come-and-take-it mentality, freedom loving Americans of all the world and of all walks of life are beginning to say enough is enough. There has to be a better way because there always is.

That is core to the very idea of hope and the very nature of human ingenuity. It is an unwillingness to accept the new normal as a fait accompli. If quantitative easing can be simplified down to a debasement of monetary savings; bitcoin can be simplified down to the freedom to convert value into a form of currency that cannot be manipulated. In the Road to Serfdom, Hayek describes the function of money most aptly: “It would be much truer to say that money is one of the greatest instruments of freedom ever invented by man.” As he goes on to further explain, it is money that ultimately affords people a range of choice far greater than could otherwise be imaginable. It does so by distributing knowledge through its pricing mechanism, the single most important market signal (in aggregate) which facilitates economic coordination and the allocation of resources. However, as the freedoms afforded by one monetary medium become impaired, it should be no surprise that human ingenuity would find a way to route around and spawn a new creation that performs that same function more effectively. That is bitcoin and there is no going back. The proverbial cat is out of the bag and the distribution of knowledge is naturally exponential.

The promise of bitcoin is a more stable monetary system. There are no promises of what its value will be on any given day; the only assurance it provides is that its supply is not subject to manipulation or systematic debasement by a central bank (or anyone else). There is the seemingly constant question as to whether bitcoin is a “safe-haven” and more recently, why bitcoin has become correlated to the broader (collapsing) financial markets. The simple reality is that bitcoin is not a safe-haven, at least not as commonly defined in the mainstream. It is not held widely enough for it to possibly be a safe-haven. It remains nascent and it is perfectly predictable that at the onset of a global deleveraging event, a liquid asset would be sold along with everything else.

However, what remains true is that bitcoin is the antifragile competitor to the inherently fragile financial system.

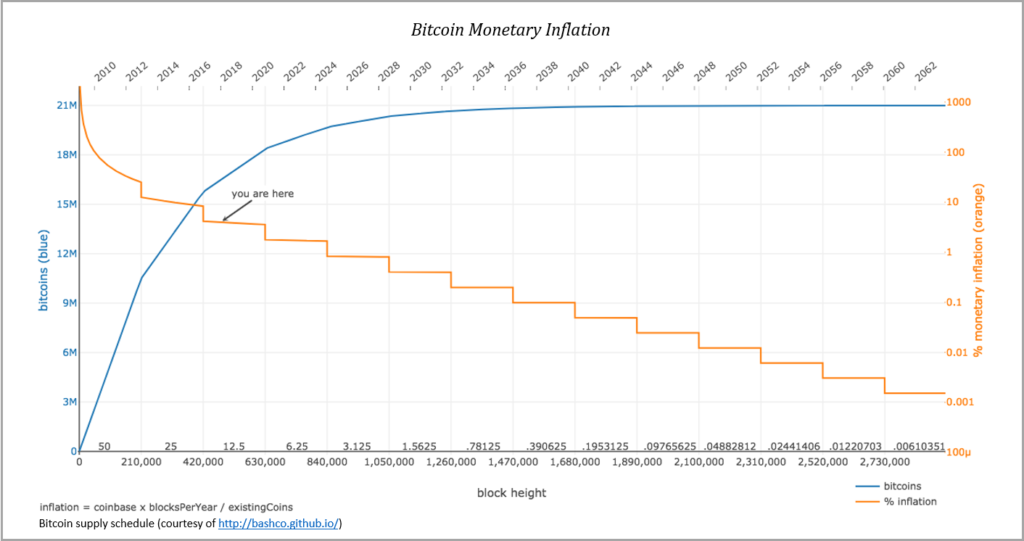

In his book under the same name, Nassim Taleb describes antifragility as not just robust or resilient, but as the opposite of fragile. Antifragile systems actually gain strength and feed on volatility. The recent volatility in bitcoin is likely just the beginning but what it really represents is uninterrupted and unceasing price discovery. There are no circuit breakers in bitcoin and there are no bailouts. Each individual participant is maximally accountable and it is a market devoid of moral hazard. When the dust settles, what does not kill bitcoin only makes it stronger. In a literal sense. It is surviving and thriving in the wild, without any central coordination. It is not for the faint of heart, but it is the land of the free and the home of the brave. When it survives, there will still only be 21 million bitcoin, and its very survival will reinforce its place in the world. Increasingly, with each monetary stimulus injected into the legacy financial system, bitcoin’s core value function will become more apparent and more intuitive to more people. It will not just be by chance; it will be so because of the stark contrast bitcoin provides. Even with all its volatility, it is laying the foundation of a more stable monetary system.

Bitcoin Price Chart (Source: Coinbase Pro Exchange, 6 hour intervals)

Because the supply of bitcoin cannot be manipulated, its price and its supply of credit will similarly and forever be unmanipulable. Both will be determined on the market. As a result, the size of the bitcoin credit system will never sustain otherwise unsustainable imbalances. Beyond the nature of its fixed supply, this is where the contrast lies in practical application. The accumulation of sustained credit system imbalances (induced by central banks) is the inherent source of fragility in the global economy today. In a market built on the foundation of a currency that cannot be manipulated, as soon as imbalances arise, economic forces will naturally course correct, preventing the system-wide and systemic credit risk that plagues the legacy financial system. Rather than impair the future by allowing imbalances to accumulate beneath the surface, the unmanipulable supply of bitcoin will act as a governor to stamp out fires as soon as they appear. The fragile individual components of the system will be sacrificed and the system as a whole will become more antifragile by that very function.

For Joe Squawk (your modern-day average joe), it was Facebook’s Libra that made bitcoin more intuitive. For others, it is hyperinflation in Venezuela. And now for many, it will increasingly become the incessant reality that financial crises and QE are a recurring fact of life. No matter how many cycles of quantitative easing the Fed and its global counterparts have in their bag of tricks, bitcoin is inevitably becoming a rallying cry for all those that see the train wreck coming and are unwilling to stand idly by. It is not just a collective act of civil disobedience; it is an individual recognition of the need to act in self-preservation. There is a point in time for most everyone when common sense and survival instinct naturally take the reins. The avenue may be different for each individual, but at the end of the day, bitcoin is a means to preserve some form of freedom that is otherwise being impaired or infringed. Whether governments attempt to ban bitcoin or it is mistakenly blamed for the failures of the legacy system, always remember the simplicity of what bitcoin represents. It is nothing more than the individual freedom to convert real world value into a form of money that cannot be manipulated. It is a most basic and fundamental freedom but one that must be earned. So to all Americans in the world, stay humble, stack sats, and hold the damn line. Whatever it takes.

“The enemy has demanded a surrender […] I have answered the demand with a cannon shot.”

— Lt. Colonel William B. Travis (February 24, 1836) Link to Full Travis Letter

Contents

- Gradually, Then Suddenly: Intro

- Bitcoin Can’t Be Copied

- Bitcoin Is Not Too Volatile

- Bitcoin Does Not Waste Energy

- Bitcoin is Not Too Slow

- Bitcoin Fixes This

- Bitcoin, Not Blockchain

- Bitcoin is Not Backed by Nothing

- Bitcoin is Not a Pyramid Scheme

- Bitcoin Cannot be Banned

- Bitcoin is Not for Criminals

- Bitcoin Obsoletes All Other Money

- Bitcoin is a Rally Cry

- Bitcoin is Common Sense

- Bitcoin is Antifragile

- Bitcoin is One for All

- Bitcoin is the Great Definancialization