Contents

- Gradually, Then Suddenly: Intro

- Bitcoin Can’t Be Copied

- Bitcoin Is Not Too Volatile

- Bitcoin Does Not Waste Energy

- Bitcoin is Not Too Slow

- Bitcoin Fixes This

- Bitcoin, Not Blockchain

- Bitcoin is Not Backed by Nothing

- Bitcoin is Not a Pyramid Scheme

- Bitcoin Cannot be Banned

- Bitcoin is Not for Criminals

- Bitcoin Obsoletes All Other Money

- Bitcoin is a Rally Cry

- Bitcoin is Common Sense

- Bitcoin is Antifragile

- Bitcoin is One for All

- Bitcoin is the Great Definancialization

This article by Parker Lewis was first published in Unchained blog.

When it comes to bitcoin adoption, there are generally two rules that never seem to fail. Everyone always feels late, and everyone always wishes they had bought more bitcoin. There are exceptions to every rule, but bitcoin has an uncanny ability to screw with the human psyche. It turns out that 21 million is a scarily small number, and it actually becomes smaller as more individuals come to understand that the fixed supply of bitcoin is credibly enforced and that monetary networks converge on a single medium. Demand for bitcoin is driven by the credibility of its monetary properties and the convergent nature of money, but increasing demand for bitcoin reinforces the scarcity of bitcoin’s fixed supply. As it does, bitcoin becomes more valuable as a monetary medium. While this becomes evident the further down the bitcoin rabbit hole one travels, it is not uncommon for individuals on the periphery to be overwhelmed by the sheer number of cryptocurrencies. Sure, bitcoin is in the “lead” today, but there are thousands; how do you know bitcoin is not MySpace? How can you be sure that something new doesn’t overtake bitcoin?

It may sound crazy to believe that bitcoin will be the dominant global currency, and it likely would be if evaluating the possibility from a top-down, probability-weighted perspective. Today, bitcoin is one of a thousand-plus competing digital currencies that all look the same on the surface. Its purchasing power of $150 billion is a drop in the bucket compared to the global financial system which supports $250 trillion of debt. Gold alone has a purchasing power of $8 trillion (50 times the size of bitcoin). What are the chances that an 11-year old internet sensation rises from the ashes of the 2008 financial crisis and goes from nothing to becoming the dominant global currency? The idea sounds laughable, or at the very least, it appears to be too low of a probability to warrant consideration. However, when starting from the bottom-up and developing conviction around a few foundational principles, the noise of a thousand cryptocurrencies fades to the background. When added together, just a few foundational principles create simplicity and clarity around what once may have seemed too complex to possibly discern. If someone had to evaluate one thousand possibilities to come to the right solution, it may not be practical or possible. But if you could eliminate 999 of those possibilities based on one, or a few starting first principles, it then becomes more practical to arrive at a coherent answer.

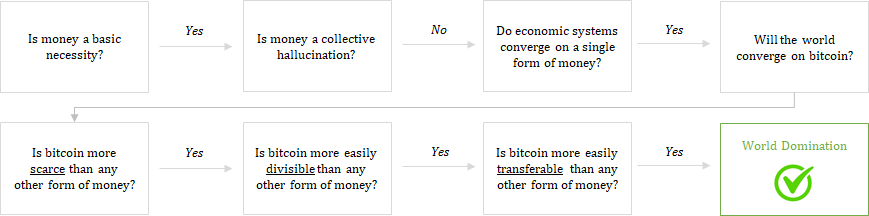

This is the roadmap to cutting out the noise and focusing on what really matters. Individuals may come to different conclusions concerning any of these questions, but this is the path to consider when attempting to understand why bitcoin consistently outcompetes all other currencies and whether it will continue to do so. Money is a basic necessity, but it is not a collective hallucination, nor is it a shared belief system. Individuals adopt bitcoin because it possesses unique properties that make it superior as a form of money relative to all other currencies. Because money is a solution to an intersubjective problem, monetary systems tend to converge on a single medium. Or rather, economic systems naturally emerge from a single medium due to the function of money. The properties inherent in bitcoin are causing the market to converge on it as a tool to communicate and measure value because it represents a step-function change improvement over any other monetary medium. If anyone comes away with the fundamental view that money is a necessity and that monetary systems naturally converge, the question then centers on whether bitcoin is optimized to fulfill the monetary function better than any of the competition.

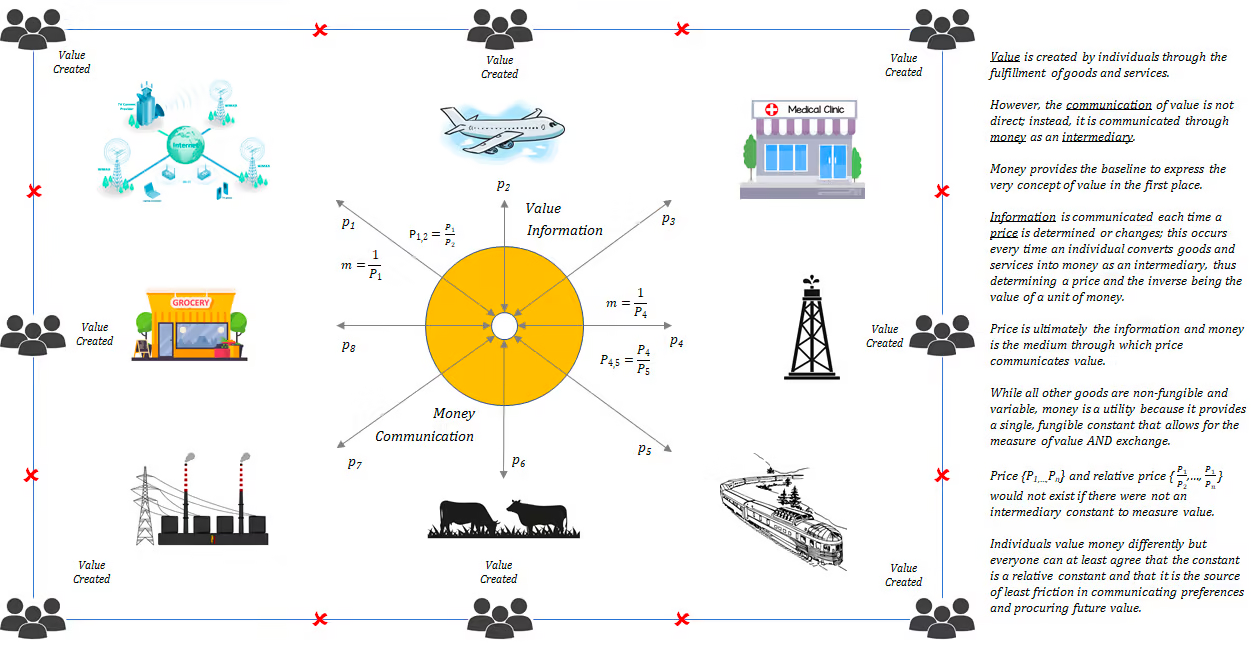

Money is a necessity #

Civilization as we know it would not exist without money. Without money, there would be no airplanes, no cars, no iPhones, and the ability to fulfill very basic necessities would become materially impaired. Millions of people could not peacefully inhabit a single city, state, or country without the function of money. Money is the economic good that allows food to reliably show up on grocery shelves, gas to be at the gas station, electricity to power homes, clean water to be abundant, etc. It is money that makes the world turn and it would not turn in the way that most have taken for granted if not for the function of money. It is a massively underappreciated function; one that is poorly understood because it is generally not consciously considered. In the developed world, reliable money is taken as given. So too are the basic necessities delivered through the coordination function of money.

Consider, for example, a local grocery store and the range of choice that converges in a single store. The number of individual contributions and skills that are required to make that happen is mind-boggling. From the coordination of the store itself, to the individual packaging, to the technology providers, to the logistics networks, to the transportation networks, to the payments systems, and right down to each individual item of food. Then as a derivative, consider all the unique inputs that go into each item on the shelf. The grocery store is just the fulfillment side; the production of each input has its own diverse supply chain. And it is just one modern marvel. Deconstructing the inputs of a modern telecom network, energy grid or water and waste management system is similarly complex. Each network and the participants therein rely on the others. Producers of food rely on individuals that help fulfill energy demand, telecom services, logistics, clean water, etc. among others and vice versa. Practically all networks are connected, and it is all made possible through the coordination function of money. Everyone is able to contribute their own skills based on their own personal interests and preferences: receive money in return for value delivered today, and then use that same money to acquire the specialized value created by others in the future.

And it does not all happen by chance either. Some not-so-rigorous thinkers suggest that money is either a collective hallucination or that it derives value from the government. In reality, money is a tool that was invented by man to satisfy a very specific market need in facilitating trade. Money helps facilitate this activity by acting as an intermediary between a series of present and future exchanges. Without any conscious control or direction, market participants evaluate various different goods and converge on the tool with the properties best-suited to facilitate the very express purpose of converting present value for future value. Whereas individual consumption preferences vary from person to person and change constantly, the need for exchange is practically universal, and the function is distinctly uniform. For every individual, money allows for value produced in the present to be converted into consumption in the future. The value one places on a home, a car, food, leisure, etc. naturally changes over time and logically varies from person to person. But the need to consume and the need to communicate preferences does not change and applies to all individuals on an intersubjective basis.

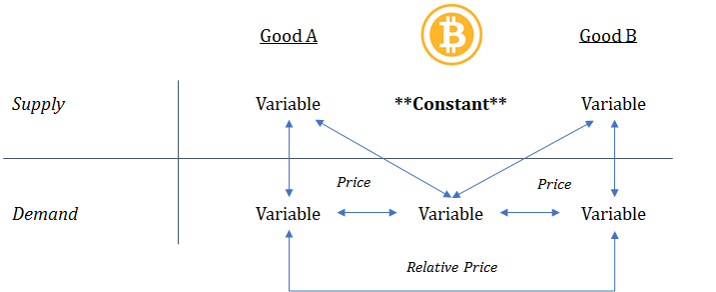

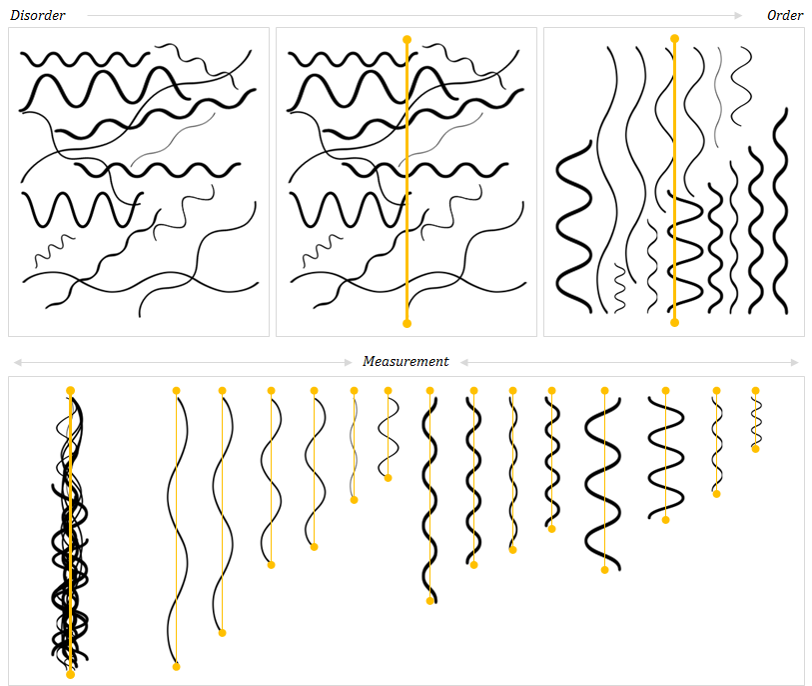

Money exists to communicate these preferences and ultimately, value. But recognizing that all value is subjective (and not intrinsic), money forms the baseline to establish an expression of value and more importantly relative value. Money represents the collective recognition that everyone benefits from the existence of a common language to communicate individual preferences. It aggregates and measures the preferences of all individuals within an economy, at any point in time, and it would not be possible, or at the very least extremely inefficient, to communicate value if not for a common constant upon which everyone could agree. Think of money as the constant against which to measure all other goods. If it did not exist, everyone would be at a practical standstill, not able to agree on the value of anything. By comparing against a single constant, it then becomes more practical to discern the relative value of two other goods. There are billions of goods and services produced by billions of individuals, all with unique preferences. Through the convergence on a single form of money to aggregate and communicate all preferences, a price system ultimately emerges. By measuring and expressing the value of all goods in a common intermediary (money), it then becomes possible to understand how much one good (or resource) is valued relative to any other.

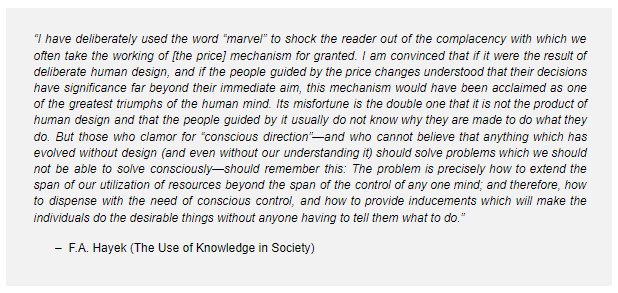

Without the use of a common currency, there would be no concept of price. And without the concept of price, it would not be possible to do any range of economic calculation. The ability to perform economic calculation allows individuals to take independent actions, relying on the information communicated through a price system, to best satisfy their own needs by understanding the needs of others. In fact, it is a price system that allows supply and demand structures to form, and it is ultimately a necessity because it provides for the communication of information, without which the fulfillment of basic needs would not be possible. Imagine if nothing you consumed had a discernible price. How would you know what you needed to produce in order to obtain the goods you prefer? Then recognize that your own conception of the value you produce and the very existence of goods and services produced by others would not be available if not for some expression of price existing. It becomes circular, but money is the good that allows the underlying structures of an economy to form through the price system. While it is often extolled as the root of all evil, money may just be the greatest accidental invention ever created by man, and one that could not have emerged by conscious control.

Economic systems converge on a single monetary medium #

Late stage Silicon Valley thinking has many people believing that hundreds, if not thousands, of currencies may exist in the future. The machines are going to do all the calculation! AI and quantum will handle it. An intellectually “safe” view to hold is that 95% of cryptocurrencies will probably fail but there are some “interesting” projects. “It is inherently difficult to know which will succeed.” “Much like venture capital investing, most will fail but the ones that win will win big.” At least, this is what most of Silicon Valley would have you believe because it is a defensible parallel to historical experiences investing in companies. In reality, it is a blanket hedge lacking in first principles. It is also applying a familiar formula to an entirely distinct class of problem.

While it may seem logical to form a mental framework around bitcoin in relation to the rhyming history of technology startups, there can be no comparison whatsoever. Bitcoin is money, not a company. It would be illogical to assume competition between two monetary mediums (or multiple) would be in any way parallel or would follow a similar pattern to that of two companies. Companies compete in a capital formation arms race; in order to do so, they need money to coordinate economic activity. How do they get money? By using money to coordinate the production of goods and services and by selling the output for more money (profit). In essence, companies compete for the same pool of money in order to accumulate capital. Money is the tool that makes the wheel go round. It simply would not be possible to coordinate all the individual skills necessary in order to allow for the fulfillment of goods and services derived from the complexity of most modern supply chains without money. It also would not be possible if it were not for the fact that a large group of people accepted a common form of money.

In the supply chain of production, money serves a distinct function of a different class than any individual good or service. It is the distinction between the fulfillment of preferences (production of goods and services) and the coordination of preferences (money). The fulfillment of preferences is dependent on the coordination of preferences, and the coordination of preferences is dependent on a price system, which can only form as a derivative of mass convergence on a single monetary medium. Without a pricing system, division of labor would not exist, at least not to the extent necessary to allow for the functioning of complex supply chains. This is the root level principle most miss when contemplating a world of many currencies. Any pricing system is derived from a single currency. The concept of price would not exist if not for a critical mass of individuals producing a diverse set of goods and services and communicating the value of those goods and services through a common medium. In order to derive the benefit of money and price, convergence is a precursor. As a result, it may be more accurate to say that economic systems emerge from a single monetary medium rather than converge on one. Individuals converge on a single monetary medium and the output is an economic system.

Whereas the value of all other goods and services is consumption, the value of money is exchange. Exchange is the good any individual is purchasing when choosing to convert value (the subjective output of time, labor and physical capital) into a monetary good. Individual consumption preferences are unique, but money serves one singular function for all market participants: to bridge the present to the future (whether it be for a day, week, year or longer). In any exchange of present value, some time continuum exists until a future exchange. At the point of exchange, each individual must make a decision as to which monetary good will best serve the function of preserving value created in the present into the future. A or B? While an individual can choose to hold one or multiple currencies, one is definitionally going to perform that function more effectively. One will preserve future purchasing power better than the other. Everyone intuitively understands this and makes a decision based on the inherent properties of one medium relative to another. When deciding which monetary good to use, the preference of one individual is impacted by the preference of others, but each individual is making an independent evaluation discerning the relative strengths of multiple monetary goods. It is not coincidence that the market converges on a single medium because each individual is attempting to solve the same problem of future exchange, which is interdependent on the preference of others.

The ultimate goal is to reach consensus such that each individual can communicate and exchange with the widest and most relevant set of trading partners. Collectively, it is an objective evaluation of tangible goods based on an intersubjective need. The whole point is to find the one good that everyone can agree is i) a relative constant, ii) measurable and iii) functional in exchange. The existence of a constant creates order where none existed previously, but that constant must also be functional as both a measurement tool and a means of exchange. It is the combination of these characteristics, often described as aggregating the properties of scarcity, durability, fungibility, divisibility, and transferability, which are unique to money. Very few goods possess all of these properties, and every good is unique, with inherent properties that cause each to be better or worse in fulfilling certain functions within an economy. A is always different than B, and the combination of properties that perfect a monetary good are so rare that the distinction from one to another is never marginal.

More practically, everyone agrees on a single monetary good through which to express value because it is in their individual and collective interests to do so. It is the problem itself: how to communicate value with other market participants. It would be counterproductive to the entire exercise if a consensus were not formed. But it is the properties of a monetary good itself that allow for convergence and consensus. The imagined world of thousands of currencies is blind to these fundamental first principles. A critical mass of individuals converging on a common medium is the input required to ascertain the information that is actually desired. And the value of a common medium only increases in value as more and more people converge on it as a tool to facilitate exchanges. The fundamental reason being that with more individuals converging on a single medium, the medium actually accumulates more information and presents a greater utility.

Think of each individual as a potential trading partner. As individuals adopt the common medium as a standard of value, all existing participants in the monetary network gain new trading partners, as do the individuals that become part of the network. There is mutual benefit, and ultimately the range of choice expands. But what also occurs as a monetary network expands is that more goods come to be valued in the common medium of exchange. More prices exist, and as a result, more relative prices do as well. More information is aggregated into the common medium, which can then be relied upon by all individuals within the network (and by the network as a whole) to better coordinate resources and respond to changing preferences. The constant becomes more valuable and inherently more reliable as it communicates more information about more goods produced by more individuals. The constant actually becomes more constant as more variable information is communicated through it.

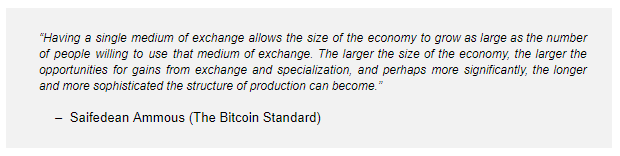

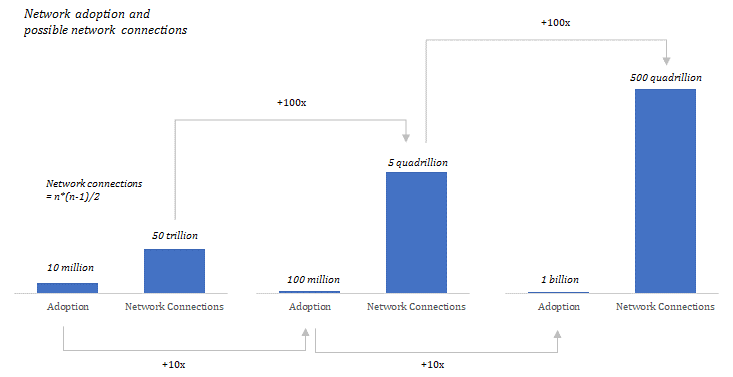

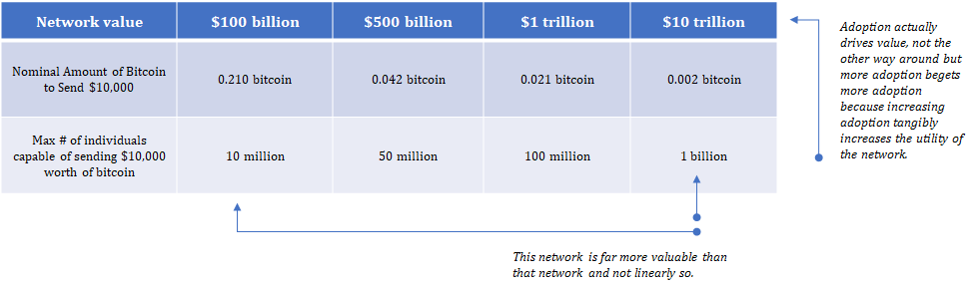

As adoption of a monetary network increases by an order of magnitude (10x), possible network connections increase by two orders of magnitude (100x). While this helps demonstrate the mutual benefit of adoption, it also highlights the consequence of converting value into a smaller monetary network. A network that is one-tenth the size has 1% of the number of potential connections. Not every network distribution is equal, but a larger monetary network translates to a more reliable constant to communicate information – greater density, more relevant information and ultimately a broader range of choice. The size of a monetary network and the expected growth of that network become critical components of the intersubjective A/B test, when each individual is determining which medium to utilize. While the number of people with whom any individual can maintain social relationships is inherently limited, the same limits do not apply to monetary networks. It is money that allows humans to break from the constraints of Dunbar’s number. A monetary network allows for millions (if not hundreds of millions) of people unknown to each other to contribute value at end points in the network, with relatively few direct connections needed.

Monetary networks ultimately accumulate the value of all other networks because all other network effects would not exist without a monetary network. Complex networks cannot form without a common currency to coordinate the economic inputs necessary to kick start the positively reinforcing feedback loops of price. A common currency is the very foundation of any monetary network, which allows other value networks to form. It provides the common language to communicate value, ultimately leading to trade and specialization, and organically creating the ability to expand the use of resources beyond the reach of “conscious control” (to steal Hayek). When contemplating the network effects of a social network, a logistics network, a telecom network, energy grid etc., add them all together and that is the value of a monetary network. A monetary network not only provides the foundation for all other value networks to form, but the currency of that network is what pays for access to all derivative networks within the monetary network. The existence of the common currency is the engine and the oil.

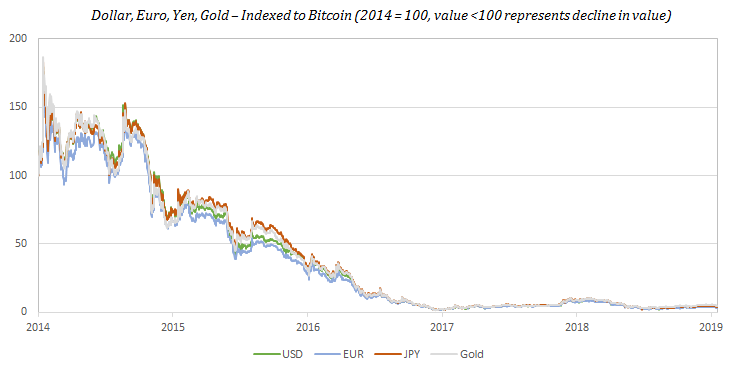

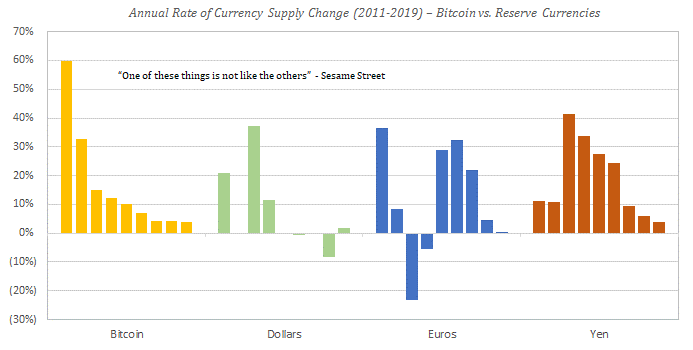

Yes, the dollar, euro, yen, pound, franc, yuan, ruble, lira, peso, etc. all co-exist today, but this is not a natural function of an open, global economy. Instead, each fiat currency that exists today emerged as a fractional representation of gold, which the world had previously converged upon as a monetary standard. None would subsist without the forces of government intervention; nor would any fiat currency have ever emerged if not for the prior existence (and limitations) of gold as a monetary medium. Modern monetary theorists and gold bugs alike will never admit it, but the calamity that is all fiat systems is nothing more than the manifestation of gold’s failure as a monetary medium. It is a dead man walking. The gold standard was formally abandoned in 1971, and the subsistence of jurisdictional fiat systems since then merely represents a transient departure from free market monetary forces. Modern fiat systems have only managed to survive as long as they have because a solution to the very problem created by fiat did not yet exist. Bitcoin is that solution, and ever since its creation, individuals have been converging upon it as a new monetary standard; a trend that will only continue as knowledge naturally distributes.

All Roads Converge on Bitcoin #

The Greatest Constant – Finite Scarcity #

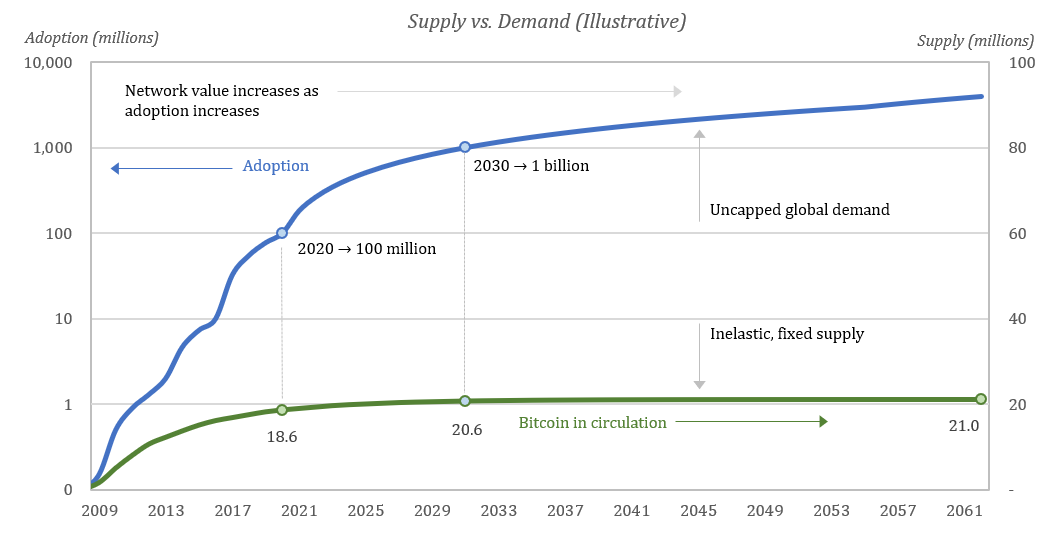

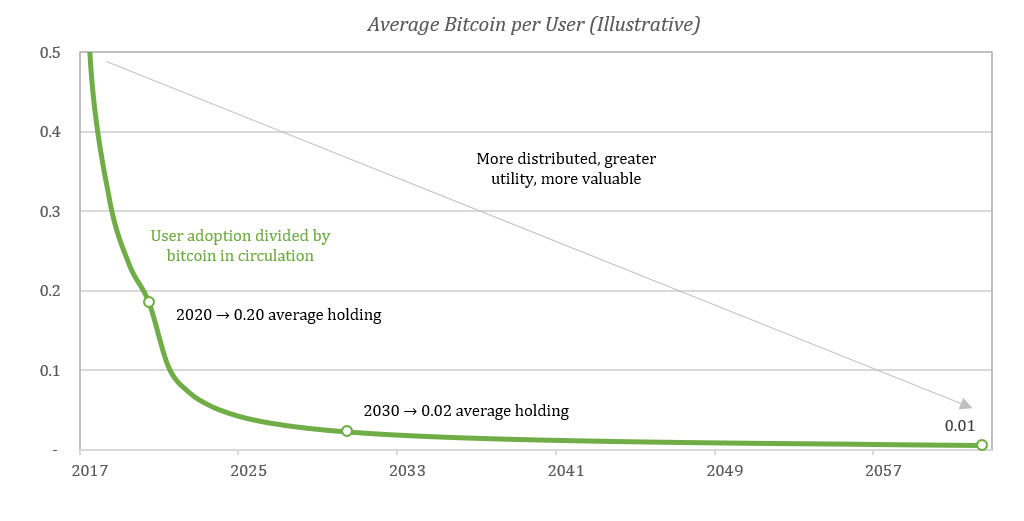

The market converges on bitcoin over time and its value continues to increase because it provides a constant that is superior to any other form of money. Bitcoin has an optimal monetary policy, and that policy is credibly enforced on a decentralized basis. Only 21 million bitcoin will ever exist, and the element of trust is removed from the equation entirely. Bitcoin’s fixed supply is enforced by a network consensus mechanism on a decentralized basis. No one trusts anyone, and everyone enforces the rules independently. As an aggregate of these two functions, bitcoin is becoming the scarcest form of money that has ever existed. Finite scarcity is a property no other form of money has ever or will ever achieve, and demand for bitcoin is fundamentally driven by that scarcity. However, scarcity is a two-sided equation. A fixed supply may be the primary draw, but demand is a critical and often overlooked aspect of scarcity. Demand is what actually makes scarcity a utility as a constant in exchange. Bitcoin becomes more and more scarce as a two-way function of increasing demand and a completely inelastic terminal supply. The scarcity of its fixed supply creates demand but increasing demand then creates greater scarcity. It sounds circular because it is. If there were 21 million bitcoin and only 1 person valued it, there would be nothing scarce or useful about bitcoin. But if 100 million people valued bitcoin, 21 million starts to become scarce. And if the network grew to one billion people, 21 million would become extremely scarce, and bitcoin would represent a greater utility as a constant.

With a fixed supply, increased demand naturally results in bitcoin becoming more distributed. There is only so much to go around, and the pie ends up getting split up into smaller and smaller shares owned by more and more people. As more individuals value bitcoin, the network not only becomes a greater utility; it also becomes more secure. It becomes a greater utility because more people are communicating in the same language of value through a more reliable constant. And as more individuals participate in the network consensus mechanism, the entire system becomes more resistant to corruption and ultimately more secure. Recognize that there is nothing about a blockchain that guarantees a fixed supply, and bitcoin’s supply schedule is not credible because software dictates it be so. Instead, 21 million is only credible because it is governed on a decentralized basis and by an ever increasing number of network participants. 21 million becomes a more credibly fixed number as more individuals participate in consensus, and it ultimately becomes a more reliable constant as each individual controls a smaller and smaller share of the network over time. As adoption increases, security and utility work in lock-step. Consider the distribution and relative density of bitcoin adoption throughout the world (heat map below of network nodes). As reach and density within each market spread, bitcoin’s constant becomes harder and harder.

As individuals increasingly opt-in, 21 million becomes more and more credible, and in the mind of those who adopt it, finite scarcity becomes what differentiates bitcoin from all other forms of money – both legacy currencies and competing cryptocurrencies alike. All other currencies either centralize over time (e.g. the dollar, euro, yen, gold) or were too centralized from the start (e.g. all other cryptocurrencies) to credibly compete with a fixed supply of 21 million. Centralization inherently creates the need to rely on trust, and trust ultimately puts the supply of any currency at risk, which in turn impairs demand and marginalizes its utility in the function of exchange. Whereas all other currencies depend on trust, the constant bitcoin provides is trustless. 21 million is only credible because bitcoin is decentralized, and bitcoin becomes increasingly decentralized over time. The best any other form of money could possibly do is match bitcoin, but practically, it is not possible because individuals converge on a single medium, and bitcoin beat every other currency to the punch. Every other currency is ultimately competing against the ideal constant; one that will not change and that does not rely on trust.

All forms of money compete with each other for every exchange. If the primary (or sole) utility of an asset is the exchange for other goods and services, and if it does not have a claim on the income stream of a productive asset (such as a stock or bond), it must compete as a form of money. As a consequence, any such asset is directly competing with bitcoin for the exact same use case, and no other currency will ever provide a more reliable constant because bitcoin already exists and it is finite. Because individuals converge on a single medium, scarcity in bitcoin will perpetually be reinforced on both the supply and demand side, whereas the opposite force will be in effect for all other currencies due to the reflexive nature of monetary competition. The distinction between two monetary goods is never marginal, and neither is the consequence of individual decisions to exchange in one medium rather than another. Money is an intersubjective problem, and a choice to opt into one monetary medium is an explicit opt out of the other, which in turn causes one network to gain value (and utility) at the direct expense of another. As bitcoin becomes more scarce and more reliable as a constant, other currencies become less scarce and more variable. Monetary competition is zero sum, and relative scarcity, a dynamic function of both supply and demand, creates the fundamental differentiation between two monetary mediums that only increases and becomes more apparent over time.

But remember that scarcity for scarcity sake is not the goal of any money. Instead, the money that provides the greatest constant will facilitate exchange most effectively. The monetary good with the greatest relative scarcity will best preserve value between present and future exchanges over time. Relative price and relative value of all other goods is the information actually desired from the coordination function of money, and in every exchange, each individual is incentivized to maximize present value into the future. Finite scarcity in bitcoin provides the greatest assurance that value exchanged in the present will be preserved into the future, and as more and more individuals collectively identify that bitcoin is the monetary good with the greatest relative scarcity, stability in its price will become an emergent property (see Bitcoin is Not Too Volatile).

The Greatest Measurement Tool – Divisibility #

While scarcity is the bedrock, not all scarce goods are functional as money. In order to be functional as a tool to communicate value, a monetary good must be a relative constant, easy to measure and functional in exchange. A ruler may be an effective measurement tool, but rulers are not scarce, nor is it easy to carve up pieces of a ruler into larger and smaller units to facilitate exchange. In exchange, a monetary good being scarce and measurable allows for the measurement of all other goods; the ability to easily subdivide and transfer a monetary unit provides for practical utility in exchange. Bitcoin combines finite scarcity with the ability to subdivide each whole unit down to 8 decimal points (0.00000001 or one 100,000,000th of a bitcoin) and transfer any amount of value, however large or small. Just as scarcity for scarcity sake is not necessarily valuable in the context of money, neither is the property of divisibility. It is the combination that becomes valuable in the context of money, particularly when each subdivided unit is fungible – when each individual unit is essentially interchangeable and each of its parts is indistinguishable from another part. It is these properties together that allow bitcoin to not only be a perfect constant but also an effective measure of value to facilitate exchange.

In the code, one bitcoin is actually represented as 100,000,000 sub-units, with the smallest unit referred to as a satoshi (or sat for short). Technically, one bitcoin is 100,000,000 sats. While one bitcoin equates to approximately $9,000 today, one satoshi is equal to one-twentieth of a penny. In essence, anyone can exchange any amount of value into bitcoin. Bitcoin, as with any money, is functional for one purpose, to store value between a series of exchanges. Receive bitcoin for value produced today, save, spend bitcoin in the future in return for value produced by others. It will perform the same function regardless of amount. The practical consequence of divisibility is that bitcoin is capable of measuring any and all value which allows it to support any and all adoption. Individuals produce a wide range of value, and divisibility allows all individuals to utilize bitcoin as a savings mechanism regardless of whether it be to store $50 or $50,000 in value. For a monetary good to be an effective communication tool, it must be able to measure the range of value produced by all individuals, and bitcoin does this flawlessly. The ability to divide and transfer any amount of bitcoin makes it accessible to all individuals and ultimately all goods produced, regardless of how much value is attributable to each.

In the A/B test of monetary competition, if A > B, any amount of A will perform the function of money better than any amount of B. Over time, A will increase in purchasing power relative to B whether it be for $50 or $50,000-worth of value. Never be confused by a list of cryptocurrencies trading on Coinbase that look like a “better deal” because the price is “cheap” whereas bitcoin appears “expensive.” Always remember that bitcoin is capable of being divided into smaller or larger units to store more or less value. One bitcoin is an inherently arbitrary unit, as is one unit of any currency. The market test is whether A is more functional as money than B. It is an intersubjective decision, and while the market is communicating which network it believes performs the monetary function more effectively through price and value, network value is the output, not the input. The input is each individual evaluating the properties of the monetary good itself relative to others. If bitcoin is A in your evaluation, then there is no “too expensive.” Bitcoin may be over or undervalued at any point in time, but each individual that adopts bitcoin increases the value of the network (recall the discussion on trading partners + network connections). And the ability to be divided easily into very small units allows for a practically limitless number of individuals to convert and communicate value through the network. If A is greater than B, and if A can support unlimited adoption, it eventually obsoletes the need for network B.

As individuals independently evaluate this A/B test, more people ultimately adopt bitcoin, and bitcoin becomes divided into smaller and smaller units (on average). This is the result of increasing demand combined with a fixed supply, and the value of the network actually increases as a function of this process. As a network, bitcoin becomes more valuable as it is valued by more people. Essentially, 0.1 bitcoin = $1,000 is more valuable than 1.0 bitcoin = $1,000, despite each being worth the same measured in dollar terms. More exchange (and ultimately more commerce) becomes possible the more valuable bitcoin becomes in total, but value is really an output of more and more people choosing to adopt bitcoin as an exchange intermediary. Each individual owns a smaller and smaller nominal amount of the currency, but the purchasing power of each equivalent unit increases over time. With each exchange, every individual is conveying his or her own value onto the network and is doing so at the direct expense of a competing monetary network. Through this process, a new price is determined specific to the value created and measured by each individual, and as a result, bitcoin accumulates more information derived from a more diverse set of trading partners.

While prices today may not yet be quoted in bitcoin terms, a pricing system is forming every time an individual converts value into bitcoin. Even if dollars are an indirect intermediary, value produced somewhere in the world, distinct to a particular individual, is expressed as a unit of bitcoin; as more and more people choose to do so and increasingly on a per-individual basis, that value converts to a smaller and smaller unit of bitcoin (on average). The consequence is that a smaller and smaller denomination of bitcoin can be used by more people to transfer an equivalent amount of value, and as bitcoin is measured by more people, its ability to measure relative value only increases. Since bitcoin can measure all value and can be adopted by a limitless number of individuals, it practically obsoletes the need for any other value transfer network over the long-term because the form of money with the lowest rate of change ultimately communicates more perfect information. Finite scarcity combined with divisibility creates an extremely powerful exchange intermediary. Bitcoin has the lowest terminal rate of change possible due to its absolute scarcity, and it can be divided to a fraction of a penny, which will allow it to measure value far more precisely than any other currency.

The Greatest Exchange Tool – Transferability #

With this baseline, the real knockout punch becomes the fact that bitcoin can be irrevocably transferred over a communication channel without the need for any trusted third-party as an intermediary. This is fundamentally different than digital payments in fiat systems, which are dependent on trusted intermediaries. In aggregate, bitcoin is a greater constant than any other form of money and is highly divisible (and measurable), while also capable of being transferred over the internet. Try to identify a single other good that could possibly share these properties: finite scarcity (greatest constant) + divisibility and fungibility (measurement) + ability to send over a communication channel (ease of transfer). This is what every other monetary good is up against as it competes for the convergent role of money. Practically, the only way to really appreciate the power of such a rare dynamic is through experiencing it firsthand. Any individual can access the network on a permissionless basis by running a bitcoin node on a home computer. The ability to power up a computer anywhere in the world and transfer a finitely scarce resource to any other individual, without permission or reliance on a trusted third-party is empowering. That hundreds of millions of people can do this in unison without anyone needing to trust other participants in the network is near-impossible to fully comprehend.

Bitcoin is often described as digital gold, but really, this does not do it justice. Bitcoin combines the strengths of physical gold with the strengths of the digital dollar without the limitations of either. Gold is scarce but difficult to divide and transfer, while the dollar is easy to transfer but not scarce. Bitcoin is finitely scarce, easy to divide, and easy to transfer. In their current forms, both gold and all fiat monetary systems are dependent on trust, whereas bitcoin is trustless. Bitcoin optimized for the strengths and weaknesses of both, which is fundamentally why the market is converging (and will continue to converge) on bitcoin to fulfill the function of money.

Bitcoin Obsoletes All Other Money #

If any individual comes to three principal conclusions:

- money is a basic necessity,

- money is not a collective hallucination and

- economic systems converge on a single medium,

that individual is going to more consciously seek out the best form of money. It is money that preserves value into the future, and ultimately, allows individuals to convert their own time and their own skills into a range of choice so great that prior generations would find it difficult to imagine. Freedom is ultimately what a reliable form of money provides: the freedom to pursue individual interests (specialization) and the ability to convert the output of that value into the value created by others (trade). Whether individuals consciously ask themselves these questions or not, they will naturally be forced to answer them through their actions. They will also arrive at the same answer as those that do. The conscious and the subconscious arrive at the same place because the fundamental truths do not change, and the function of money is singular: to intermediate a series of present and future exchanges and to provide the very baseline to communicate subjective value among a wide group of individuals that stand to benefit from trade and specialization. Money is a necessity. There are discernible properties that make certain goods more or less functional in exchange, and exchange is an inherently intersubjective problem.

Owning bitcoin is becoming the cost of entry to what will likely be the largest and most diverse economy that has ever existed. Bitcoin is global and it is accessible on a permissionless basis. Because bitcoin becomes the common language of value for all participants, anyone that is a part of the network will be able to communicate and ultimately trade with other network participants. The more trading partners, the greater the value each unit provides to the individuals holding the currency. While there will likely always be jurisdictional friction that impedes trade, access to the same common currency removes the root source of friction in the communication of value, and bitcoin’s fixed supply will allow its pricing mechanism to accumulate and communicate more perfect information with the least amount of distortion relative to any other form of money. And as more individuals choose to store value in bitcoin, its fixed supply becomes more credible and its pricing mechanism more reliable and relevant. New adopters of a monetary network both contribute value and realize value as a function of adoption, which is why it is not possible to be late to bitcoin, nor will bitcoin ever be too expensive.

It does not matter how complex bitcoin is. At the end of the day, bitcoin becomes an A/B test. The need for money is real and individuals will converge on the form of money that best fulfills the function of exchange. No other currency in the world can ever be more scarce than bitcoin, and scarcity will act like a gravitational force driving adoption and communication of value. Today, most billionaires do not understand bitcoin. Bitcoin is an equal opportunity mind-bender. But even those who do not understand bitcoin will come to rely upon it. There are many fundamental questions. Bitcoin is volatile, seemingly slow, challenges to scaling, not commonly used for payments, consumes a lot of energy, etc. Stability is an emergent property that follows adoption, and all other perceived limitations will be solved as a function of the value that is derived from finite scarcity combined with the ability to measure, divide and transfer value. That is the innovation of bitcoin. Currency A has a fixed supply. Currency B does not. Currency A keeps increasing in value relative to Currency B. Currency A continues to increase in purchasing power relative to goods and services while Currency B does the opposite. Which one do I want? A or B? Make the right choice because the opportunity cost is your time and value. All of the rest simply explains why individuals will increasingly opt for A over B, but in practice, it all comes down to basic common sense and survival instincts. Bitcoin obsoletes all other money because economic systems converge on a single currency, and bitcoin has the most credible monetary properties.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.”

— F.A. Hayek

Thanks to Will Cole and Phil Geiger for reviewing and for providing valuable feedback.

Contents

- Gradually, Then Suddenly: Intro

- Bitcoin Can’t Be Copied

- Bitcoin Is Not Too Volatile

- Bitcoin Does Not Waste Energy

- Bitcoin is Not Too Slow

- Bitcoin Fixes This

- Bitcoin, Not Blockchain

- Bitcoin is Not Backed by Nothing

- Bitcoin is Not a Pyramid Scheme

- Bitcoin Cannot be Banned

- Bitcoin is Not for Criminals

- Bitcoin Obsoletes All Other Money

- Bitcoin is a Rally Cry

- Bitcoin is Common Sense

- Bitcoin is Antifragile

- Bitcoin is One for All

- Bitcoin is the Great Definancialization