A Philosophical, Technical, and Economic Critique of Prospects in “Crypto” Beyond Bitcoin.

This article by Allen Farrington & Anders Larson was first published on uncerto.com website.

Allen Farrington holds a board observer role at Blockstream. Anders Larson works for a US-based hedge fund.

What follows does not represent the views of either author’s employer and is not financial or investment advice. It is intended as a philosophical, technical and economic assessment of a novel class of internet protocols. These protocols mostly happen to give rise to natively digital assets, which lend themselves to naturally emerging online and effectively public markets, and which present direct investment opportunities. Nonetheless the following is merely and only our opinion of how these technologies are likely to progress. Readers considering investing in any asset discussed herein should do their own research and should not rely on our work.

ABSTRACT #

In this piece we discuss our concerns around the broader “crypto” space beyond Bitcoin. Our arguments revolve around three primary themes: Philosophical, Technical, and Economic. From a philosophical perspective, we discuss the core properties that make Bitcoin work and that make it unique, in our view. From a technical perspective, we evaluate how these properties are lacking to a greater or lesser extent in alternative “crypto assets,” having been designed out again on questionable philosophical justifications. From an economic perspective, we walk through our concerns that “crypto” has not shown a path to establishing a basis for justifiable real-world value, explain why we believe this would be very difficult to ever accomplish, and suggest therefore that their technical flaws are especially vulnerable. Given the complexity of the task we have set ourselves, this piece is intended to bring our arguments into long form and provide a discussion base for good faith disagreement.

“Talk, talk, talk: the utter and heart-breaking stupidity of words.”

— William Faulkner on the authors of this piece

Bitcoin is an important innovation. We doubt any serious financial professional now disputes this. However, the importance of Bitcoin’s many imitations, collectively dubbed “cryptocurrencies” – or just “crypto” – is contentious. Our argument is that, in the long run i) it is likely that much of the current value will prove unsustainable and therefore will disappear and ii) it is possible similar systems built on Bitcoin will capture much of this value. This paper is a rigorous philosophical, technical, and economic analysis of why we hold this view.

Given we use the terminology throughout the paper, we must be absolutely clear on both what we mean by “decentralized finance” and “DeFi” and our attitude towards it. This is equally for the purposes of clarifying our chosen terminology and clarifying our motivation and attitude. We are strongly supportive of the principles of decentralized finance, which we will do our best to explain and examine shortly.

By the concept of decentralized finance, we mean an ecosystem in which the building blocks of financial and capital markets products are freely accessible to all without having to navigate technical bottlenecks or economic middlemen; in which their workings are transparently inspectable and auditable on the basis of free and open-source code; in which not only the products but even the architecture of marketplaces operates on these principles; in which this constitution lends itself naturally to programmability at origin and interoperability thereafter; and in which, due to the combination of all the aforementioned factors, no individual or entity can maliciously or politically affect market activity, be this in the form of agitating to advantage themselves or to disadvantage others. The dream is, in effect, that all participation is honest, and all honest participation is accepted, such that a long and inclusive tail can be unlocked for capital market activity – a domain of social and political economy notoriously inefficient, exclusive, extractive, and oppressive throughout modern history.

Our argument is that this instantiation of the concept is mostly built on unfirm foundations and, unfortunately, is unlikely to last. It is also worth being as upfront as possible that much (probably all) of the financial constructions we criticize could eventually end up being reconstructed on Bitcoin – on Bitcoin DeFi as we might call it – and would be equally worthy of criticism. Our argument here is not that Bitcoin and its higher layers are unequivocally good, but rather that such questionable constructions seem to be encouraged – even necessary – in the non-Bitcoin environment so as to fill a gap in justification of robust value that emerges in the first place due to having injudiciously altered Bitcoin’s design in their own construction.

Our opinion of the folly of these design choices makes up Section 1 of the paper. We therefore have two worries about non-Bitcoin crypto DeFi that builds on this folly, which make up Sections 2 and 3 of the paper, respectively: that the design folly means they are unlikely to last as allegedly robust, decentralized assets, and: that this fundamental flaw has implicitly encouraged a more superficial flaw of attempting to bootstrap an alternative foundation of value, but which, on rigorous inspection, cannot be justified (because the applications are not really finance). Section 4 evaluates the contemporary investment rationale, and Section 5 explores our belief that much, if not all, of the functionality will eventually be rebuilt on Bitcoin.

To clarify our terminology, therefore, by either “DeFi” or “decentralized finance” we mean only the concept. By “crypto” we mean the current, non-Bitcoin based instantiation. We appreciate this may cause some confusion given DeFi seems to mean both the concept and the instantiation in different situations, and crypto seems to mean public blockchains both inclusive of and exclusive of Bitcoin when spoken by different people or in different settings, but frankly, we had to bite the bullet somewhere. Given we want to emphasize (repeatedly!) our fondness of the concept of decentralized finance, this seemed like the best permutation on which to settle.

Overview and Section Summaries #

1 - The Innovation From First Principles

We provide a philosophical analysis of what we believe to be the real innovation in Bitcoin: proof-of-work and the difficulty adjustment enabling distributed consensus and “money” as an emergent and endogenous use case.

2 - Crypto Is Not Decentralized

We argue that the variety of changes crypto projects make to Bitcoin’s design make it likely that all instantiations will have to centralize at some point, and in some form. This both undermines the alleged goals and makes it a questionably costly alternative to already centralized systems, but also introduces an even more ominous attack vector: not even technical or economic but instead social.

We argue that the attempt to bootstrap value not by security but instead by utility – in particular, utility in financial applications – does not solve crypto’s core problem but only exacerbates it and delays its resolution. We also highlight that the common and popular metrics that capture the extent of apparent “financial activity” are deeply misleading as indicators of health and success and primarily serve to encourage further capital inflows that are, in fact, necessary to sustain the ecosystem, but without contributing to real economic productivity.

4 - The “Investment” Rationale

We provide a rationale for investing in the space to date, and argue that the most sensible investment thesis is essentially a subtle category error that results in transferring across principles from software venture investing that do not quite apply in this space. We argue further that only a certain class of investors is likely to commit this error, and the realization that others will not follow will likely mark the beginning of the end.

5 - Layered Architecture and Gall’s Law

We argue that the desirable features of DeFi will likely emerge before too long on Bitcoin. Furthermore, we argue that the fact of these features taking longer and being more difficult to build is a fundamentally good thing; it reflects that Bitcoin’s architecture has been built in a more robust and prudent manner than its DeFi peers. Ironically, in the long run, this is likely what will enable extension of functionality. We give basic details on a handful of relevant projects before analysing this dichotomy in more philosophical detail.

In this short final section, we give a (non-exhaustive) list of reasons why the above analysis may turn out to be mistaken.

Appendix A - Common Pool Resources

In Appendix A, we argue that all “crypto assets,” Bitcoin included, are properly understood as “common pool resources,” as opposed to, for example, public goods, or truly private property. We then argue that, according to arguably the most respected analysis of such entities, the governance characteristics of Bitcoin are excellent while those typical of crypto are mediocre to poor. This is not crucial to the main argument of the paper, but may be of interest to readers interested in academic political philosophy and economics.

Appendix B - Rehypothecation Algebra

In Appendix B we provide the workings for the discussion near the start of Section 2 as to how to actually calculate systemic exposure, contrary to naive claims of “overcollateralization ratios” common in the space.

1/n – The Innovation From First Principles #

One Ring to rule them all, One Ring to find them, One Ring to bring them all, and in the darkness bind them.

— J.R.R. Tolkien on “Crypto”

TLDR: in Section 1, we provide a philosophical and technical analysis of what we believe to be the real innovation in Bitcoin: proof-of-work and the difficulty adjustment enabling distributed consensus and “money” as an emergent and endogenous use case.

Jump to Section 2 for how crypto attempts to upgrade this innovation, but potentially just breaks it.

What is the innovation of Bitcoin? Is it a decentralized computer? Is it digital real estate? Is it a peer-to-peer payments tool? Is it a solution to the Byzantine Generals Problem?

Answering the first question depends on understanding the context in which it is being asked. The questions that follow, in response to the first, each suggest their own context. But we believe all to be unhelpful. We offer two contexts of our own, and hence two answers. Technically, the innovation is the proof-of-work algorithm, the difficulty adjustment, and the native monetary unit that is able to endogenously emerge. Socially, on the other hand, the innovation is an immutable and uncheatable distributed ledger.

Let us now break out the two categories: Technical and Social.

Technically: The proof-of-work algorithm and difficulty adjustment enabling distributed consensus on censorship-resistant, integrity-assured, floating value is the breakthrough. What the design achieves, is a social matter, and in purely technical terms, nothing else about Bitcoin is either original or all that interesting. Public key cryptography and hash functions have been perfectly well understood for decades and implemented across industries and applications without much fanfare.

Achieving consensus is a compromise. Permissionless consensus involves an achievement of compromise previously impossible due to problems in coordination and incentives. Every actor may have an incentive to manipulate consensus to their own benefit. The innovation of Bitcoin is the creation of an incentive to protect honest contributions to consensus from a distributed network that is greater than the incentive to either attack honest contributions or to submit dishonest contributions. This way there is an economic incentive to reach consensus in a decentralized environment that otherwise lacks a single source of truth. This innovation is implemented via proof-of-work: value is programmatically escrowed and probabilistically returned on the basis of valid and honest contributions, and is otherwise confiscated. These contributions are both perfectly competitive and auditable. It is the work that is respected, not the worker. The worker need not be known to the rest of the network.

That the resulting protocol can be considered “money” is endogenous to this incentive scheme – but it is also necessary. The reward for honesty must have a denomination that can reliably be weighed up against the cost of escrow, dishonesty, or overt attack. This enables a native monetary unit. The difficulty adjustment enables cryptanalytic stability in the provision of security via work, the aggregation of work as input, transformed by the algorithm, will always create an output with the same temporal properties, enabling decentralized timing as well as decentralized truth. A verifiable order of events allows the updating of the ledger to be sensibly interpreted as transfers of b alances of the monetary unit, and stability to inputs makes the incentive scheme flexible and reactive to real-world costs expensed by the growth, or shrinkage, of the network, enabling the value of the monetary unit to float.

This is the breakthrough that allowed Bitcoin to advance beyond previous attempts at digital cash, in which the hoped-for digital value was assumed to correspond to an external yardstick, almost always a given denomination of fiat money. Previous attempts disallowed a workable incentive scheme to protect the integrity of the asset in a distributed manner. Without such a scheme, value and timestamping had to be guaranteed centrally. This grounded that value, ultimately, in trust in the issuing authority. This made the asset, in whatever form it took, little more than an IOU in digital guise.

This breakthrough also allowed Bitcoin to advance beyond previous, effectively decentralized, schemes. Plenty of which exist. Arguably every internet protocol is one; from the web to email to TOR to torrents to git. Because they contributed to decentralized consensus and immutability via unforgeable costliness. Any attempt to manipulate the record by passing off a change as honest would require a single actor (re)performing as much work as the entire distributed network had to that point, and racing it in real time to overtake its aggregate. That this is practically infeasible grants Bitcoin the additional benefits of transparently verifiable accuracy of the timing of transactions. In addition to the high cost of attack via attempted dishonest contribution, contributes to a low cost of defending the network against such an attack

The entire decentralized system needs the prospect of value to motivate the provision of censorship resistance and integrity assurance. Hence, the “value” realized by the network must be emergent and endogenous; it must float relative to any external measure.

Bitcoin’s distributed security is endogenous and depends on its value as money; and its value as money is endogenous and depends on its distributed security.

Socially: Bitcoin is not a computer, it is a ledger. This is not to deny Bitcoin is “money.” Of course, it has a monetary aspect, but only because money is arguably the most important ledger, in whatever form it happens to take. Adam Back essentially made this point on Preston Pysh’s podcast recently, reflecting on previous failed attempts to create digital cash. One way of conceiving the real breakthrough of Bitcoin is that Satoshi realized stable value could not be robustly targeted. The robustness of the ledger itself would have to be paramount, from which value might endogenously emerge, if the prospects of the protocol design are appreciated by the market and speculated upon. This is as far as we need to go into the philosophy of “what is money?”, given that referring to money as a ledger is not terribly controversial.

What may be controversial is our claim that the presence of computers in the workings of Bitcoin is a red herring as far as this analysis goes. Computers are useful because they allow the introduction of mathematical precision into the necessarily probabilistic proving of work. The presence of computers wrestles with the inherent uncertainty of distributed competition and reduces it to comprehensible and manageable statistics. This is useful for those weighing up monetary costs and benefits. Also, “the Internet” is useful because it allows the desired consensus to be reached and verified globally nearly instantaneously. But neither technically matter. Bitcoin could work in principle with pen and paper and carrier pigeons bringing the result of computations-by-hand back and forth to a public square: the ledger would work, but its intended use case as money likely would not. Computers make Bitcoin far more useful, but they do not make Bitcoin.

The consensus (i.e., the ledger) is what matters. The breakthrough of proof-of-work and the difficulty adjustment is far more about harnessing energy and existing communications infrastructure to calibrate incentives than it has to do with computation. Computation is a tool that makes the process more efficient and reliable, but Bitcoin is not itself a “computer.”

Calling Bitcoin an “inefficient database” is equally unhelpful. A car is an inefficient stove if you run the engine hot enough to fry an egg on the hood, but only because you are using it for something other than its intended purpose. The Bitcoin timechain exists as a digital data structure due to the coincidental presence of computers as just discussed, but not as an essential feature. Rather than a “database,” what matters is that it is an append-only ledger, appendable by anybody, and verifiable by anybody that it has only ever been appended. In other words, a ledger that is censorship resistant and integrity assured. This could be implemented by hand and then all discarded besides the UTXO set: an unordered list of mostly optical gibberish – hardly a “database.” If you want to call a given implementation a database, knock yourself out, but don’t expect that this will help you understand it any better. It would be like calling the HTML, CSS, and JavaScript on a web server a special variety of text document, or perhaps a form of atrocious blank verse. This is true, but tells you nothing, and is more likely to confuse you than it is to help you understand what is happening or why.

There are a handful of interrelated characteristics that constitute the real innovation of Bitcoin and that delicately balance to give it unprecedented functionality. These are:

- i) The proof-of-work algorithm

- ii) The difficulty adjustment

- iii) The native unit of (only) monetary value

- iv) The lack of a founder or acknowledged leader

- v) The economic incentive created for distrusting individual actors to achieve distributed consensus, unforgeably and immutably.

This all allows Bitcoin to realize endogenous value as an asset grounded in its security, and endogenous provision of security as incentivized by this asset.

Our thesis is that all non-Bitcoin crypto projects, usually in an attempt to add functionality deemed to be an improvement on that offered by Bitcoin or that is even fundamentally impossible to offer on Bitcoin, necessarily sacrifice at least one element just outlined. Section 5 will argue that this thinking is impatient and misguided in the long-run and that the hoped-for functionality is likely to slowly but surely emerge on Bitcoin. Next, Section 2, will explore what we believe to be the consequence of this sacrifice, which we believe to evidence short-termism: that decentralization is put at risk.

2/n – Crypto Is Not Decentralized #

“Where I’m from, only the strong survive.”

— Allen Iverson on “Crypto”

TLDR: in Section 2, we argue that crypto’s design differences to Bitcoin, as discussed in Section 1, make it difficult to live up to its promise of openness and trustlessness and hence likely if not inevitable that it will have to centralize at some point. This will likely both undermine the alleged goals and turns it into a questionably costly alternative to already centralized systems. It also introduces an even more ominous attack vector: not even technical or economic, but instead social.

Jump to Section 3 for a critique of the “financial” pretensions of crypto.

Any hope for decentralized finance must be grounded in a technology that is reliably and probabilistically secure, open, and distributed. We reiterate once again our belief in the potential of this concept, were it to be built on such a secure, open, and distributed base. Our problem with crypto – with this instantiation of decentralized finance – is essentially that it is not decentralized enough and it is not finance. In this section we will describe why we believe it is fair to say it is not sufficiently decentralized: why this is true in theory, how it manifests in practice, and how we believe it is likely to develop.

As far as we can tell, the intention behind the handful of ways this has happened is to attempt to improve upon some parameter of the Bitcoin timechain’s operation: its block time or regularity, its inflation schedule, its programmability, its privacy, the difficulty at the layer of the timechain to either introduce total token fungibility or definable nonfungibility (arguably a special case of programmability, but also, an enormously popular one) or more exotic goals as well.

To avoid the accusation that our criticisms are cherry-picked or that we are ignoring the benefits of what has so far been built, we will first do our best to steelman what is gained by making these changes.

In social terms, Marvin Ammori gives the following helpful characterization of the ecosystem in Decentralized Finance: What It Is, Why It Matters:

“With DeFi, anyone in the world can lend, borrow, send, or trade blockchain-based assets using easily downloadable wallets without having to use a bank or broker. If they wish, they can explore even more advanced financial activities — leveraged trading, structured products, synthetic assets, insurance underwriting, market making — while always retaining complete control over their assets.

DeFi protocols abide by key criteria — in particular, permissionless-ness and transparency — reflecting values found in Ethereum, the open-source decentralized software platform that forms the infrastructure for most decentralized applications.”

He adds on the importance of permissionless-ness specifically that,

“The permissionless nature of Ethereum-based applications…collapses barriers to entry for entrepreneurs down to zero. End consumers are the primary beneficiaries of this innovative environment: Because all applications share the same database (the Ethereum blockchain), moving capital between platforms is trivial. This forces projects to ruthlessly compete on fees and user experience.”

This is an admirable achievement. It is easy to see why this combination of features enormously benefits consumers. Referring back to our initial characterization of the concept of decentralized finance in the introduction, no individual or entity can maliciously or politically affect market activity, be this in the form of agitating to advantage themselves or to disadvantage others. If Ammori’s account is accurate (now and indefinitely into the future) then clearly any malicious advantaging of oneself, or abuse of others, will be met with immediate and unstoppable abandonment of the adversarial environment. It stands to reason that this possibility should keep participants honest in the first place.

Balaji Srinivasan gives an interesting technical accompaniment to the social interpretation just presented, arguing in Yes, You May Need A Blockchain, that, “public blockchains are massively multiclient databases, where every user is a root user.” By “root user,” Srinivasan essentially means, in straightforward English, somebody with the rights and permissions to change whatever they want about the structure of the database, rather than “regular users’’ (clients) who can only read from and write to the database within prescribed rules.

Srinivasan’s point in establishing this somewhat technical premise is to make the following argument, which is rather powerful,

“Different applications typically don’t … give users certainty that their data wasn’t intentionally tampered with or inadvertently corrupted during all the exporting and importing.

The reason why boils down to incentives. For most major internet services, there is simply no financial incentive to enable users to export their data…some call this the data portability problem, let’s call it the data export/import problem to focus attention on the specific mechanisms for export and import.”

This underpins Ammori’s point above, that users can “retain complete control over their assets” and “[trivially] move capital between platforms.” This can happen because all applications point to the same underlying “database” in which all users are root users: no user has the privileged ability to override the activity of others.

What allows this in the first place, Srinivasan argues, comes down to incentives. Regular databases have no incentive to enable seamless import and export, and possibly their operators have social or corporate disincentives in addition. “Public blockchains” on the other hand, have a fundamentally different feature that allows these incentives to exist. Srinivasan explains,

“Because the data associated with a public blockchain represents something of monetary value, it finally delivers the financial incentive for interoperability. After all, any web or mobile app that wants to receive (say) BTC must honor the Bitcoin blockchain’s conventions. Indeed, the application developers would have no choice due to the fact that Bitcoin by design has a single, canonical longest proof-of-work chain with cryptographic validation of every block in that chain.

So, that’s the financial incentive for import.

As for the incentive for export, when it comes to money in particular, users demand the ability to export with complete fidelity, and very quickly. It’s not their old cat pics, which they might be ok with losing track of due to inconvenience or technical issues. It’s their money…Any application that holds it must make it available for export when they want to withdraw it, whether that means supporting send functionality, offering private key backups, or both. If not, the application is unlikely to ever receive deposits in the first place.

So, that’s the financial incentive for export.”

Srinivasan builds toward the conclusion that,

“This is a real breakthrough. We’ve now got a reliable way to incentivize the use of shared state…while enforcing a common standard and maintaining high confidence in the integrity of the data.

This is very different from the status quo. You typically don’t share the root password to your database on the internet, because a database that allows anyone to read/write to it usually gets corrupted. Public blockchains solve this problem with cryptography rather than permissions…

In other words, public blockchains are massively multiclient open state databases where every user is a root user.”

A fundamental question of all that has been described above: Does any of it require a token? Recall tokens are by no means the essence of “decentralization” – HTTP, email, BitTorrent, TOR, Git, and wikis are decentralized and involve only exchanging information, not value.

Srinivasan argues it does because he recognizes that the technical blueprint borrowed from Bitcoin necessitates a native unit of value. But any self-respecting representation of value, or system purporting to guarantee representations of value, must possess precisely the properties teased out in Section 1: there must be consensus as to who owns what, for starters. If this is to be achieved solely in the digital realm, where only information exists and where the transformation of information is effectively free, we need a means of making dishonest claims to ownership or transfer of ownership both identifiable as dishonest, and, preferably, disincentivized on the basis of being too costly to attempt in the first place. We require immutability and unforgeable costliness.

Which is all to say we presuppose a distributed ledger with censorship resistance and integrity assurance. But imagine then that the token is intended to be something other than money. We anticipate three conceptual issues with whatever design is then conceived, all of which will threaten any previously credible claims to “decentralization”: i) it will lose a fight for liquidity with actual money, ii) it becomes a poor economic signal for coordinating security provision, and iii) the timechain itself bloats.

Everything Fights for Liquidity: why would a non-monetary token need to have a nonzero holding period and hence a non-negligible value in the first place? In short, why would anybody hold something that is money, but only for X, for any period other than the nanosecond required to transact it? It’s analogous to the choice between dollar bills and casino chips of the same denomination. Why willingly take on the casino’s liabilities and restrict the ability to engage in any other commerce? Why not buy casino chips when and only when you go to the casino?

This isn’t a death knell in and of itself but note it relies on a far more delicate consensus than would an asset straightforwardly trying to be money, and nothing more. If you can’t rely on others holding it (because it’s money and nobody needs a particular reason to hold money) then sustaining its value very likely requires some kind of coordination. And worse still, whatever coordination is arrived at likely has no inherent economic incentives that independently motivate coordination (as in, besides the attempt to realize benefit that depends on the coordination) and must overcome the economic disincentive to just hold money instead. In other words, everything fights for liquidity.

As far as we can tell, the current “independent motivation” to fight for liquidity and hold most crypto assets for a nonzero period is “yield.” This is a good segue to Section 3 given we have arrived at requiring that the “use case” is, in fact, that the tokens are to be considered securities 1 : their value is realized via the rights to future cash flows. But we will leave this for now and merely comment on the inherent contradictions already engendered given i) a security, and a yield, assumes and requires a separate money, and we set out to architect all of this so as to both only require itself and yet not be money, and ii) a “yield” is not a “utility.” This is a dire philosophical error: utility can be immediately realized, yield cannot; utility is non-monetary and is priced, yield is defined as a ratio of a flow of money over a stock. But we will come back to this – for now, we will leave our argument as: if one tries to win the fight for liquidity by toying with the very concept, we doubt one will achieve anything productive 2.

Poor Economic Signal For Coordinating Security Costs: Energy has a real cost. Proof-of-work and the difficulty adjustment provide a way to manipulate the effectively free activity of transforming information – the only material in the digital realm – into an actually measurably costly process, hence providing a link between the physical and the digital. If you can’t rely on endogenous value as money, there will be no sensible basis on which to evaluate the merits of the real cost of security contribution. We don’t want to overstate the importance of this point: obviously, it can be done if the tokens have value for any reason whatsoever. Our suspicion is rather that the process of justifying this decision is far less of a rational calculation than were the security reward nothing more than endogenous monetary value; it bakes into the calculation an element of belief (we might say a disregard for the robustness of this link between digital and physical reality) that there is no particular reason to expect to be stable or reliable over the long-term. Once again, we arrive at a coordination problem, the resolution of which does not benefit from any inherent economic incentive; the solution to the coordination problem is precariously rooted in the desire for there to be a solution.

Money is just a type of information. More specifically, it is the information reflecting the social consensus of the value of time. Bitcoin is just a ledger of transfers of value. As a form of money endogenous to distributed consensus, the information in the Bitcoin timechain is arguably as pure a representation as possible of precisely what costs and what time have been contributed to its security. This leads to Bitcoin’s continued existence and honest and valid distributed operation. Were the token intended for some economic property besides pure information, or too far removed from information, then it is likely the signalling mechanism linking the information to the cost of its provision and security and the value of time will at some point start to falter.

Timechain Bloat: this is by no means logically necessary, but it is easy to predict as a possibility and easy to observe as it has happened often. If a timechain is structured so as to contain more than this bare minimum of information (either in the form of economically loaded content that takes up far more data than validation of monetary balance transfers, or just too much validation) then it may reach such a size that it becomes practically or economically impossible for many to either run a node or contribute to security. This could be either in absolute terms or in the throughput of keeping a live view of timechain validly updating. It is impossible to reason conclusively about such an outcome entirely in general, as any touted thresholds will be arbitrary. But there will be some point at which this is concerning, given how degraded immutability and unforgeable costliness have become. Whether the community input on any technicality of the consensus mechanism remains sufficiently decentralized also risks becoming jeopardized.

It is easy enough to predict that, as these interrelated problems start to make themselves felt, so too will the pressure to ward off security issues by further centralizing control of the timechain. We repeat this does not follow necessarily from our argument thus far – it is in no sense predetermined – it is merely unfortunately easy to articulate as an increasingly likely possibility. Ammori draws attention to this,

“The underlying backend infrastructure for DeFi, Ethereum, must continue to scale in order to support higher bandwidth demands. Processing approximately 1.5 million unique transactions per day, Ethereum is already at its current max capacity, and transaction fees have spiked as a result.”

But notice “transaction fees spiking” is good for security! So we have a somewhat perverse situation in which the more secure the protocol becomes, the more its value proposition suffers. In order to become “more usable” it has to become less secure.

This is all arguably exacerbated by proof-of-stake, a consensus algorithm proposed in contrast to proof-of-work in which economic incentive is provided in the form of locking up capital for the right to validate blocks, having it stripped if deemed by the community to have done so dishonestly, but otherwise being rewarded with some combination of newly issued tokens and more manageable fees. But notice the tacit admission of having lost the fight of liquidity: the basis of value grounding has explicitly become “yield,” meaning the token is fighting for liquidity not on the basis of being money, but of being a security. Of course, it is not marketed as such, but we believe the economic logic here is clear and becomes remarkably easy to discern once recognized. In a blog post titled Why Proof Of Stake, Ethereum co-founder Vitalik Buterin even refers to the validator reward under proof-of-stake as “interest.”

To be clear, money does not bear interest: securities do.

The core philosophical issue at play rests on the answer to what was left dangling as a rhetorical question: do you need a token for that?, which seems to be, no, you do not. Because “that,” whatever it is, is not money, hence it will lose the fight for liquidity, it won’t sustain endogenous value, nor will it sustain endogenous security. For the tokens of a timechain, if value is exogenous, then security must be exogenous. If security is exogenous, then value must be exogenous. Without pure and simple “money” – concise information on the social value of time – both value and security will likely have to end up exogenous and coordinated to a greater or lesser extent, at which point we have sacrificed decentralization almost by definition.

It seems to us that, from a purely philosophical perspective, the only way to stop the technical and economic structure of a non-Bitcoin timechain from breaking is therefore to effectively centralize it in some or other way. This brings us to a curious junction because i) whatever we are talking about would clearly no longer be decentralized finance, however impressive it otherwise may be, and ii) this centralization is likely to introduce an entirely new attack vector of whoever is in charge. Surely this makes the ecosystem not only not decentralized, but in fact, incapable of living up to the promises of an actually decentralized system in theory as well.

Our rebuttal to the Devil’s Advocate of what is gained by non-Bitcoin crypto is therefore quite simply that what is lost is the credible ability to resist attack. The fanciest cryptography facilitating the most complex securitisation scheme with the fastest confirmation time the world has ever seen will be worth precisely zero if or when the infrastructure supporting it is attacked in such a way that it can no longer claim to be secure, open, and distributed, at best, or simply ceases to exist, at worst. To be clear on this point, price activity in the meantime is more or less completely irrelevant. If anything, positive price activity attracts attack, be it from economic speculators, technical exploiters, or state based social actors.

Why this obsessive focus on security, vulnerability, and costs to attack and defend? This might be a strange way to talk about what Ammori calls a, “globally accessible supercomputer,” whose, “native programming language (Solidity) can be used to create any conceivable application.”

Because timechains are not fundamentally computers. They are (or ought to be) ledgers. We see crypto as facing an impossible dilemma: if the timechains are computers in any sense, they are surely only valuable as decentralized computers. Ethereum is much more expensive than AWS, by just about every conception of cost: write cost, storage cost, write speed, and sync speed. If, at the end of all of this, crypto protocols turn out to be every bit as centralized as cloud computing, the debate ends precisely at the point on which they are outcompeted on cost by many orders of magnitude.

The benefits must be some feature that follows from decentralization, which in turn must be justified on the basis of superiority to AWS. What benefits are afforded the user of Ethereum that cannot be derived from AWS? Presumably some measure of censorship-resistance and integrity-assurance in their decentralized computation. After all, AWS can turn off its customers’ access, so the higher cost must surely be to overcome this danger.

Surely, following this logic, the user has to know that this danger has been overcome. Why pay the cost of uncensorable computation for censorable computation? This is why we focus on security, vulnerability, and the costs to attack and defend – because it is required for the decision to be remotely economically rational in the first place.

The vulnerabilities are far more than merely technical or economic. That sufficient technical or economic vulnerabilities exist at all create additional social vulnerabilities. “Cost” can be expended via bribes or threats to physical wellbeing. How much would it cost to bribe the possibly three or four Amazon employees who could literally flick the switch on Infura, given ~22% of fully synced Ethereum “full nodes” are hosted on AWS, and ~71% of all fully synced nodes are hosted with some or other cloud provider 3? And should any crypto protocols become genuine financial infrastructure, hence capable of being shorted if self-respecting in their ambitions, how good an investment would such a bribe turn out to be? Or, as Anthony Pompliano recently put it while interviewing Jack Mallers,

“All this stuff that claims to be “decentralized,” I just ask the founders, if the government came and said you had to go to jail if you don’t shut it off, would you shut it off? Oh, you could? Then it’s not decentralized.”

It is effectively free – or perhaps the cost is socialized – for the SEC or FATF or whoever to send a cease-and-desist letter. Secure, open, and distributed finance must be able to resist all of these attack vectors or it is pointless.

We do not mean to be morbid for the sake of it. We mean to be morbid because if or when all the securitized value in the world is at stake, there will be sophisticated attacks. These things will happen. If the intention is to rebuild finance in a decentralized manner, these attacks need to be rigorously studied and forestalled.

There is the perfectly realistic possibility that much of contemporary crypto becomes fully institutionalized. Not simply the involvement of institutions, which would itself be a necessary eventuality to a bull case, but something more like, the total capture by institutions. The probably intractable cost/attack dilemma could be solved by centralized and authorized hosting, which may also lead to shifting all operations to dollar stablecoins as a default. The outcome of something along these lines would transparently not be decentralized, open, nor any similar stylization that is touted as the advantage in this space in the first place. This outcome will not be mentioned again. For the purposes of our discussion, “institutional involvement” in crypto will mean that crypto is still attempting to be decentralized, and attempting to compete with legacy finance.

And yet, crypto has not been institutionalized in this way and seems to be attracting increasing institutional flows. It is eating Wall Street rather than being eaten and the dire consequences of centralization suggested as likely in the long run do not seem to have been fully borne out. Are these scenarios too pessimistic?

We think not, for two related reasons that form the basis of Sections 3 and 4: in Section 3 we posit that what is actually happening in crypto reflects at least an implicit awareness of some of the problems outlined in Sections 1 and 2, and attempts to overcome them by bootstrapping its own grounded value in the form of financial utility rather than as money. Put another way, as the virtuous circle of security and value from which money can endogenously emerge. We argue this is doomed to fail in the long run as the attempt at bootstrapping does nothing to address the philosophical and technical issues that have been created by all attempts so far at moving the design away from Bitcoin. This is an important distinction: the argument is not that it is theoretically impossible to create a superior design of a public blockchain to Bitcoin. This is strongly suspected to be true, but it can hardly be proven. What can be observed and understood beyond any doubt is that no real-life attempt has come close to succeeding. Bootstrapping may actually introduce more such issues in their stead, this time primarily economic, and in either case makes the ecosystem only more systemically fragile. It also perversely delays the stress sufficient for revelatory fracture.

In Section 4 we address that these early institutional flows are a kind of self-fulfilling prophecy with no happy ending: the flows prevent the resolution of the fundamental flaws, and provide more dry powder to create financial constructions that provide paper returns but solve no real problems. This attracts more flows, and perpetuates the irresolution of these flaws, maintaining and growing the illusion of secure, open, distributed, and yielding financial applications that are, in fact, nothing of the sort.

3/n – Crypto Is Not Finance #

“There are three ways to make a living in this business: be first, be smarter, or cheat.”

— Jeremy Irons as John Tuld in Margin Call, on “Crypto”

TLDR: in Section 3, we observe that non-Bitcoin crypto seems to have positioned itself as bootstrapping its own value by providing financial utility rather than money, and argue that this is likely fundamentally unsustainable and does not solve the core problem. Furthermore, we argue that most conceptions of the health of the ecosystem can only be sensibly interpreted as transient – be they “valuation” metrics, liquidity and solvency assurances, or the prospect of a link to real economic productivity.

Jump to Section 4 for a critique of the typical rationale for investing in the space, as far as we believe we can identify it.

We reiterate our support for the concept of decentralized finance in general, and that our objection to contemporary crypto is not its purported aims, but the method of its attempt to achieve these aims. If anything, we feel the instantiation is letting down the concept, even if not widely realized at the moment. In Section 2 we explained our view that the technical design choices inadvertently threaten any element of decentralization that is surely necessary for passable “decentralized” finance. In this section, we evaluate the economic merits (or demerits) of the “finance” this system realizes.

We believe that most crypto projects have attempted to escape the issues explained in Section 2 by catalyzing value via utility instead of security, so far mainly opting for utility in financial applications, and hence adopting the moniker “DeFi.” 4 We believe this is likely to end in tears because the base layer is neither money nor secure. The “finance” being constructed seems to us to therefore have the perverse effect of compounding an original fragility that follows from technical and economic unsoundness, but also buying time in the minds of those yet to become fully cognizant of all this. A charitable characterization might be that the hope is to bootstrap value via utility; a harsher characterization would be that it is all an attempt to borrow its way out of debt: monetary and technical. In short, whatever it is, crypto is not finance.

To lay some conceptual and rhetorical groundwork for what might seem like a sweeping claim, consider the expression “yield farming” – a concept that has driven enormous interest and capital into the crypto ecosystem. The concept does not refer to any real “yield.” A yield is the generated flow above maintenance or depreciation of the carrying capacity of some stock of economically productive assets. Less the recouped seeds for the next year’s crop, a harvest is a yield from a sewn field. Less the financing costs, the interest on a bond is a yield. If the issuing business is solvent and profitable in unit economics-terms and hence the par value of the principal is relatively assured, the market will settle on a value that implies a probability of all the interest being paid as promised. The markets assesses the productive carrying capacity of economic stock generating the ability to pay the flow of the interest.

So what yield is being farmed in crypto? There is transparently none. There are flows, but they are not generated by economically productive assets over time but rather appear near instantaneously as a result of speculative pricing across non-productive assets. The word “speculative” is not a denigration. There is nothing wrong with speculative value. But there is something bizarre and circular about discrepancies between different speculations on the potential future value itself forming the basis of profitable arbitrage that is then mislabeled as a “yield.”

Perhaps this is just semantics? Redefine it not as a “yield,”, but arbitrage typical of any market-making activity. Normal market-making itself relies on trading between those who naturally disagree in their assessment of speculative value. But the speculative value of what?

Of yields! This is the essence of speculation as opposed to, say, appraisal. Most financial assets are assigned value on the basis of their discounted future cash flows – that is, at least psychologically and philosophically if not mathematically. Hardly any financial assets of note have no capacity to generate a yield and simply have a value in the moment that a potential buyer believes to be mispriced – at least hardly any with noteworthy capitalization that makes them relevant to broader capital markets activity. “Speculation” arises from the inability to know the future. Yields take time and skill to generate. No real yield is generated instantaneously by arbitrage, and hence no real financial asset attains value and pricing this way, either. At root, financial assets must derive their value from a spot appraisal or from the prospect of future productivity from a stock of carrying capacity generating a yield. Does crypto?

No. Curiously, this is the simple part of the answer. Understanding what is happening is often a lot more complicated. The remainder of this section breaks into the following subsections to trace what is quite a complicated line of reasoning:

- i) an analysis of how the crypto ecosystem embraces and encourages rehypothecation, leverage, and securitization, liberally borrowed from traditional finance but that don’t quite serve any coherent purpose in this environment.

- ii) how these three collectively contribute to creating systemic fragility such that, in general, capital has to keep flowing in to keep the system seeming healthy, and,

- iii) an analysis of how the popular and common metrics worryingly both conceal the fragility analyzed in subsection i) and encourage the continuation of systemically necessary capital inflows as analyzed in subsections ii) and iii).

i) rehypothecation, leverage, and securitization #

The first thing we want to highlight is the immense amount of rehypothecation of assets happening in the crypto ecosystem today. What we mean by “rehypothecation” is quite simple, albeit a little different to traditional finance (hence creating the potential for a great deal of confusion we also hope to dispel): a given asset can be used as “collateral” in one protocol, contributing to a new asset being minted, and then either itself reused, its collateralized “end product” reused, or its securitized governance rights reused, all again and again throughout multiple different protocols. It is actually difficult to disentangle these three separate concepts, hence us treating them all at once. Leverage on its own might not be so bad were the “rights” to the levered “end product” not dubiously securitized. Nor would securitization on its own be cause for concern were the securitization tokens not used as “collateral” and unboundedly rehypothecated.

Let us consider an example of how assets in the crypto ecosystem can be, and are, reused and recycled:

- To start, a user takes $1500 of Ether, deposits it into Maker, and gets $1000 of the DAI stablecoin in return. This assumes a 150% collateralization ratio, a dubious metric, but it will do for now.

- The user then deposits the new DAI as well as $1000 of Tether into the Curve 3 pool and becomes an LP with $2000 total staked into the pool’s liquidity.

- The user, as an LP, on top of garnering fees, is also granted a CRV token for being an LP. The CRV token was issued by the protocol as a “governance” token. The value of the CRV is supposed to derive from voting rights, over such matters as enabling access to treasuries or any other fees generated by the protocol. As of today, and in most crypto protocols, the “treasuries” of these protocols are actually just these self-created tokens.

- This CRV token can then be lent out by the user using a lending protocol such as Aave. In Aave, the user can deposit these CRV tokens they received and earn interest on them, or collateralize against them for stablecoins in yet another protocol.

- Once the “stablecoin” is generated from the CRV the user just used as collateral, the user is free to reuse these “stablecoins” to make another round of “investments,” in theory now going back to step 2 above.

Let us analyze Curve and 3pool in a little more detail. Curve is an automated market maker that facilitates the transfer of different Ethereum-based assets between users looking to trade. 3pool is a pool for stablecoins which allows users to exchange DAI, USDC and USDt and rewards participants with CRV, the Curve “token.”

Liquidity providers in 3pool – users with balances of stablecoins – deposit proportional numbers of DAI, USDC and USDt to provide liquidity for these exchanges. In return for staking these assets, the liquidity providers are paid back in two different forms. There is a “swap fee,” which can be thought of as users or “takers” paying a fee to the liquidity providers: stablecoins in this instance. There is also a staking reward to which liquidity providers are entitled. In exchange for locking up the underlying assets to the Curve protocol, the liquidity providers earn a certain amount of CRV in reward. The size of the transaction fee earned also scales with the amount of value staked. While clearly not advertised as such, it is fair to say that these staking rewards are effectively paid via unbacked seigniorage, which the protocol uses to incentivize makers to provide liquidity.

Next to touch on the native token to Curve. Why this token ought to have a value, and how it ought to be used, is unclear. The token has a programmatically unlimited supply and a vague value proposition for any investor. The governance to / claim on any “real” cash flows by any definition is unclear, even if defined so loosely as to potentially consist of receipt of other Ethereum-based tokens. On top of this, the only reason anybody would continue to hold their CRV tokens, from a capital allocation perspective, is a mechanism that gives more “rewards” in trading fees for continued staking.

Does that not sound rather convoluted? We are talking about a token whose only evidenced utility and function is to be re-staked into the very system that creates it to create more of it. The red herring of “governance rights” seems only to entitle the holder to contribute to the “governance” of this process of creating more of itself, and nothing more.

This clearly depends on new capital coming into the system to be sustained. But what happens when, one day, people decide they would like to own an alternative asset that actually provides access to real cash flows, or that has some more persistent basis for its spot valuation? Our contention is a “bank run” cascades the value of CRV down, and with it will crash the value proposition of running liquidity pools. Crypto investors who currently own CRV do seem to largely understand that, today, much of the governance is unproductive but hope that in the future the protocol will continue to mature and these tokens will accrue value as derived from their governance rights. Clearly, we are skeptical.

Figure 1: Explanation of why CRV has value

We use Curve as an example because it simultaneously encapsulates multiple risks we discuss within one subsystem of crypto. Curve enables the trading of Ethereum-based assets for each other, many (possibly all) of which have a market value in the first place that is justified via exactly the process we are currently analysing, in which the underlying assets are referenced either to each other’s values, or to governance rights over flows of these assets (presumed to have value, hence the rights are presumed to have value). And as the icing on the cake, Curve created its own such token, the only utility or function of which is to re-stake into the same system, thus providing yet more pseudo-leverage to the Curve token ecosystem, and to crypto as a whole.

One further layer to all this is that many other crypto protocols aggregate user funds to help them become liquidity providers in Curve. An example is a protocol called Yearn Finance, which aggregates user funds and deposits it into protocols such as Curve to do the work of automated market making and entitle the original providers of funds to interest (styled as “yield” but we know better). Suddenly we have a crypto protocol (yEarn), that is built to allocate funds to other crypto protocols (Curve in our example), with users earning interest from the fees and once again the Curve token, CRV, but now also YFI token. From a user perspective just looking to garner “yield,” YFI is a brilliant offering. How the yield is generated and what it actually represents, as well as the underlying risks is what concerns us. Funnily enough, there are even other projects that then attach onto Yearn Finance, notably Alchemix, but at this point we think our concerns have been voiced. Let us just say that we see no practical reason this iterative process would ever need to end…

In all, what we have seen is how starting with $1500 of ETH and $1000 of Tether can lead to multiple different steps of assets being created and recycled, either via an implicit form of leverage or an implicit form of securitization. We (re)use the word “implicit” as these activities are not openly described as either “leverage” or “securitization” within the ecosystem, yet they seem to be the closest accurate descriptions in terms of traditional financial concepts: some of the protocols involved (MakerDAO above) take “deposits,” of sorts, and mint new assets (more suggestively, credit instruments) determined to have some value as a function of the value of the deposit. This is essentially the role of a bank in creating leverage. Some other of the protocols involved (Curve above) mint new assets (more suggestively, securities) on the basis of the value ascribed to control of some or other resource. This is essentially the role of investment banks (or capital markets at large, but this is possibly just semantics) in securitization.

It is worth emphasizing that rehypothecation, leverage, or securitization are not necessarily bad things if employed properly and transparently. Our concern is effectively that they are being employed improperly and opaquely, such that systemic risks are created and which seemingly go entirely unnoticed, or perversely, the effects of which are misunderstood and celebrated!

For example, crypto proponents will often cite “overcollateralization” as a reason to be reassured that things can only go so wrong, or that, if things go wrong, we can be relatively sure the various structures in place can be unwound safely and the originators of capital made whole. To be clear on terminology before we get into the weeds, by x% collateralization, we mean every $100 of synthetic asset is backed by $x (i.e. x% of $100) of collateral. By y% overcollateralized, we mean that a synthetic asset is 100+y% collateralized. We will try to stick to the former to avoid confusion unless it cannot be helped.

The idea that overcollateralization grants safety might be nice were it nor for a naive arithmetic glitch in the reasoning just presented: only 200% collateralization (or greater) can achieve this systemically. For any lower ratio, there will be some number of iterations of rehypothecating collateral such that the value outstanding ex-initial collateral is greater than the initial collateral. Let’s use the simple example of 150% to demonstrate:

$150 (of actual dollars) is required as collateral to issue $100 of StableAliceCoin, and likewise to issue $100 of StableBobCoin. If we take our $100 of SAC and pledge it as 150% overcollateralization to issue $67 of SBC, our gross synthetic exposure is already $167 on only $150 of “real” collateral. In fact, we can keep on iterating this, pledging SBC to issue more SAC, and back and forth indefinitely, and approach a limit of $300 aggregate synthetic value. 175% collateralization would take 3 iterations and only approaches a limit of $233. 200% will never be overtaken by synthetic value in excess of the collateral, and the limit of unboundedly many rehypothecations approaches $200. (Appendix B elucidates the algebra from which all numbers presented in this discussion pop out).

What all this demonstrates, beyond any individual example, is that the idea of “overcollateralization” means something very different in isolation on the one hand, and in an environment in which assets can be endlessly rehypothecated on the other (“money legos,” one might say). What we arrive at is really pseudo-leverage. Nobody thinks of themselves as having put capital at meaningful risk, because everything is overcollateralized. And yet the ecosystem as a whole is undercapitalized. Far from enabling greater transparency, security, and so on, this connectedness of potentially individually robust elements perversely creates systemic vulnerability.

This may seem oddly familiar to fractional reserve banking (“FRB”) with the algebra causing déjà vu, to boot. What we have termed the percentage of “overcollateralization” could equally be thought of as the “reserve ratio” should the reader wish to translate all the algebra for themselves. But of course there are numerous drastic differences, the very fact the comparison can be made and that the algebra translates ought to set off alarm bells. We see three obvious issues here, although of course there may be more.

First, fractional reserve deposits are not “collateral,” but rather are savers’ funds lent at risk and put to productive ends. The “end” in crypto is not as of today productive but is rather a continued, and seemingly endless, recombination of the instruments. The purpose of real collateral is precisely that it is not rehypothecated but is used to guarantee the value of a securitized debt contract, given the obvious possibility that the loan itself will fail on account of some real-world economic enterprise failing. In crypto, none of these financial primitives are present, making it entirely unclear what the purpose of “collateral” is in the first place - or perhaps, more harshly, if the concept of “collateral” even applies.

Secondly, the purpose of the reserve ratio in FRB is to provide the liquidity of an equity buffer to manage the risk of maturity mismatch. It is not an entirely arbitrary leftover of recombinatory rehypothecation. Again, “maturity mismatch” is, in the first place, a product of the real economic activity FRB is intended to facilitate. Liquid reserves have a maturity of effectively zero and a definite value, whereas illiquid economic projects requiring debt finance have longer-dated maturity and indeterminate value, pending real world economic uncertainty. Given the lack of these primitives, it is unclear what the purpose is of the similar construction.

Lastly, in FRB, there is a lender of last resort in the form of a central bank. Not only is this a bad thing and not worth copying, it is what Bitcoin fixes. It isn’t even really possible to mimic in this environment in the first place. As a result, the role is taken up by pseudo-equity issuance to boost the equity buffer that also doesn’t quite make sense here. This is accomplished in the form of additional - essentially centralized - securitization, and additional primary capital from investors.

ii) systemic fragility #

Given how much of the ecosystem is “collateralized” by Ether and other similar assets, some of which themselves generate new tokens, and given there is no clear link to stocks of economically productive assets (despite the prevalent securitization, underlying cash flows is not what has been securitized, to date) there is a need for real, external capital to act as the backstop of value. Taking into account the expected “return” this capital seeks, there is arguably also a need for continual new capital. Crypto has seen major drawdowns, but the bleeding has always been stopped by fresh capital being injected into the system. We suspect this has been largely due to the cheap capital environment across the world, and, perfectly ironically, the depression of real yields across alternative allocations, but we will cover this in more detail in Section 4. After all, if you buy into the investment hypothesis anyway, then a 40%+ drawdown in 24 hours, as Ether for example experienced in March 2020, surely seems like an excellent opportunity to buy on price weakness.

Below we will speculate as to what might follow a similarly dramatic drawdown in the price of Ether, today or in the short to medium term future, and what this might mean for the health and wealth of the ecosystem at large. We should stress upfront that what follows is in no way scientific, nor is it a prediction we insist is predetermined. We readily admit the obvious criticism that this is merely speculation. This is true. Indeed, we contemplated including a historical analysis instead but found (obviously, on reflection) that no period and no data suffice given what we are speculating about here has never happened, to date. What interests us is that the thought experiment provides a means of better appreciating the extent of what we believe to be the systemic fragility caused by the not-widely-appreciated combinations of rehypothecation, leverage, and securitization described in the subsection above.

What would likely follow a large enough crash in the price of Ether is that protocols like Curve and others require more “collateral” to be put up or for loans to automatically close. Once this process starts, Curve tokens, which could be collateralized elsewhere, would likely begin to lose value. As this “bleeding” would play out, it is natural (and matches with the young history of the space) to expect some forced selling by market participants who otherwise believed their collateralized positions were relatively secure. With this forced selling of CRV and other tokens we would expect to see “Total Value Locked” and many other metrics used to describe the “value” of the networks begin to drop precipitously. This in turn would undermine the perceived value of the networks as well as the actual value of assets previously contributed, leading to anything for which their securitized “governance” tokens were used as collateral to also be subject to various liquidations and collateral calls.

As these liquidations and collateral calls ripple through the ecosystem, there would only be two ways the bleeding could end. Either nearly all of the leverage in the system would need to be wiped out, which of course would be a catastrophic decline in aggregate value, particularly so given our outline above of just how much pseudo-leverage can exist globally without anybody being locally aware. The alternative option is simply that more capital flows into these assets than the forced selling via the liquidations. The practicalities of new capital flowing in is worth pondering also. It is possible that this would simply take the form of buying pressure to counteract forced selling pressure; but it is also possible that the buys would be of newly minted assets, hence recycling the liquidity unlocked by collapsing leverage immediately into new leverage. This would have a naturally magnified effect on the valuation metrics cited – and shortly to be criticized in subsection iii) – and may help push back against an equally collapsing narrative, should that be a contributing factor.

In one sense, this is all straightforwardly understood as a spiral of debt collapse. If this were all, it would be fair to dismiss our analysis thus far as uninteresting fear mongering given that, clearly, any debt can default, and any leveraged financial system therefore bears risk. But this is not our point. It is not interesting that the debt could collapse, but how it could collapse, and what such a collapse might reveal about its mechanics all along.

There are two factors that are perhaps discordant in this scenario, and that the reader may have noticed: i) what the backstop really is, given what the value really is, and, ii) how seemingly irrelevant the cause of the collapse is to its consequences. While Tolstoy knew well that every unhappy debt collapse was unhappy in its own way, what “normal” deleveragings at least have in common is that expectations of future profitability (i.e. real yield) were realised to have been overly optimistic and are adjusted downwards. The adjustment means both the financing costs and fragility of the capital structure erected in more optimistic times can no longer be sustained. But in this case there is no real yield in the first place, so this cannot be neither the trigger, nor the backstop.

To tick off i) above, then, the value here is conceptualized by all involved to be the complexity of rehypothecation, leverage, and securitization created! What is boasting about the creation of “money legos” if not a celebration of this complexity, regardless of what the complexity either represents or achieves on fundamentals? The backstop clearly cannot be that the underlying real value arrives at a more appropriate capital structure once enough debt it could not previously sustain has been washed out because, here, the debt is the value! When the debt collapses, so does the value proposition. Crypto, entirely perversely, is most conceptually sustainable the more debt there is – which is clearly at odds with its financial stability and, to our minds, has no resolution. Which all means, of course, that the backstop is fresh external capital. It has always been fresh external capital, and it probably always will be.

As for ii), the trigger, the reader will recall, is simply prices falling. If the price in question were a securitization of rights to the product of all this leverage, the mechanics might seem comparable, but by far the most likely trigger is a fall in the price of Ether. And if this is not a specific trigger, it is likely at the front of the queue of consequences and hence will quickly become a compounding trigger. But what is Ether itself? Why does it have value?

This is the root of what we deem to be a severe philosophical discordance. Ether is (allegedly) the right to claim decentralized computation. To make the link more obvious, it is the right to run a crypto application. Its price is surely a reflection of “how much running a crypto application is worth,” somewhat tautologically? To force the conceptual link to Section 1, then, this has value because the decentralized computational resource that contributes to creating the Ethereum timechain is itself scarce, hence this “right” ought to have a market clearing price.

Surely this is something of an operating expense in the scheme of things? Or, at least, surely it ought to be? What should this have to do with the solvency of the “decentralized financial” enterprise on which it runs? A strict analogy here would be something like a bank that not only has an office and an electricity bill but which also decides to index its leverage ratio to the price it is paying for wholesale electricity or on its rent. And just to rub it in, the analogy demands we rule out the one way this might make some economic sense: we are not postulating that the link comes about because rent is a high component of the bank’s costs, hence with profit margins contracting, it is prudent for the bank to prune its own risk. In fact, the exact opposite! “Costs” going up are a good thing and costs going down are a bad thing! Hence a borrower could receive a margin call, not because of anything to do with financing – her own or even the bank’s – but solely because the bank’s bills went down! The perverse justification might be something like: the bank only needs to make so much profit, so with more profit now expected, some outstanding loans can be cancelled.

The reasoning we are forced to follow in this analogy is clearly absurd. But what about the base case that we are using the analogy to try to elucidate? Is it absurd too? To be frank, we think that yes, it is. This is the paradoxical core of all the securitized values pointing at something else and at each other in the absence of real economic productivity. The financial health of the ecosystem depends on the price of an asset that can only conceivably have value as a proxy for enthusiasm about the ecosystem given it is a cost that all must pay to participate. But is this really to say anything more than: the value depends on everybody thinking it ought to have value? We do not think it is.

Bitcoin arguably fits this description too, but we explained in Section 1 that there is a very good reason for people to believe this in the first place. Or rather: there is good reason for people to believe other people will believe Bitcoin has value. Crypto appears not to have this philosophical buttress, and as such, we believe that crypto is incredibly systemically fragile. What if people stop thinking this? What does this perverse mechanism of justifying value churn out at that point? Is there any reason not to expect an eventual catastrophic crash, except precisely as perpetually staved off by fresh capital, as repeatedly alluded to above?

New investors daring enough to buy during the bad times would be forced to take a harder look at what “value” they are actually buying into. As much of this piece has touched on, we think when investors cannot simply ride the coat-tails of high beta, the “value” they will see in these assets during this time will be far lower than what is being perceived today. This scenario does not necessarily imply the “end of crypto,” but instead a reset of expectations and beliefs that will bring to the surface important questions about how the ecosystem is structured.

It will be fascinating to see those passionate about crypto cast their arguments during such times. Those that will still have conviction during, and after, a mass liquidation event across the ecosystem are best to be at least listened to and debated, as they are likely the most thoughtful around. For what it is worth, and to foreshadow Section 5, our prediction is that, at such a time, activity will move to then-more-mature higher layers of Bitcoin. This is, once again, because it is not the concept of decentralized finance that we believe is at fault, just this instantiation. This instantiation might be thought of as using “the fact of not having yet defaulted” as the toxically self-referential basis for leverage rather than real cash flows, real productivity, and a real grounding of value.

iii) misleading metrics #

The reader may be aware that, despite our concerns, such headline numbers as “market capitalization” and “total value locked” continue to rise, seemingly indicating ever-growing health and utility of the ecosystem. Is this not contrary to our rhetorical framing that crypto is not finance? It seems to be getting more and more financial!

Unfortunately, we believe these metrics are deeply misleading, and we would argue further that the precise way in which they are misleading is insidiously what contributed to attracting more fresh capital in the first place. As above, this capital is then rehypothecated, levered, securitized, misleadingly quantified after all this to look wildly more successful than before, and the cycle begins once again.

Our thesis on “crypto valuation,” as briefly as possible, is that none of it makes sense. Similarly to what we will discuss in Section 4, it involves a grave category error that originates in thoughtlessly transferring methodologies from one area of finance to another, without having given the requisite thought to the fundamentals of the methodology in the original environment. This leads to failing to understand what the methodologies mean and why they mean that where they do apply, and subsequently misapplying them where they very much do not apply.

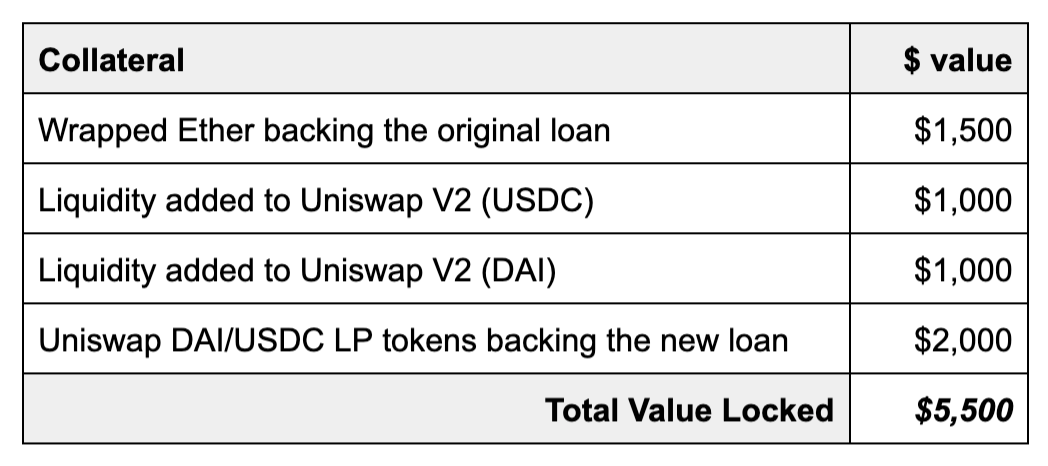

Evidencing this abstract objection, we have two specific critiques: i) double counting leverage and rehypothecation in “total value locked,” and, ii) misusing “market capitalization.” The first is easier to grasp and nicely communicable and we borrow an example from Lucas Nuzzi, Antoine Le Calvez, and Kyle Waters’ recent CoinMetrics blog post, Understanding Total Value Locked, the building blocks of which are very much like our own above, albeit more typical and less complex-for-the-sake-of-making-a-point:

“take a look at the following example:

- A user deposits $1,500 worth of Wrapped Ether (WETH) into Maker to get a loan in the form of $1,000 worth of DAI (150% collateralization ratio).

- The user then deposits this newly minted DAI, as well as another $1,000 worth of USDC in the Uniswap V2 USDC-DAI pool. In return, the user gets Liquidity Provider (LP) tokens representing that $2,000 stake of that pool’s liquidity.

- The user can then redeposit these LP tokens into Maker to get another loan of $1,960 of DAI (102% collateralization ratio).

From a naive perspective, TVL could be computed as:

Yet, a more sophisticated approach would only count the $1,500 of Wrapped Ether and $1,000 of USDC as the “real” collateral giving a TVL of $2,500. This approach would not include assets that are claims to other collateral such as DAI (which is minted as a loan against collateral), and Uniswap DAI/USDC LP tokens (which represent a claim to the liquidity held by the Uniswap V2 DAI/USDC pair).”

Above we articulated the prospect of rehypothecated collateral as presenting a systemic risk. Here it is clear it also lends itself to misleading quantification of value in the ecosystem. This contributes to a narrative that serves to attract more capital, making this initial problem worse still.